Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. Consider an economy with the following components in GDP. Consumption depends only on disposable income. National saving is 225, investment is given by

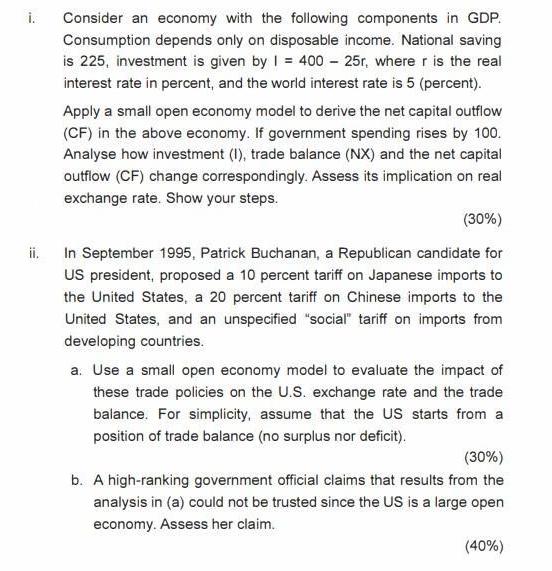

i. Consider an economy with the following components in GDP. Consumption depends only on disposable income. National saving is 225, investment is given by I = 400 25r, where r is the real interest rate in percent, and the world interest rate is 5 (percent). Apply a small open economy model to derive the net capital outflow (CF) in the above economy. If government spending rises by 100. Analyse how investment (1), trade balance (NX) and the net capital outflow (CF) change correspondingly. Assess its implication on real exchange rate. Show your steps. (30%) In September 1995, Patrick Buchanan, a Republican candidate for US president, proposed a 10 percent tariff on Japanese imports to the United States, a 20 percent tariff on Chinese imports to the ii. United States, and an unspecified "social" tariff on imports from developing countries. a. Use a small open economy model to evaluate the impact of these trade policies on the U.S. exchange rate and the trade balance. For simplicity, assume that the US starts from a position of trade balance (no surplus nor deficit). (30%) b. A high-ranking government official claims that results from the analysis in (a) could not be trusted since the US is a large open economy. Assess her claim. (40%)

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

i In an open economy S NX I 225 NX 400 25r Now as the economy given i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started