Question

2. Marshall Solomon wants to purchase $50,000 (principal amount) of 7.5% bonds issued by the Tonga Resorts Corporation. If he agrees to do the

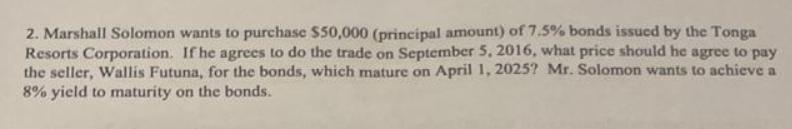

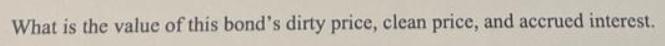

2. Marshall Solomon wants to purchase $50,000 (principal amount) of 7.5% bonds issued by the Tonga Resorts Corporation. If he agrees to do the trade on September 5, 2016, what price should he agree to pay the seller, Wallis Futuna, for the bonds, which mature on April 1, 2025? Mr. Solomon wants to achieve a 8% yield to maturity on the bonds. What is the value of this bond's dirty price, clean price, and accrued interest.

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Face value of bond 50000 Coupon rate 75 pa Date of purchase 5 September 2016 Date of maturity April ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: James R Mcguigan, R Charles Moyer, William J Kretlow

10th Edition

978-0324289114, 0324289111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App