Question

2. Mary Johnson decides to invest $10,000 on financial market. She is allowed to invest on only two stocks IBM and GE if the

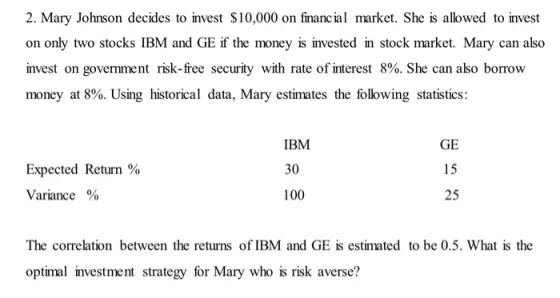

2. Mary Johnson decides to invest $10,000 on financial market. She is allowed to invest on only two stocks IBM and GE if the money is invested in stock market. Mary can also invest on government risk-free security with rate of interest 8%. She can also borrow money at 8%. Using historical data, Mary estimates the following statistics: Expected Return % Variance % IBM 30 100 GE 15 25 The correlation between the returns of IBM and GE is estimated to be 0.5. What is the optimal investment strategy for Mary who is risk averse?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To determine the optimal investment strategy for Mary we need to calculate the expected return and risk of various portfolios that she can create using IBM and GE stocks as well as the govern...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Governmental and Nonprofit Accounting

Authors: Robert Freeman, Craig Shoulders, Gregory Allison, Robert Smi

10th edition

132751267, 978-0132751261

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App