Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Mary, who is single, and lives in south Florida, suffered damage to her house and car during a flood in a federally declared

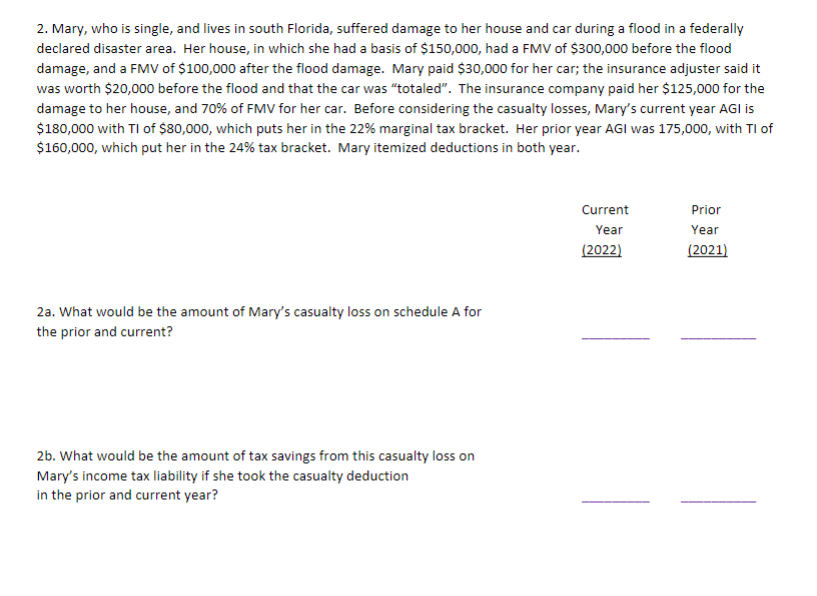

2. Mary, who is single, and lives in south Florida, suffered damage to her house and car during a flood in a federally declared disaster area. Her house, in which she had a basis of $150,000, had a FMV of $300,000 before the flood damage, and a FMV of $100,000 after the flood damage. Mary paid $30,000 for her car; the insurance adjuster said it was worth $20,000 before the flood and that the car was "totaled". The insurance company paid her $125,000 for the damage to her house, and 70% of FMV for her car. Before considering the casualty losses, Mary's current year AGI is $180,000 with TI of $80,000, which puts her in the 22% marginal tax bracket. Her prior year AGI was 175,000, with TI of $160,000, which put her in the 24% tax bracket. Mary itemized deductions in both year. 2a. What would be the amount of Mary's casualty loss on schedule A for the prior and current? 2b. What would be the amount of tax savings from this casualty loss on Mary's income tax liability if she took the casualty deduction in the prior and current year? Current Prior Year Year (2022) (2021)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine Marys casualty loss and tax savings we need to calculate the de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started