Answered step by step

Verified Expert Solution

Question

1 Approved Answer

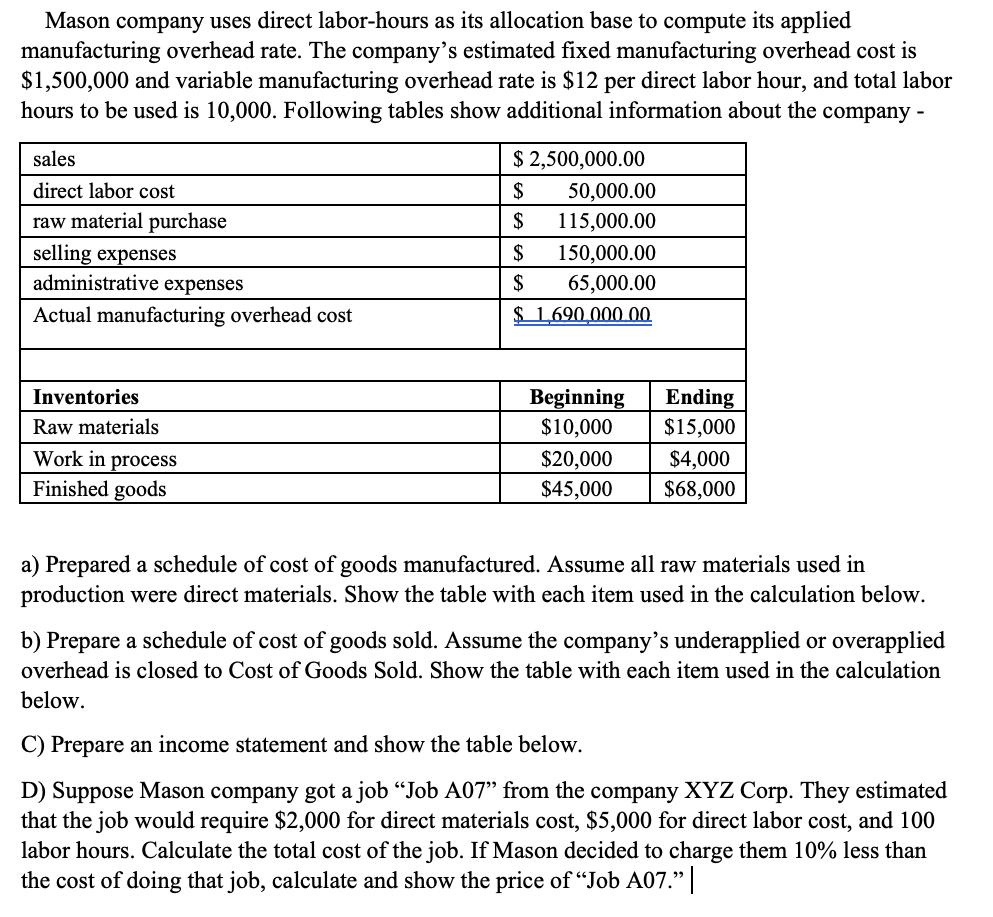

Mason company uses direct labor-hours as its allocation base to compute its applied manufacturing overhead rate. The company's estimated fixed manufacturing overhead cost is

Mason company uses direct labor-hours as its allocation base to compute its applied manufacturing overhead rate. The company's estimated fixed manufacturing overhead cost is $1,500,000 and variable manufacturing overhead rate is $12 per direct labor hour, and total labor hours to be used is 10,000. Following tables show additional information about the company - sales $ 2,500,000.00 direct labor cost $ 50,000.00 raw material purchase $ 115,000.00 selling expenses administrative expenses $ 150,000.00 $ 65,000.00 Actual manufacturing overhead cost $ 1,690 000 00 Beginning $10,000 Inventories Ending $15,000 Raw materials Work in process Finished goods $20,000 $4,000 $45,000 $68,000 a) Prepared a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. Show the table with each item used in the calculation below. b) Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Show the table with each item used in the calculation below. C) Prepare an income statement and show the table below. D) Suppose Mason company got a job Job A07" from the company XYZ Corp. They estimated that the job would require $2,000 for direct materials cost, $5,000 for direct labor cost, and 100 labor hours. Calculate the total cost of the job. If Mason decided to charge them 10% less than the cost of doing that job, calculate and show the price of "Job A07."|

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Predetermined overhead rate Budgeted Fixed manufacturing overhead per rate Variable manufactu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started