Question: 2 Moral Hazard and Adverse Selection (50') We change the setting of question 1 slightly to discuss the effect of moral hazard. x still affects

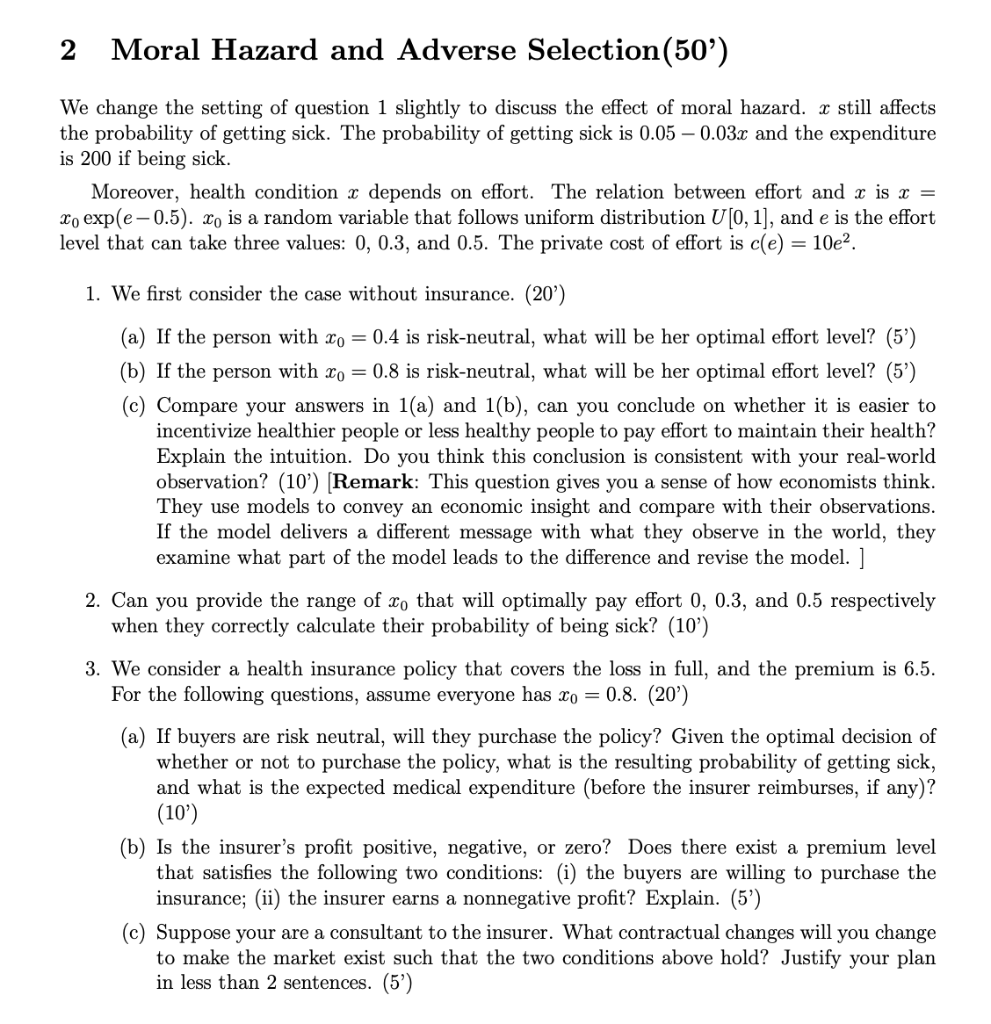

2 Moral Hazard and Adverse Selection (50') We change the setting of question 1 slightly to discuss the effect of moral hazard. x still affects the probability of getting sick. The probability of getting sick is 0.05 0.03x and the expenditure is 200 if being sick. Moreover, health condition x depends on effort. The relation between effort and x is x = X, exp(e-0.5). Xo is a random variable that follows uniform distribution U [0, 1], and e is the effort level that can take three values: 0, 0.3, and 0.5. The private cost of effort is c(e) = 10e2. 1. We first consider the case without insurance. (20') (a) If the person with Xo = 0.4 is risk-neutral, what will be her optimal effort level? (5') (b) If the person with Xo = 0.8 is risk-neutral, what will be her optimal effort level? (5) (c) Compare your answers in 1(a) and 1(b), can you conclude on whether it is easier to incentivize healthier people or less healthy people to pay effort to maintain their health? Explain the intuition. Do you think this conclusion is consistent with your real-world observation? (10') (Remark: This question gives you a sense of how economists think. They use models to convey an economic insight and compare with their observations. If the model delivers a different message with what they observe in the world, they examine what part of the model leads to the difference and revise the model. ] 2. Can you provide the range of xo that will optimally pay effort 0, 0.3, and 0.5 respectively when they correctly calculate their probability of being sick? (10') 3. We consider a health insurance policy that covers the loss in full, and the premium is 6.5. For the following questions, assume everyone has Xo = 0.8. (20') (a) If buyers are risk neutral, will they purchase the policy? Given the optimal decision of whether or not to purchase the policy, what is the resulting probability of getting sick, and what is the expected medical expenditure (before the insurer reimburses, if any)? (10) (b) Is the insurer's profit positive, negative, or zero? Does there exist a premium level that satisfies the following two conditions: (i) the buyers are willing to purchase the insurance; (ii) the insurer earns a nonnegative profit? Explain. (5') (C) Suppose your are a consultant to the insurer. What contractual changes will you change to make the market exist such that the two conditions above hold? Justify your plan in less than 2 sentences. (5') 2 Moral Hazard and Adverse Selection (50') We change the setting of question 1 slightly to discuss the effect of moral hazard. x still affects the probability of getting sick. The probability of getting sick is 0.05 0.03x and the expenditure is 200 if being sick. Moreover, health condition x depends on effort. The relation between effort and x is x = X, exp(e-0.5). Xo is a random variable that follows uniform distribution U [0, 1], and e is the effort level that can take three values: 0, 0.3, and 0.5. The private cost of effort is c(e) = 10e2. 1. We first consider the case without insurance. (20') (a) If the person with Xo = 0.4 is risk-neutral, what will be her optimal effort level? (5') (b) If the person with Xo = 0.8 is risk-neutral, what will be her optimal effort level? (5) (c) Compare your answers in 1(a) and 1(b), can you conclude on whether it is easier to incentivize healthier people or less healthy people to pay effort to maintain their health? Explain the intuition. Do you think this conclusion is consistent with your real-world observation? (10') (Remark: This question gives you a sense of how economists think. They use models to convey an economic insight and compare with their observations. If the model delivers a different message with what they observe in the world, they examine what part of the model leads to the difference and revise the model. ] 2. Can you provide the range of xo that will optimally pay effort 0, 0.3, and 0.5 respectively when they correctly calculate their probability of being sick? (10') 3. We consider a health insurance policy that covers the loss in full, and the premium is 6.5. For the following questions, assume everyone has Xo = 0.8. (20') (a) If buyers are risk neutral, will they purchase the policy? Given the optimal decision of whether or not to purchase the policy, what is the resulting probability of getting sick, and what is the expected medical expenditure (before the insurer reimburses, if any)? (10) (b) Is the insurer's profit positive, negative, or zero? Does there exist a premium level that satisfies the following two conditions: (i) the buyers are willing to purchase the insurance; (ii) the insurer earns a nonnegative profit? Explain. (5') (C) Suppose your are a consultant to the insurer. What contractual changes will you change to make the market exist such that the two conditions above hold? Justify your plan in less than 2 sentences. (5')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts