Question

2. Mr. E. Terry, an engineer, begins a small consulting business. The accounts for the firm are as follows: Bank A/R-various Office Supplies Office

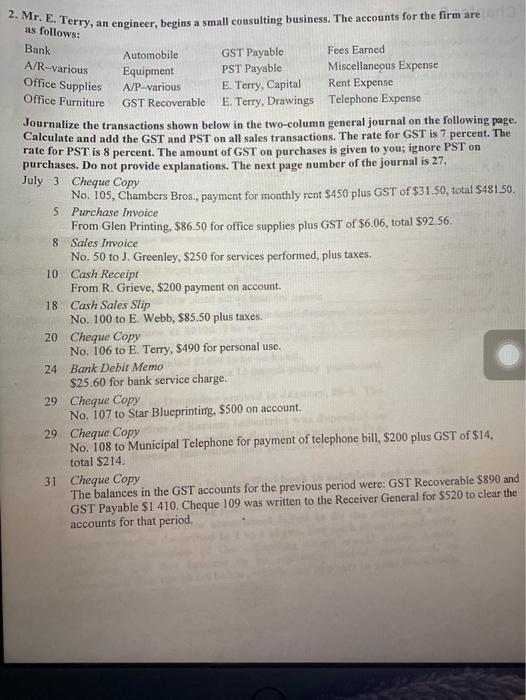

2. Mr. E. Terry, an engineer, begins a small consulting business. The accounts for the firm are as follows: Bank A/R-various Office Supplies Office Furniture Automobile Equipment A/P-various GST Recoverable GST Payable PST Payable E. Terry, Capital E. Terry, Drawings Fees Earned Miscellaneous Expense Rent Expense Telephone Expense Journalize the transactions shown below in the two-column general journal on the following page. Calculate and add the GST and PST on all sales transactions. The rate for GST is 7 percent. The rate for PST is 8 percent. The amount of GST on purchases is given to you; ignore PST on purchases. Do not provide explanations. The next page number of the journal is 27. July 3 Cheque Copy No. 105, Chambers Bros., payment for monthly rent $450 plus GST of $31.50, total $481.50. 5 Purchase Invoice From Glen Printing, $86.50 for office supplies plus GST of $6.06, total $92.56. 8 Sales Invoice No. 50 to J. Greenley, $250 for services performed, plus taxes. 10 Cash Receipt From R. Grieve, $200 payment on account. 18 Cash Sales Slip No. 100 to E. Webb, $85.50 plus taxes. 20 Cheque Copy No. 106 to E. Terry, $490 for personal use. 24 Bank Debit Memo $25.60 for bank service charge. 29 Cheque Copy No. 107 to Star Blueprinting, $500 on account. 29 Cheque Copy No. 108 to Municipal Telephone for payment of telephone bill, $200 plus GST of $14, total $214. 31 Cheque Copy The balances in the GST accounts for the previous period were: GST Recoverable $890 and GST Payable $1 410. Cheque 109 was written to the Receiver General for $520 to clear the accounts for that period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a stepbystep journal entry approach based on the transactions in the provided image The GST rate is 7 and the PST rate is 8 July 3 Cheque Copy R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started