Question

2. On January 1, 2016, Blaugh Co. signed a long-term lease for an office building. The terms of the lease required Blaugh to pay

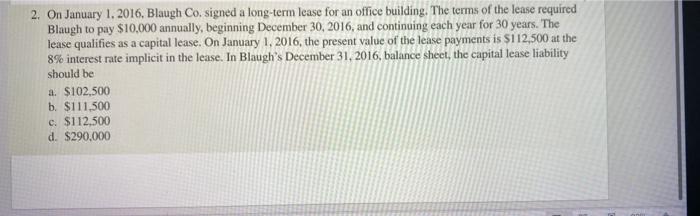

2. On January 1, 2016, Blaugh Co. signed a long-term lease for an office building. The terms of the lease required Blaugh to pay $10,000 annually, beginning December 30, 2016, and continuing each year for 30 years. The lease qualifies as a capital lease. On January 1, 2016, the present value of the lease payments is $112,500 at the 8% interest rate implicit in the lease. In Blaugh's December 31, 2016, balance sheet, the capital lease liability should be a. $102,500 b. $111,500 c. $112,500 d. $290,000

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Principal payment in Year 1 Total payment Interest pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Theory and Analysis Text and Cases

Authors: Richard G. Schroeder, Myrtle W. Clark, Jack M. Cathey

12th edition

1119386209, 978-1119299349, 1119299349, 1119186331, 978-1119186335, 978-1119386209

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App