Question

(2) Opening inventory (units) at the start of January will be 150 units. Closing inventory for each month is estimated at 10% of the sale

(2) Opening inventory (units) at the start of January will be 150 units. Closing inventory for each month is estimated at 10% of the sale units for the next month.

(3) Production occurs in the same month of sales. Materials and labour costs are paid for in the same month of production.

(4) From the month of January, assume that all sales are on credit, with sales revenue being received in the following pattern: 75% in the month of sale and 25% in the following month.

(5) Fixed overheads are paid for in the month in which they are incurred. There are expected to be as follows: January $10,000, February $ 15,000 and it is assumed that fixed overheads will increase to $ 18,000 from the month of March.

(6) Machinery costing $1,200,000 is due to be installed in February. One third of this cost will be paid in each of the months April, May and June.

(7) Taxation of $150,000 will be paid in June.

(8) A $7,000,000 loan from the Development Bank will be received in June.

(9) The opening bank balance in January will be $ 500,000. Required:

Prepare the following budgets for the six months January to June

a) Production Budget

b) Cash Budget

c) Sales Budget

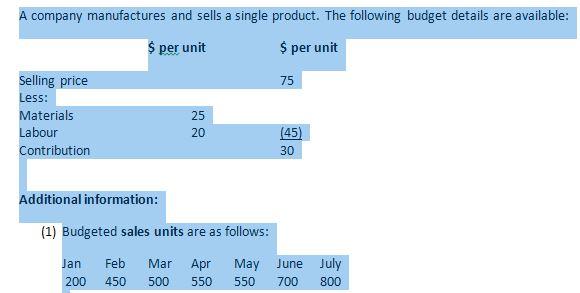

A company manufactures and sells a single product. The following budget details are available: $ per unit $ per unit Selling price 75 Less: Materials 25 Labour 20 (45) Contribution 30 Additional information: (1) Budgeted sales units are as follows: Jan Feb 450 Mar 500 Apr 550 May 550 June July 700 800 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started