Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P8-14 Activity-Based Costing as an Alternative to Traditional Product Costing: Simplified Method This chapter emphasizes the use of activity-based costing in internal decisions. However,

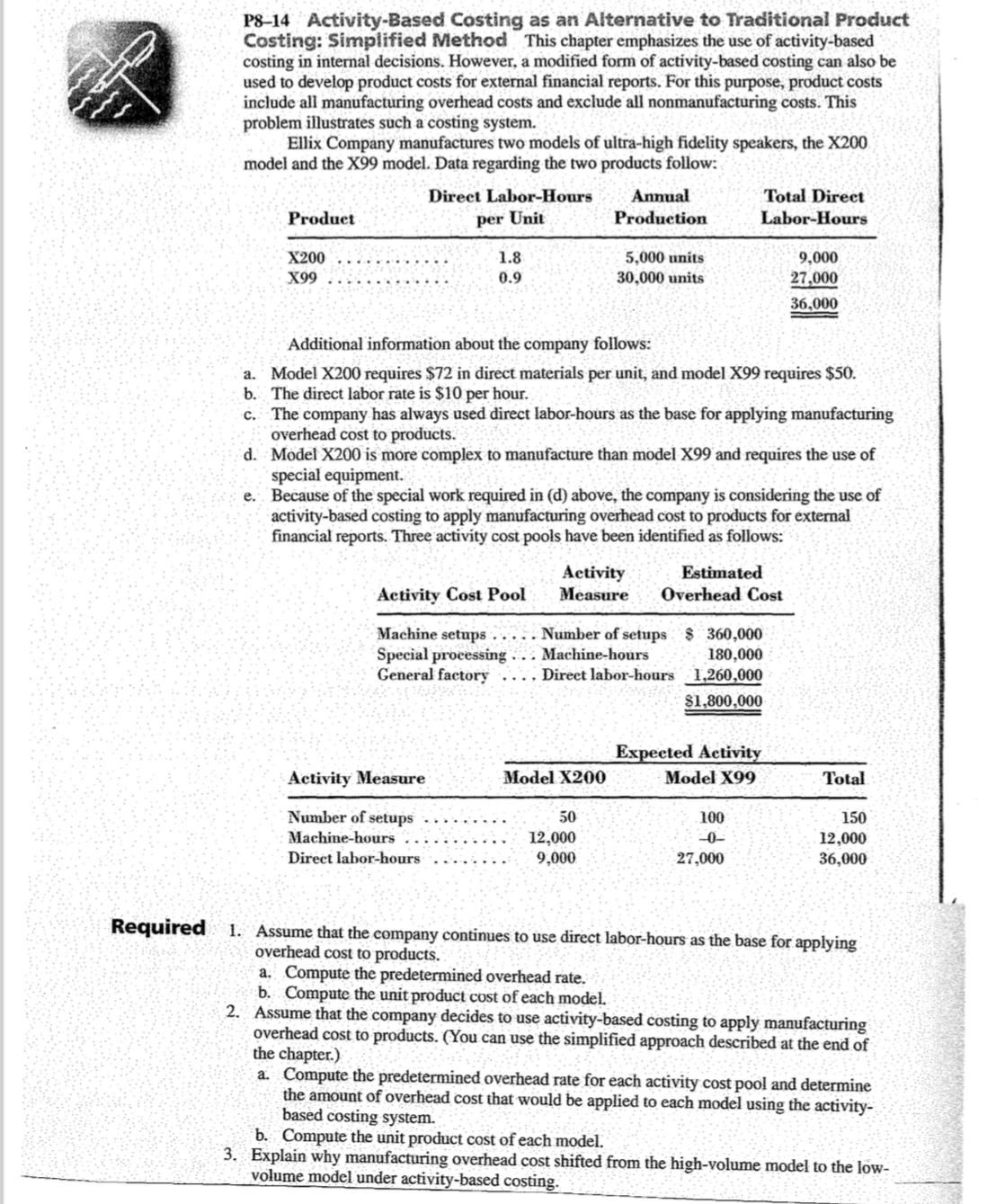

P8-14 Activity-Based Costing as an Alternative to Traditional Product Costing: Simplified Method This chapter emphasizes the use of activity-based costing in internal decisions. However, a modified form of activity-based costing can also be used to develop product costs for external financial reports. For this purpose, product costs include all manufacturing overhead costs and exclude all nonmanufacturing costs. This problem illustrates such a costing system. Ellix Company manufactures two models of ultra-high fidelity speakers, the X200 model and the X99 model. Data regarding the two products follow: Product X200 X99 Total Direct Labor-Hours Direct Labor-Hours per Unit Annual Production 1.8 0.9 5,000 units 30,000 units 9,000 27,000 36,000 a. Additional information about the company follows: Model X200 requires $72 in direct materials per unit, and model X99 requires $50. b. The direct labor rate is $10 per hour. C. The company has always used direct labor-hours as the base for applying manufacturing overhead cost to products. d. Model X200 is more complex to manufacture than model X99 and requires the use of special equipment. e. Because of the special work required in (d) above, the company is considering the use of activity-based costing to apply manufacturing overhead cost to products for external financial reports. Three activity cost pools have been identified as follows: Activity Cost Pool Machine setups Special processing General factory Activity Measure Number of setups Machine-hours Estimated Overhead Cost $360,000 180,000 Direct labor-hours 1,260,000 $1,800,000 Expected Activity Activity Measure Model X200 Model X99 Total Number of setups Machine-hours Direct labor-hours 50 12,000 100 150 -0- 12,000 9,000 27,000 36,000 Required 1. Assume that the company continues to use direct labor-hours as the base for applying overhead cost to products. a. Compute the predetermined overhead rate. b. Compute the unit product cost of each model. 2. Assume that the company decides to use activity-based costing to apply manufacturing overhead cost to products. (You can use the simplified approach described at the end of the chapter.) a. Compute the predetermined overhead rate for each activity cost pool and determine the amount of overhead cost that would be applied to each model using the activity- based costing system. b. Compute the unit product cost of each model. 3. Explain why manufacturing overhead cost shifted from the high-volume model to the low- volume model under activity-based costing.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Continuing to use direct labor hours as the cost driver a Predetermined overhead rate Total overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started