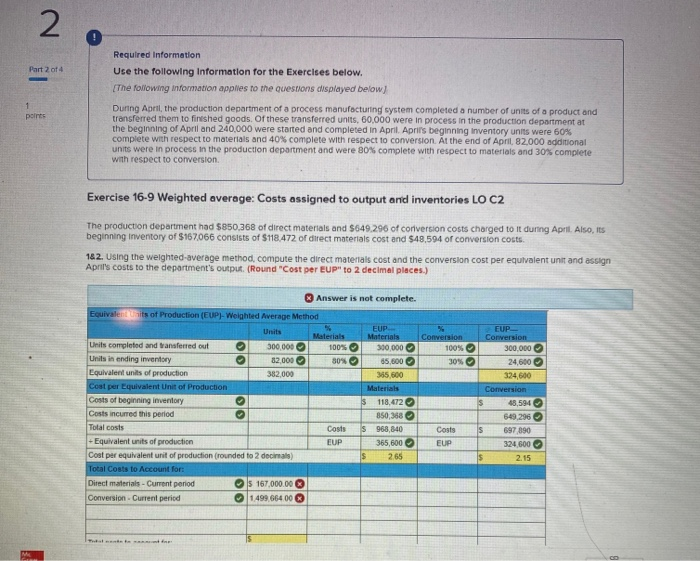

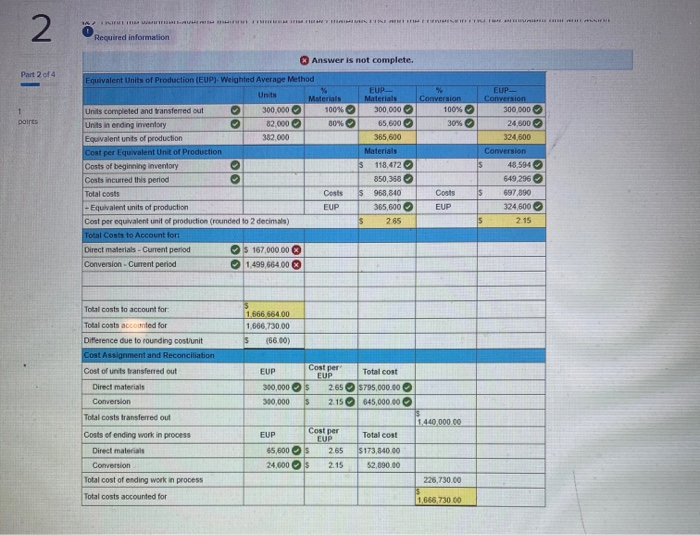

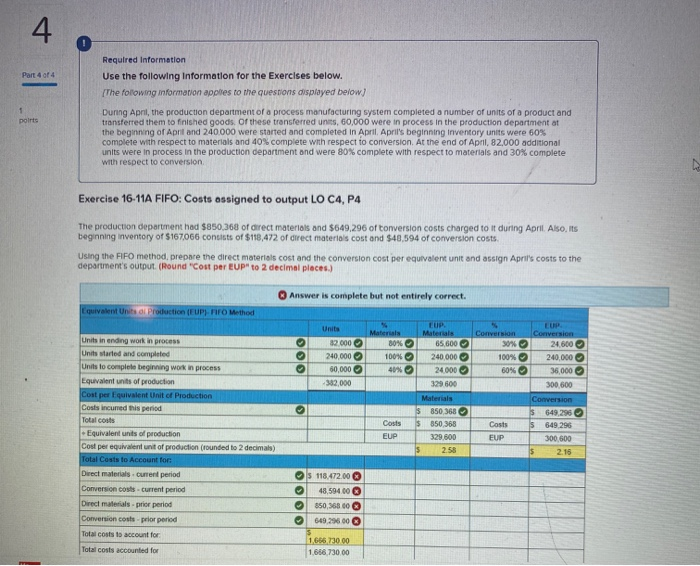

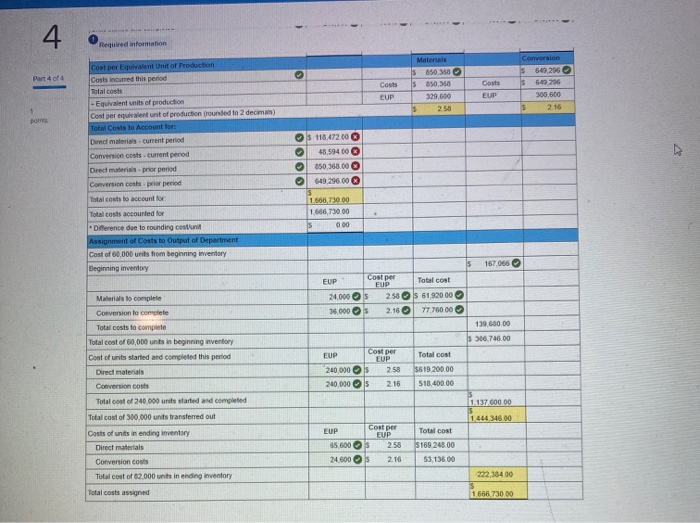

2 Part 2 of 4 Required Information Use the following Information for the Exercises below. The following information applies to the questions displayed below) 1 points During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 60,000 were in process in the production department at the beginning of April and 240,000 were started and completed in April. Aprils beginning inventory units were 60% complete with respect to materials and 40% complete with respect to conversion. At the end of April, 82,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion Exercise 16-9 Weighted average: Costs assigned to output and inventories LO C2 The production department had $850,368 of direct materials and $649.296 of conversion costs charged to it during April. Also, its beginning inventory of $167066 consists of $118.472 of direct materials cost and $48,594 of conversion costs. 182. Using the weighted-average method, compute the direct materials cost and the conversion cost per equivalent unit and assign April's costs to the department's output (Round "Cost per EUP" to 2 decimal places.) OO OO Answer is not complete. Equivalents of Production (EUP)-Weighted Average Method EUP Materials Materials Conversion Units completed and transferred out 300,000 100% 300,000 100% Unitsin ending inventory 82,000 80% 65,800 30% Equivalent units of production 382,000 345.500 Coat per Equivalent Unit of Production Materials Costs of beginning inventory $ 118,472 Costs incurred this period 850,368 Total costs Costs S968,840 Costs +Equivalent units of production EUP 365,600 EUP Cost per equivalent unit of production (rounded to 2 decimals $ 265 Total Costs to Account for: Direct materials - Current period 167,000.00 Conversion Current period 1499,66400 . EUP Conversion 300.000 24,600 324,600 Conversion $ 48,594 649,296 IS 697 890 324,600 s 2.15 M WIMPERN FREE 2 Required information Answer is not complete. Part 2 of 4 EUP- Conversion 300,000 Conversion 100% 30% OO points Equivalent Units of Production (EUP)-Weighted Average Method Units Materials Units completed and transferred out 300,000 100% Unitsin ending inventory 82,000 80% Equivalent units of production 382,000 Cost per Equivalent Unit of Production Costs of beginning inventory Costs incurred this period Total costs Costs -Equivalent units of production EUP Cont per equivalent unit of production (rounded to 2 decimals) Total Costs to Account for: Direct materials - Current period $ 167,000.00 Conversion - Current period 1,499,66400 EUP Materials 300,000 65,600 365,600 Materials $ 118,472 850,358 $ 968,840 365,600 $ 265 . 24,500 324,500 Conversion 48,594 649,296 697.890 324 600 15 215 Costs EUP Total costs to account for Total costs accounted for 1,666 564.00 1,666.730.00 3 (56.00) EUP 300,000 300,000 Cost per EUP Total cost 2.655795,000.00 2.15 645,000.00 Difference due to rounding costunit Cost Assignment and Reconciliation Cost of units transferred out Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for 1.440,000.00 EUP Cost per EUP 65,600 2.65 24,600S 2.15 Total cost 5173,840.00 52,690.00 226,730.00 1.666,730.00 4 O Part 4 of 4 1 points Required information Use the following Information for the Exercises below. The following formation applies to the questions displayed below) Dunng Apnl, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods of these transferred units, 60,000 were in process in the production department at the beginning of April and 240.000 were started and completed in April April's beginning inventory units were 60% complete with respect to materials and 40% complete with respect to conversion. At the end of April, 82,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion Exercise 16-11A FIFO: Costs assigned to output LO C4, P4 The production department had $850,368 of direct materials and $649,296 of tonversion costs charged to it during April. Also, its beginning inventory of $167006 consists of $118,472 of direct materials cost and $40,594 of conversion costs Using the FIFO method, prepare the direct materials cost and the conversion cost per equivalent unit and assign April's costs to the department's output (Round "Cost per EUP to 2 decimal places.) Answer is complete but not entirely correct. Equivalent Units Production (FUPFIFO Method OOO Units 82.000 240.000 60,000 382,000 Materials 80% 100% 40% OOO Materials 65,600 240.000 24.000 329600 Conversion 30 100% 60% LUR Conversion 24.600 240,000 36.000 300,600 Conversion 649,296 649.296 300,600 2.15 5 Costs EUP Costs Unitsin ending work in process Units started and completed Units to complete beginning work in process Equivalent units of production Cost per Equivalent Unit of Production Costs incurred this period Total costs Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total Costs to Account for Direct materials. Current period Conversion cost current period Direct materials prior period Conversion costs-prior period Total costs to account for Total costs accounted for Materials $ 850,368 $ 350.368 329,600 5 2.58 EUP OOOO S 118.472.00 48,594.00 850,368 00 649 25000 1.666 730 00 1.666.730.00 4 Required information Part 4 of 4 Costs EUP Materiais S 500 S 650,00 329,600 5 258 Costs EUP Conversion 5 549,296 S 64 206 300 600 5 2.16 potre $ 118,472.00 48,594.00 Cost per Equivalent Unit of Production Costs incurred this period Total costs -Equivalent units of production Cost per equivalent of production rounded to 2 decima) Total Costs to Account for Direct materials current period Conversion costs. Current period Direct materias prior period Conversion cost prior period Total costs to account for Total costs accounted for Difference due to rounding con Assignment of Costs to Output of Department Cost of 60,000 units from beginning inventory Beginning inventory oooo 850.368.00 649,296.00 1.608.730.00 1.666,730.00 5 0.00 167065 EUP" 24.000 36.000 Cost per FUP Total cost 2.58 61,920 00 2.15 77.76000 139.600.00 $ 306.746.00 EUP Cost per EUP 2.58 240,000 240,000 Materials to complete Conversion to complete Total costs to complete Total cost of 60,000 unts in beginning inventory Cost of units started and completed this period Direct materials Conversion costs Total cost of 240.000 units started and completed Total cost of 300.000 units transferred out Costs of unitsin ending inventory Direct materials Conversion costs Total cost of 2000 units in ending inventory Total cost $519 200.00 518.400.00 2.16 1.137.600.00 1.444.346.00 Cost per EUP 55,600 24600 EUP 2.58 Total cost $169 248.00 53.136.00 2.16 222,334 00 Total costs assigned 1.666 730.00