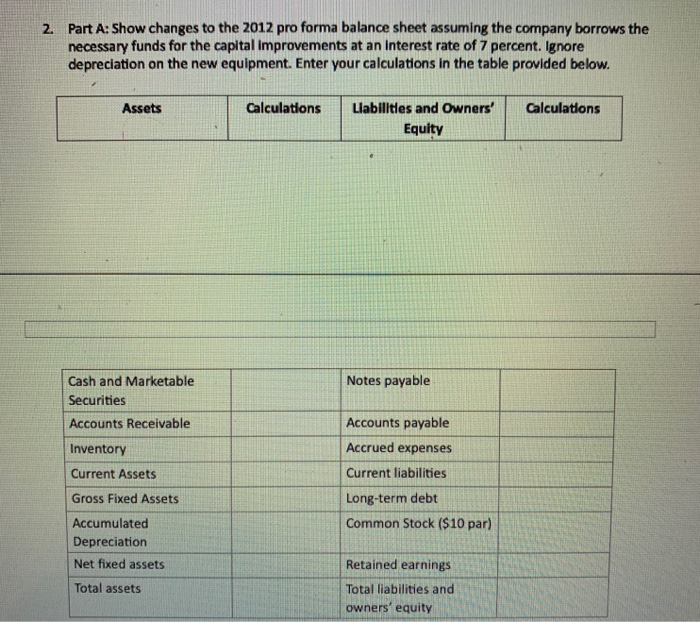

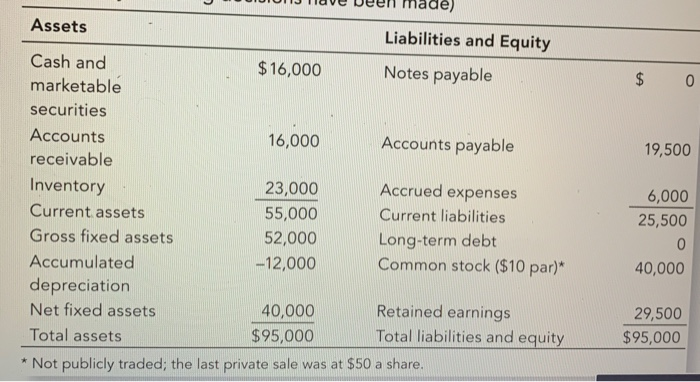

2. Part A: Show changes to the 2012 pro forma balance sheet assuming the company borrows the necessary funds for the capital improvements at an interest rate of 7 percent. Ignore depreciation on the new equipment. Enter your calculations in the table provided below. Assets Calculations Calculations Llabilities and Owners' Equity Notes payable Cash and Marketable Securities Accounts Receivable Accounts payable Accrued expenses Inventory Current Assets Current liabilities Gross Fixed Assets Long-term debt Common Stock ($10 par) Accumulated Depreciation Net fixed assets Total assets Retained earnings Total liabilities and owners' equity de) $ 0 19,500 Assets Liabilities and Equity Cash and $ 16,000 Notes payable marketable securities Accounts 16,000 Accounts payable receivable Inventory 23,000 Accrued expenses Current assets 55,000 Current liabilities Gross fixed assets 52,000 Long-term debt Accumulated -12,000 Common stock ($10 par)* depreciation Net fixed assets 40,000 Retained earnings Total assets $95,000 Total liabilities and equity * Not publicly traded; the last private sale was at $50 a share. 6,000 25,500 0 40,000 29,500 $95,000 2. Part A: Show changes to the 2012 pro forma balance sheet assuming the company borrows the necessary funds for the capital improvements at an interest rate of 7 percent. Ignore depreciation on the new equipment. Enter your calculations in the table provided below. Assets Calculations Calculations Llabilities and Owners' Equity Notes payable Cash and Marketable Securities Accounts Receivable Accounts payable Accrued expenses Inventory Current Assets Current liabilities Gross Fixed Assets Long-term debt Common Stock ($10 par) Accumulated Depreciation Net fixed assets Total assets Retained earnings Total liabilities and owners' equity de) $ 0 19,500 Assets Liabilities and Equity Cash and $ 16,000 Notes payable marketable securities Accounts 16,000 Accounts payable receivable Inventory 23,000 Accrued expenses Current assets 55,000 Current liabilities Gross fixed assets 52,000 Long-term debt Accumulated -12,000 Common stock ($10 par)* depreciation Net fixed assets 40,000 Retained earnings Total assets $95,000 Total liabilities and equity * Not publicly traded; the last private sale was at $50 a share. 6,000 25,500 0 40,000 29,500 $95,000