Answered step by step

Verified Expert Solution

Question

1 Approved Answer

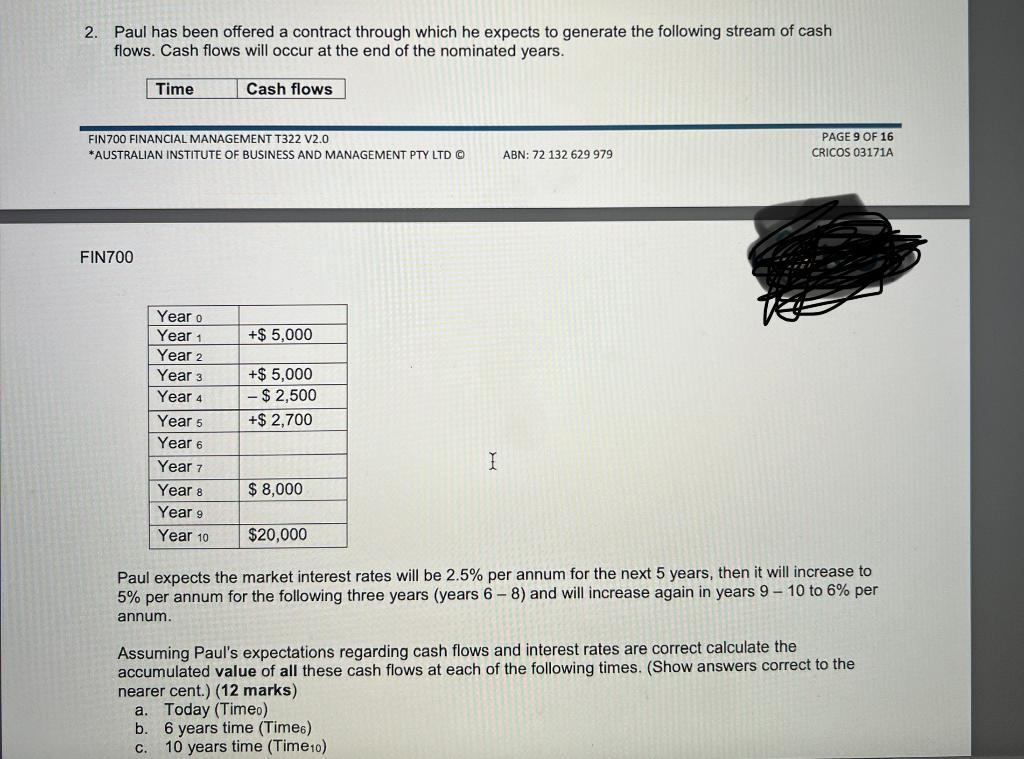

2. Paul has been offered a contract through which he expects to generate the following stream of cash flows. Cash flows will occur at

2. Paul has been offered a contract through which he expects to generate the following stream of cash flows. Cash flows will occur at the end of the nominated years. Time FIN700 FINANCIAL MANAGEMENT T322 V2.0 *AUSTRALIAN INSTITUTE OF BUSINESS AND MANAGEMENT PTY LTD FIN700 Year o Year 1 Year 2 Year 3 Year 4 Cash flows Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 +$ 5,000 +$ 5,000 -$2,500 +$ 2,700 $ 8,000 $20,000 I ABN: 72 132 629 979 5 years time (Times) 10 years time (Time 10) PAGE 9 OF 16 CRICOS 03171A Paul expects the market interest rates will be 2.5% per annum for the next 5 years, then it will increase to 5% per annum for the following three years (years 6-8) and will increase again in years 9 - 10 to 6% per annum. Assuming Paul's expectations regarding cash flows and interest rates are correct calculate the accumulated value of all these cash flows at each of the following times. (Show answers correct to the nearer cent.) (12 marks) a. Today (Timeo) b. C.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the accumulated value of the cash flows we need to discount each cash flow to its prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started