2.

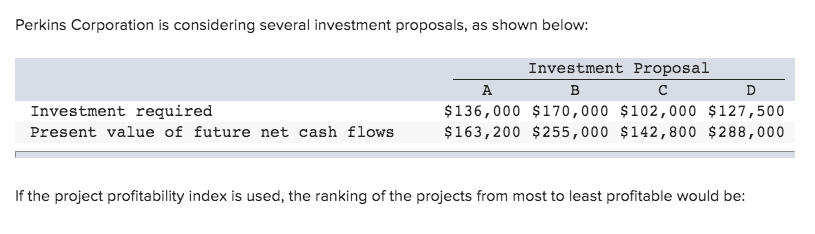

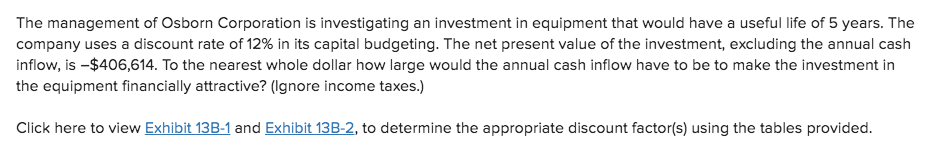

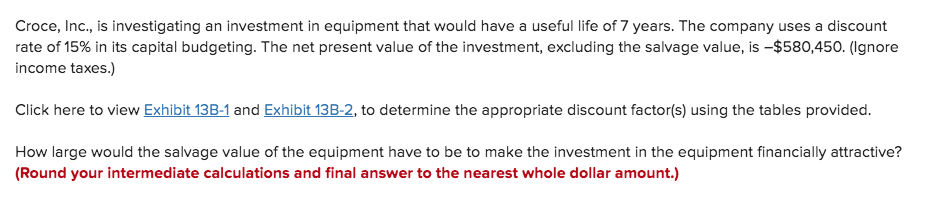

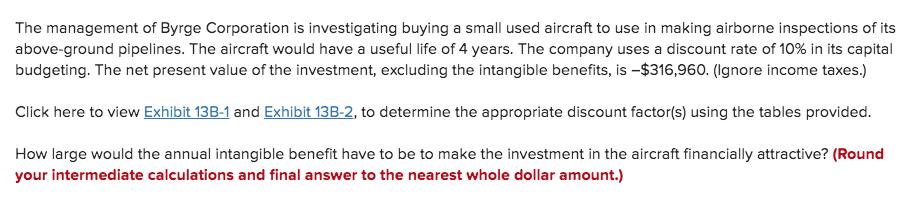

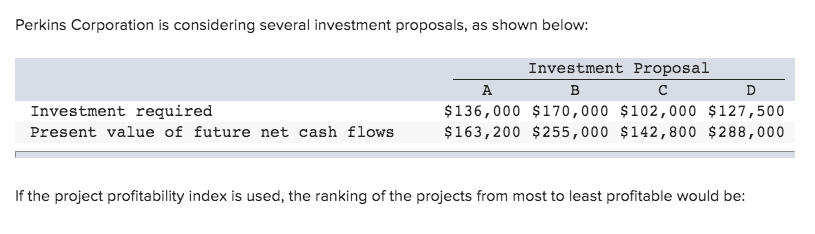

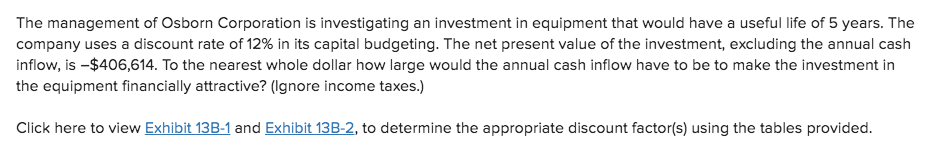

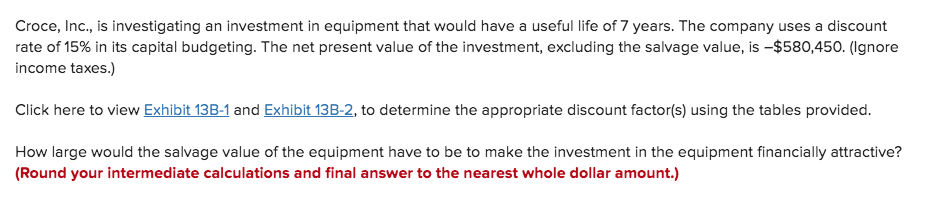

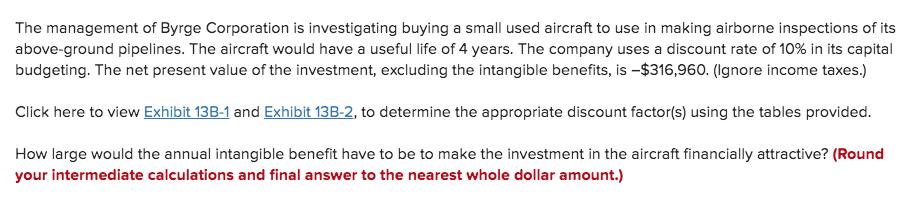

Perkins Corporation is considering several investment proposals, as shown below: Investment Proposal A $136,000 $170,000 $102,000 $127,500 $ 163,200 $ 255,000 $142,800 $288,000 Investment required Present value of future net cash flows If the project profitability index is used, the ranking of the projects from most to least profitable would be: The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 5 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is -$406,614. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. Croce, Inc., is investigating an investment in equipment that would have a useful life of 7 years. The company uses a discount rate of 15% in its capital budgeting. The net present value of the investment, excluding the salvage value, is -$580,450. (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. How large would the salvage value of the equipment have to be to make the investment in the equipment financially attractive? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) The management of Byrge Corporation is investigating buying a small used aircraft to use in making airborne inspections of its above-ground pipelines. The aircraft would have a useful life of 4 years. The company uses a discount rate of 10% in its capital budgeting. The net present value of the investment, excluding the intangible benefits, is -$316,960. (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. How large would the annual intangible benefit have to be to make the investment in the aircraft financially attractive? (Round your intermediate calculations and final answer to the nearest whole dollar amount.)