Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Philip Enterprises has a job costing system. The following items appeared in the Work in Process account during April 2024: April 1, 2024,

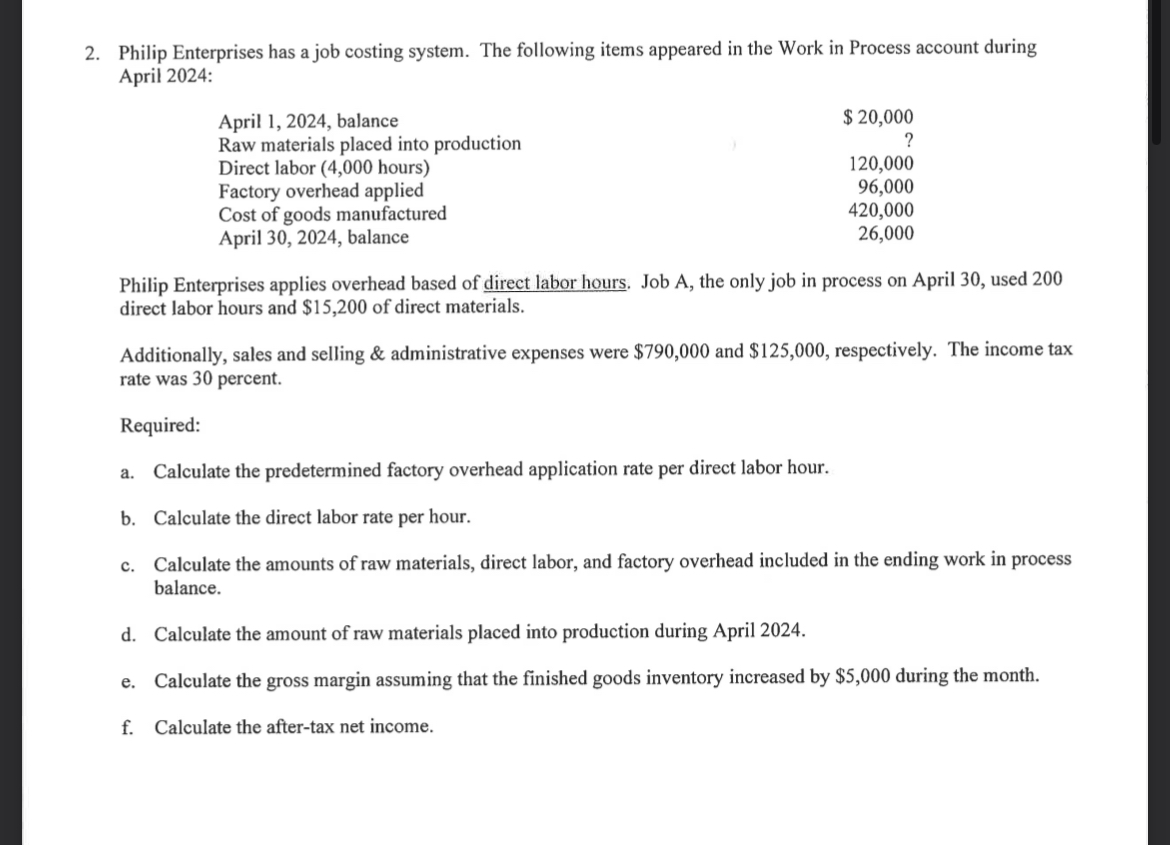

2. Philip Enterprises has a job costing system. The following items appeared in the Work in Process account during April 2024: April 1, 2024, balance Raw materials placed into production Direct labor (4,000 hours) Factory overhead applied Cost of goods manufactured April 30, 2024, balance $20,000 ? 120,000 96,000 420,000 26,000 Philip Enterprises applies overhead based of direct labor hours. Job A, the only job in process on April 30, used 200 direct labor hours and $15,200 of direct materials. Additionally, sales and selling & administrative expenses were $790,000 and $125,000, respectively. The income tax rate was 30 percent. Required: a. Calculate the predetermined factory overhead application rate per direct labor hour. b. Calculate the direct labor rate per hour. C. Calculate the amounts of raw materials, direct labor, and factory overhead included in the ending work in process balance. d. Calculate the amount of raw materials placed into production during April 2024. e. Calculate the gross margin assuming that the finished goods inventory increased by $5,000 during the month. f. Calculate the after-tax net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started