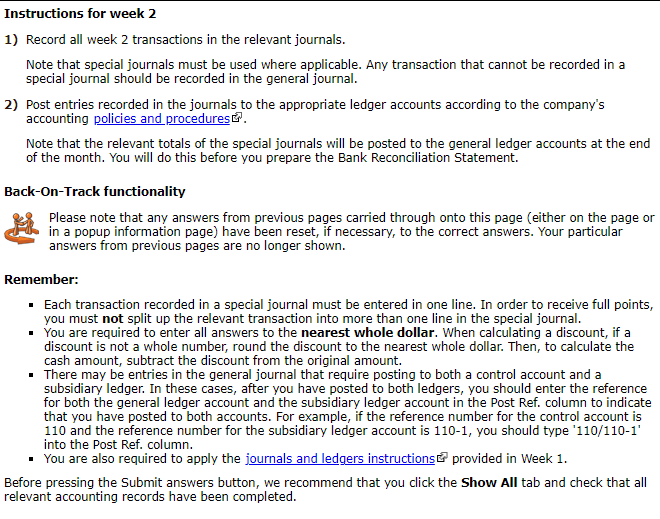

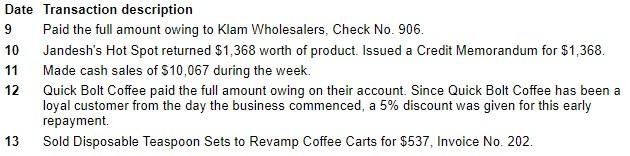

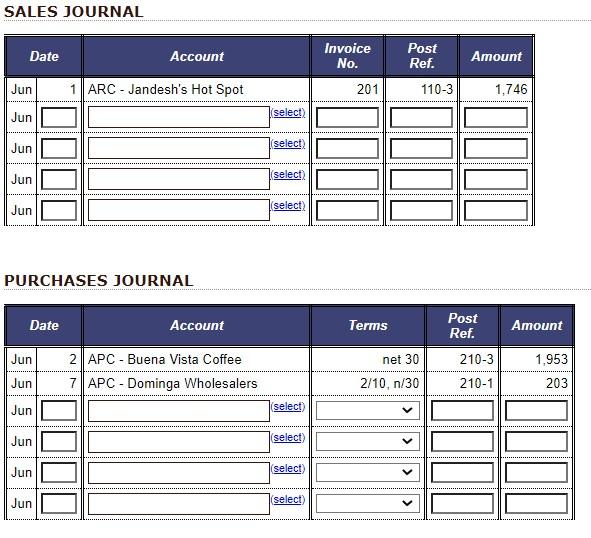

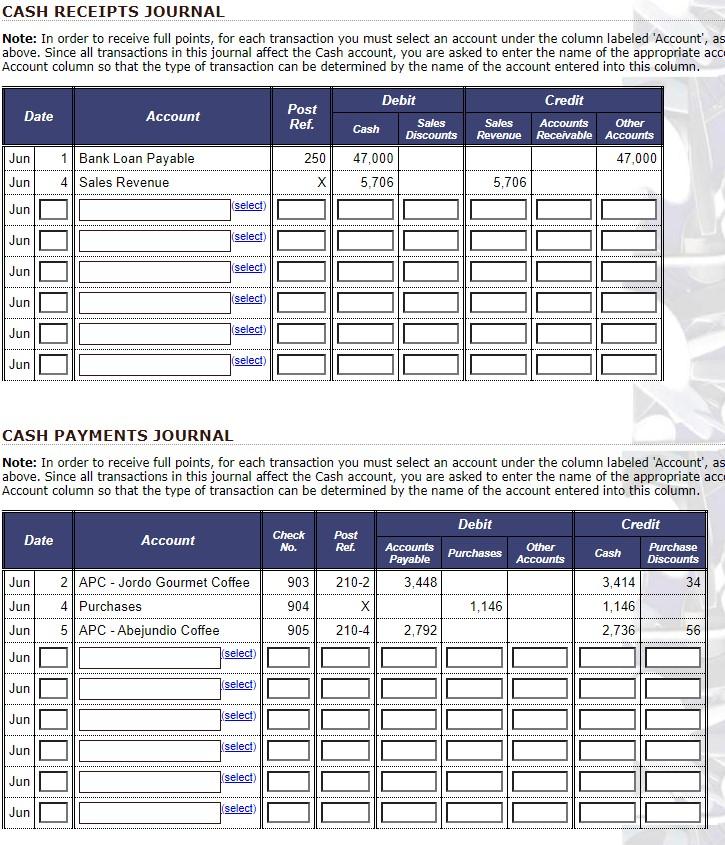

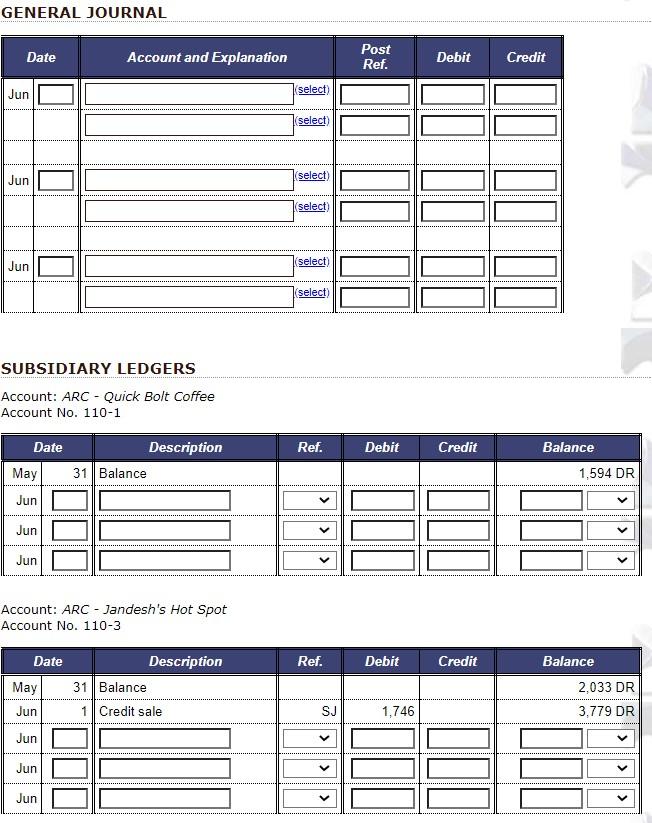

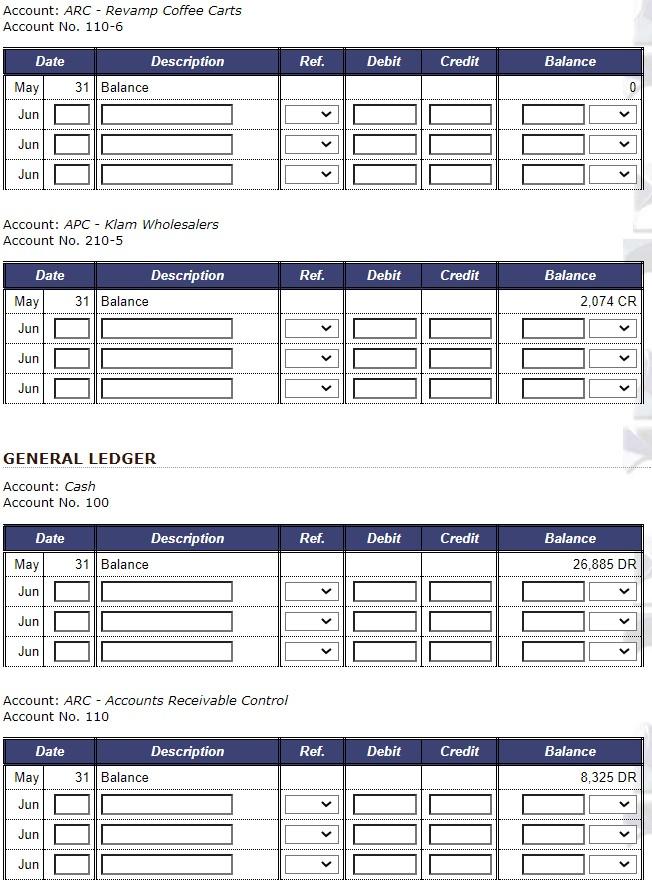

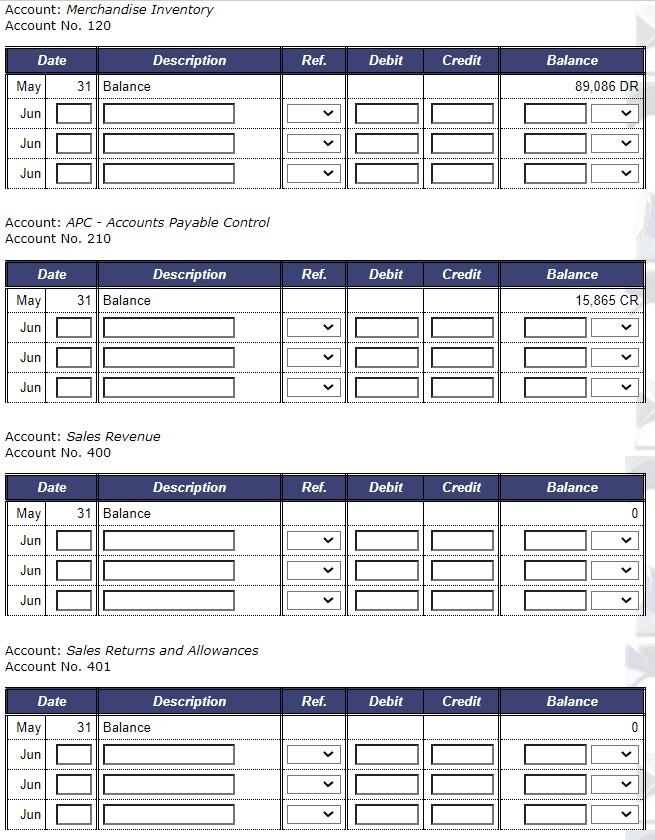

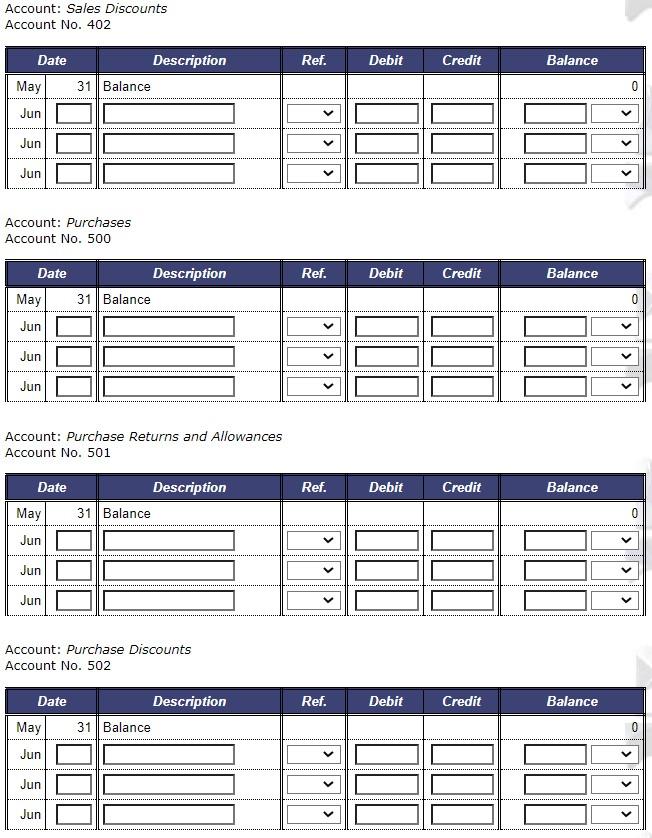

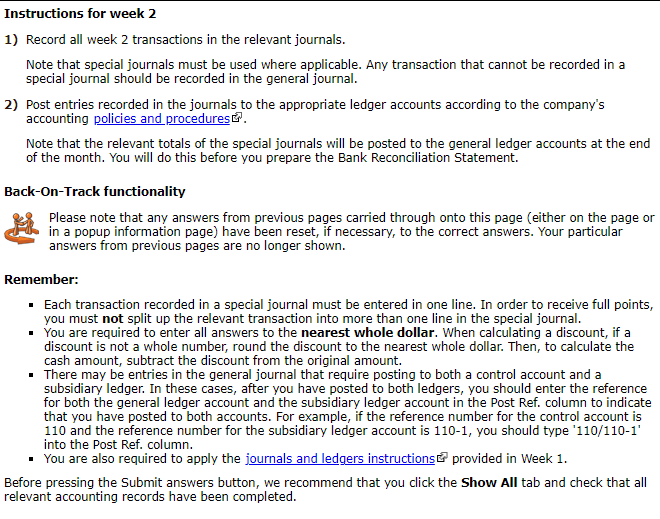

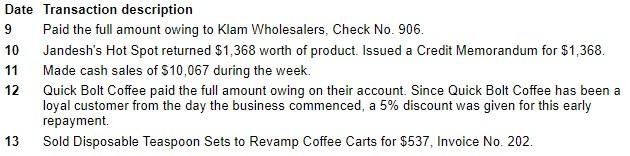

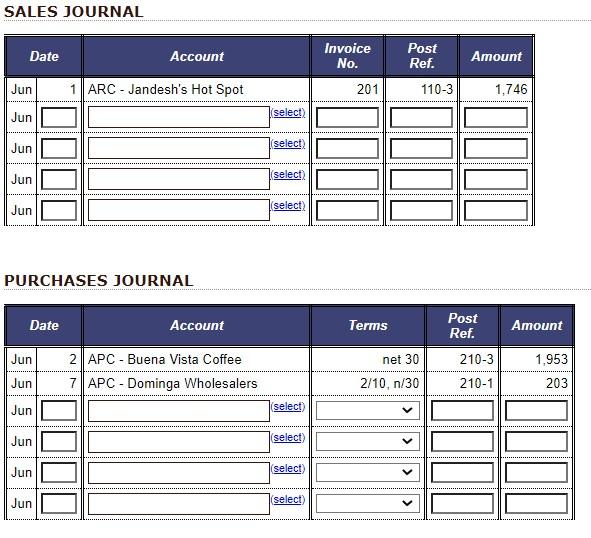

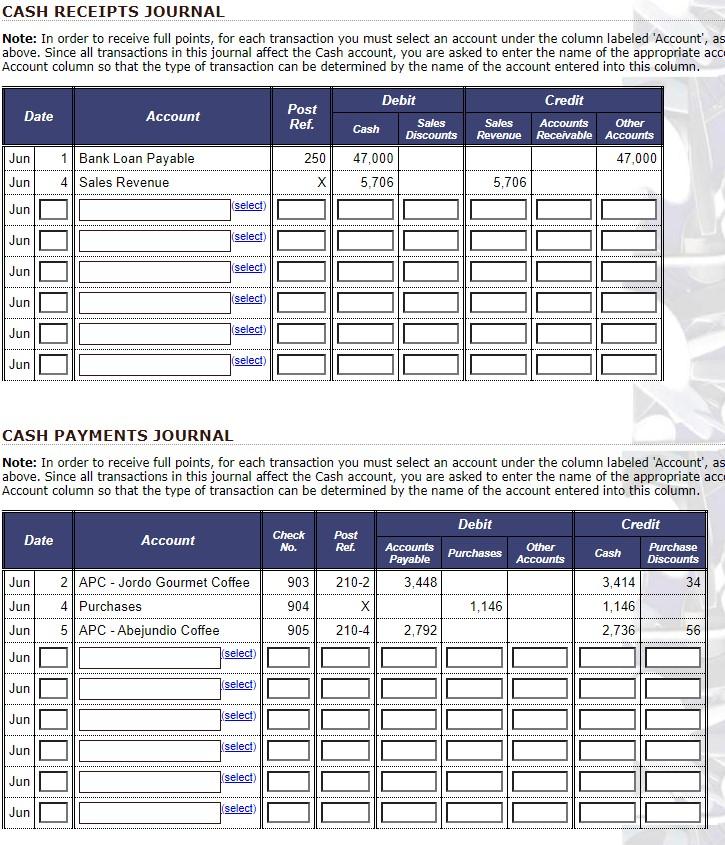

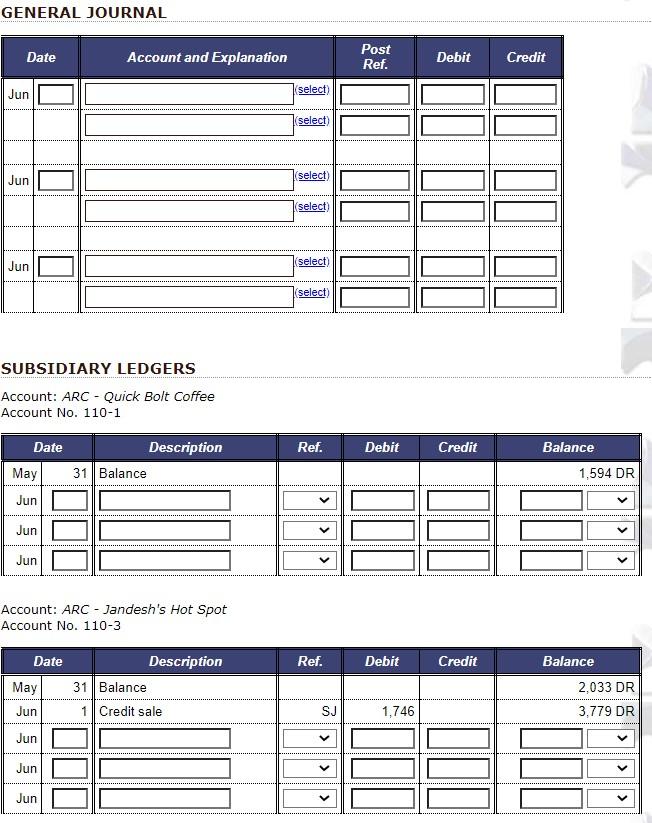

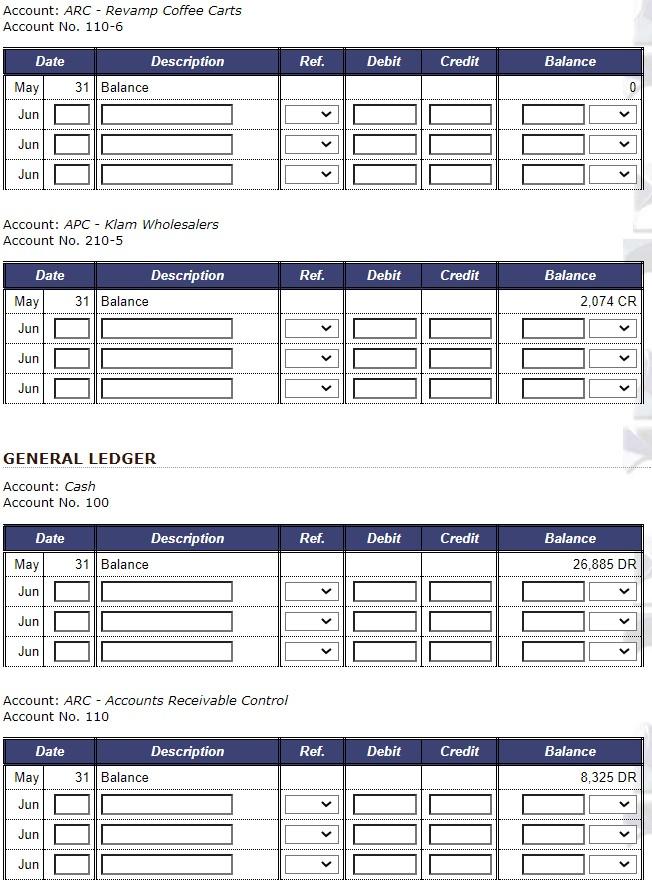

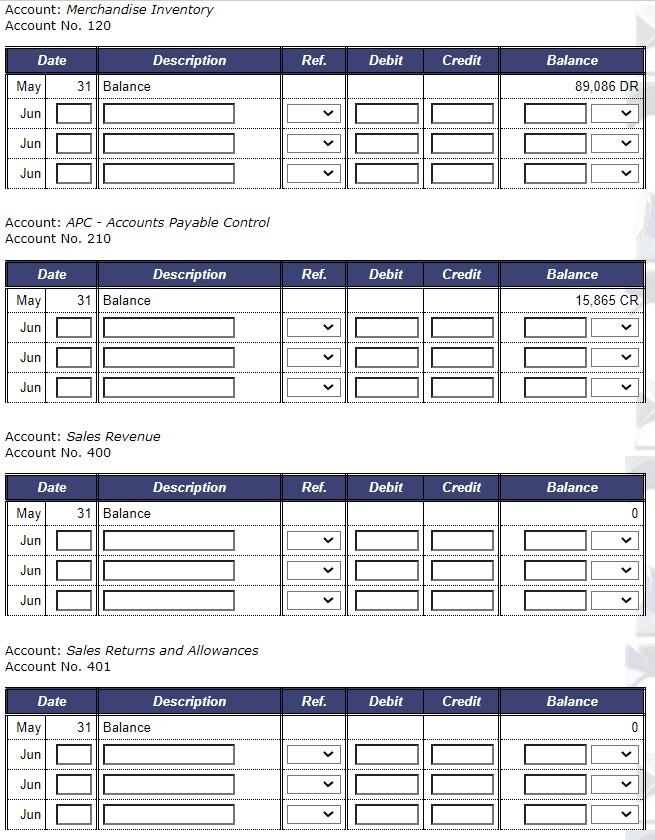

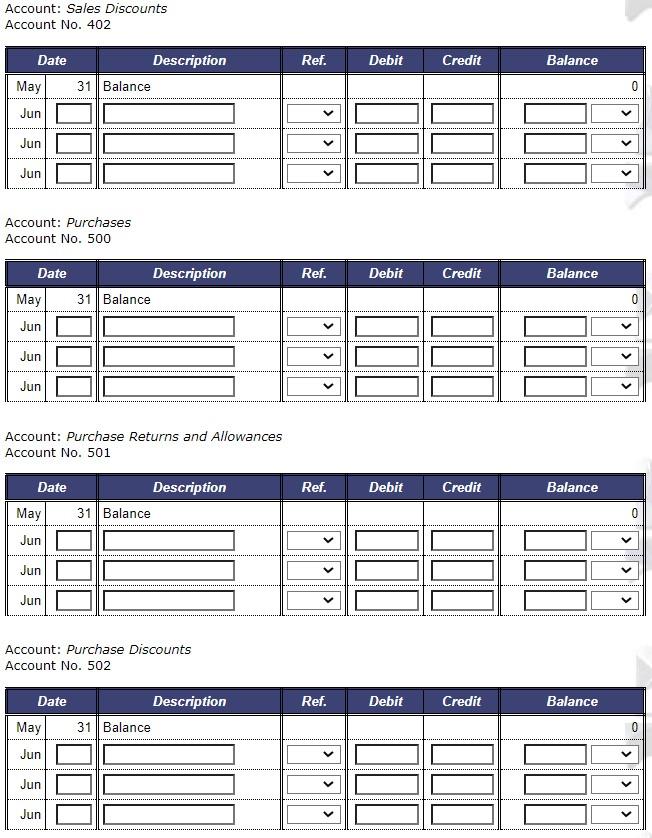

2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures 3. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will do this before you prepare the Bank Reconciliation Statement. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: - Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. - You are required to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash amount, subtract the discount from the original amount. - There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 1101, you should type ' 110/1101 into the Post Ref. column. - You are also required to apply the journals and ledgers instructions 3 provided in Week 1. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Date Transaction description 9 Paid the full amount owing to Klam Wholesalers, Check No. 906. Jandesh's Hot Spot returned $1,368 worth of product. Issued a Credit Memorandum for $1,368. Made cash sales of $10,067 during the week. Quick Bolt Coffee paid the full amount owing on their account. Since Quick Bolt Coffee has been a loyal customer from the day the business commenced, a 5% discount was given for this early repayment. 13 Sold Disposable Teaspoon Sets to Revamp Coffee Carts for $537, Invoice No. 202. SALES JOURNAL PURCHASES JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', a above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate ac Account column so that the type of transaction can be determined by the name of the account entered into this column. CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', a above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate ac Account column so that the type of transaction can be determined by the name of the account entered into this column. SUBSIDIARY LEDGERS Account: ARC - Quick Bolt Coffee Account No. 1101 Account: ARC - Jandesh's Hot Spot Account No. 1103 Account: ARC - Revamp Coffee Carts Account No. 110-6 Account: APC - Klam Wholesalers Account No. 210-5 GENERAL LEDGER Account: Cash Account No. 100 Account: ARC - Accounts Receivable Control Account No. 110 Account: Merchandise Inventory Account No. 120 Account: APC - Accounts Payable Control Account No. 210 Account: Sales Revenue Account No. 400 Account: Sales Returns and Allowances Account No. 401 Account: Sales Discounts Account No. 402 Account: Purchases Account No. 500 Account: Purchase Returns and Allowances Account No. 501 Account: Purchase Discounts Account No. 502 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures 3. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will do this before you prepare the Bank Reconciliation Statement. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: - Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. - You are required to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash amount, subtract the discount from the original amount. - There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 1101, you should type ' 110/1101 into the Post Ref. column. - You are also required to apply the journals and ledgers instructions 3 provided in Week 1. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Date Transaction description 9 Paid the full amount owing to Klam Wholesalers, Check No. 906. Jandesh's Hot Spot returned $1,368 worth of product. Issued a Credit Memorandum for $1,368. Made cash sales of $10,067 during the week. Quick Bolt Coffee paid the full amount owing on their account. Since Quick Bolt Coffee has been a loyal customer from the day the business commenced, a 5% discount was given for this early repayment. 13 Sold Disposable Teaspoon Sets to Revamp Coffee Carts for $537, Invoice No. 202. SALES JOURNAL PURCHASES JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', a above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate ac Account column so that the type of transaction can be determined by the name of the account entered into this column. CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', a above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate ac Account column so that the type of transaction can be determined by the name of the account entered into this column. SUBSIDIARY LEDGERS Account: ARC - Quick Bolt Coffee Account No. 1101 Account: ARC - Jandesh's Hot Spot Account No. 1103 Account: ARC - Revamp Coffee Carts Account No. 110-6 Account: APC - Klam Wholesalers Account No. 210-5 GENERAL LEDGER Account: Cash Account No. 100 Account: ARC - Accounts Receivable Control Account No. 110 Account: Merchandise Inventory Account No. 120 Account: APC - Accounts Payable Control Account No. 210 Account: Sales Revenue Account No. 400 Account: Sales Returns and Allowances Account No. 401 Account: Sales Discounts Account No. 402 Account: Purchases Account No. 500 Account: Purchase Returns and Allowances Account No. 501 Account: Purchase Discounts Account No. 502