Answered step by step

Verified Expert Solution

Question

1 Approved Answer

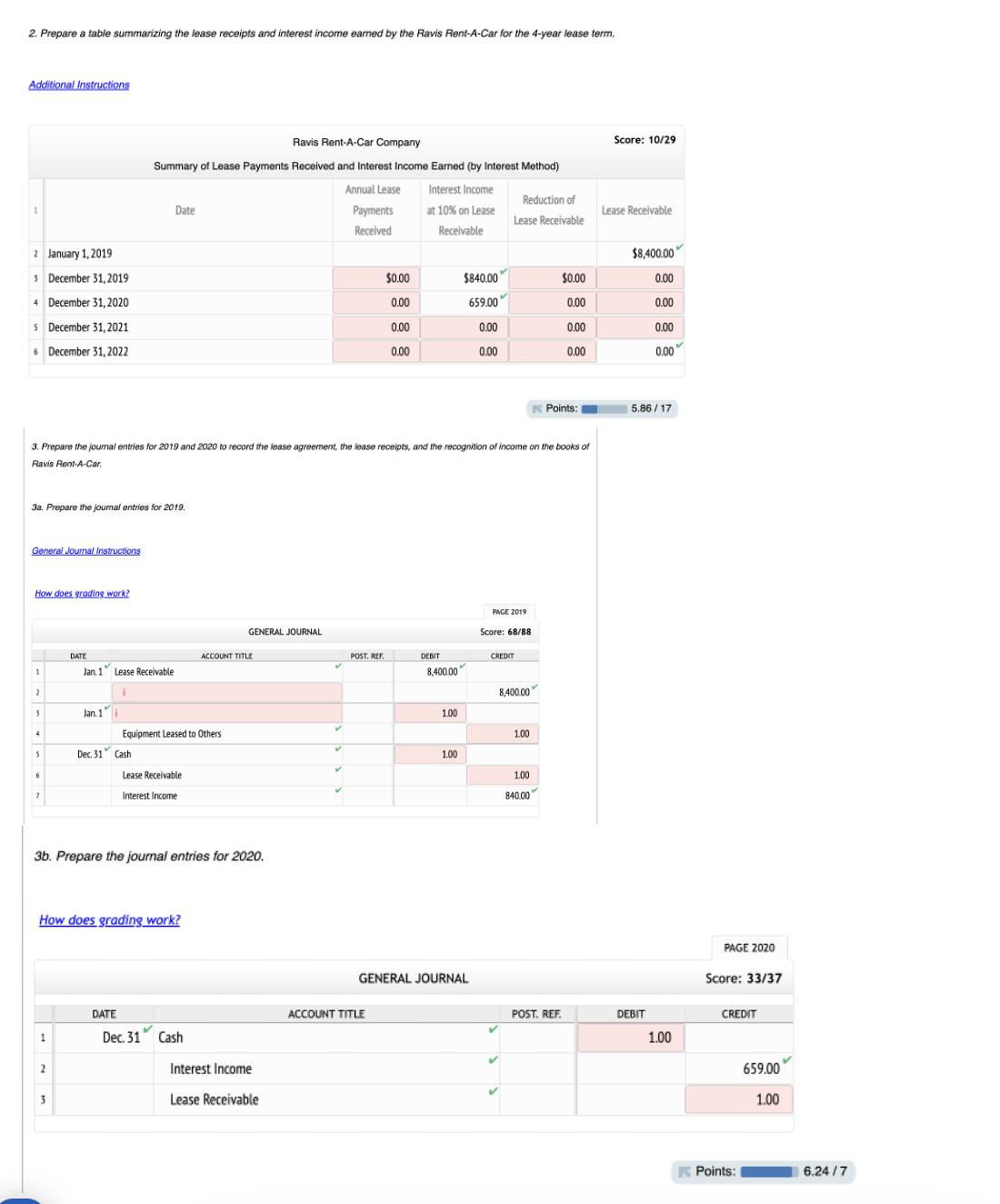

2. Prepare a table summarizing the lease receipts and interest income earned by the Ravis Rent-A-Car for the 4-year lease term. Additional Instructions 2

2. Prepare a table summarizing the lease receipts and interest income earned by the Ravis Rent-A-Car for the 4-year lease term. Additional Instructions 2 January 1, 2019 3 December 31, 2019 4 December 31, 2020 5 December 31, 2021 6 December 31, 2022 Ravis Rent-A-Car Company Summary of Lease Payments Received and Interest Income Earned (by Interest Method) Date Score: 10/29 Annual Lease Interest Income Payments at 10% on Lease Reduction of Lease Receivable Lease Receivable Received Receivable $8,400.00 $0.00 $840.00 $0.00 0.00 0.00 659.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Points: 3. Prepare the journal entries for 2019 and 2020 to record the lease agreement, the lease receipts, and the recognition of income on the books of Ravis Rent-A-Car 3a. Prepare the journal entries for 2019. General Journal Instructions How does grading work? DATE 1 7 Jan. 1 Lease Receivable Jan. 1 GENERAL JOURNAL ACCOUNT TITLE POST. REF. DEBIT Equipment Leased to Others Dec. 31 Cash Lease Receivable Interest Income 3b. Prepare the journal entries for 2020. How does grading work? DATE 1 Dec. 31 Cash 2 Interest Income 3 Lease Receivable PAGE 2019 Score: 68/88 8,400.00 CREDIT 1.00 8,400.00 1.00 1.00 1.00 GENERAL JOURNAL ACCOUNT TITLE 840.00 5.86/17 POST. REF. DEBIT 1.00 PAGE 2020 Score: 33/37 CREDIT 659.00 1.00 Points: 6.24/7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started