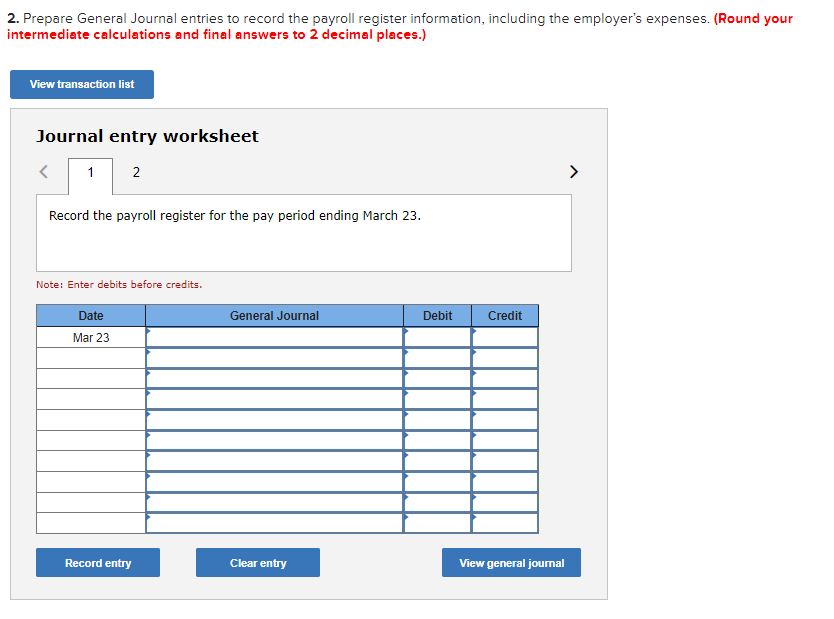

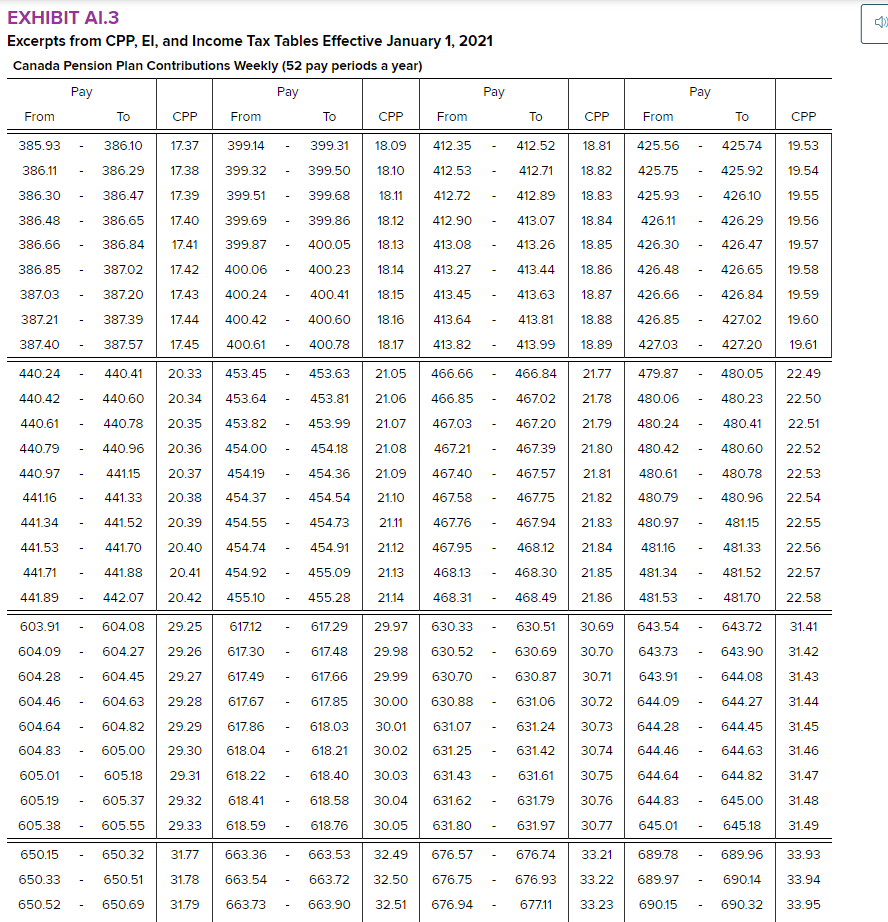

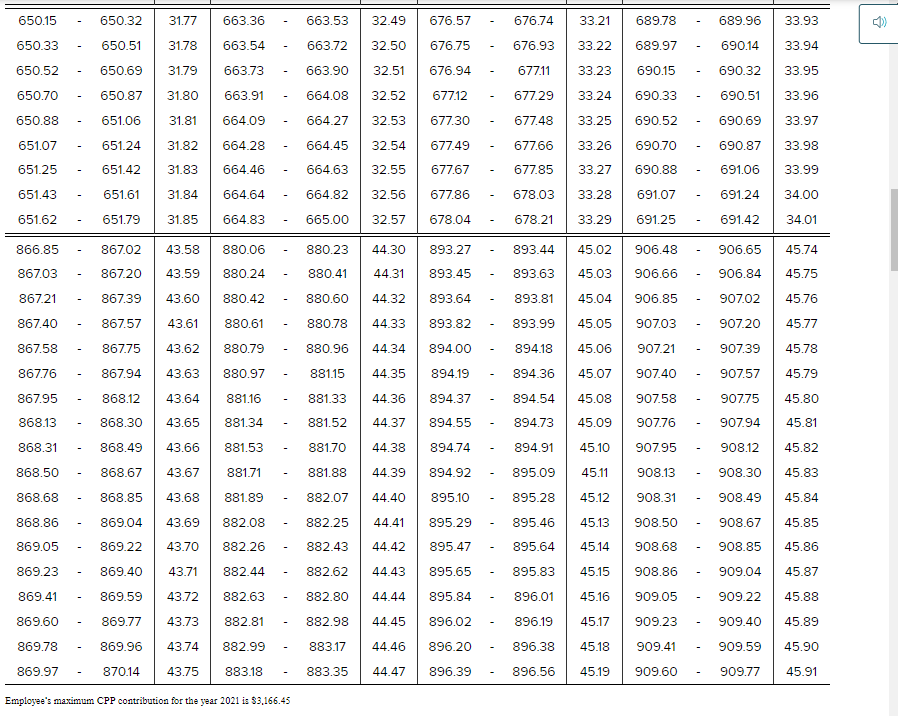

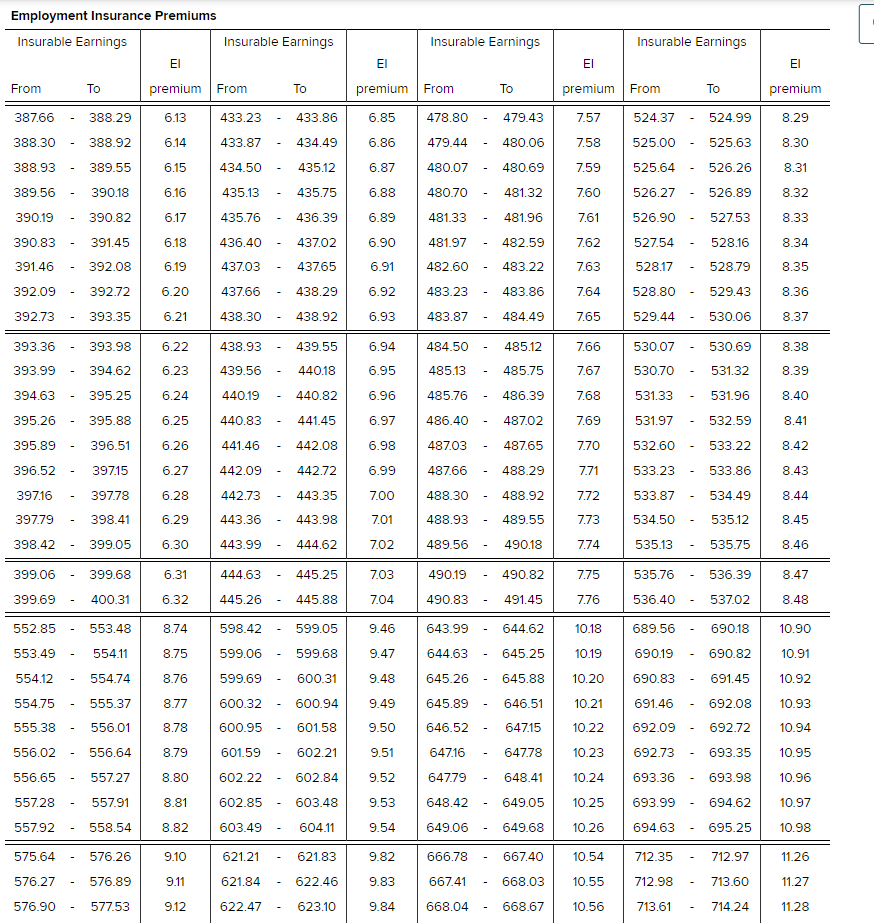

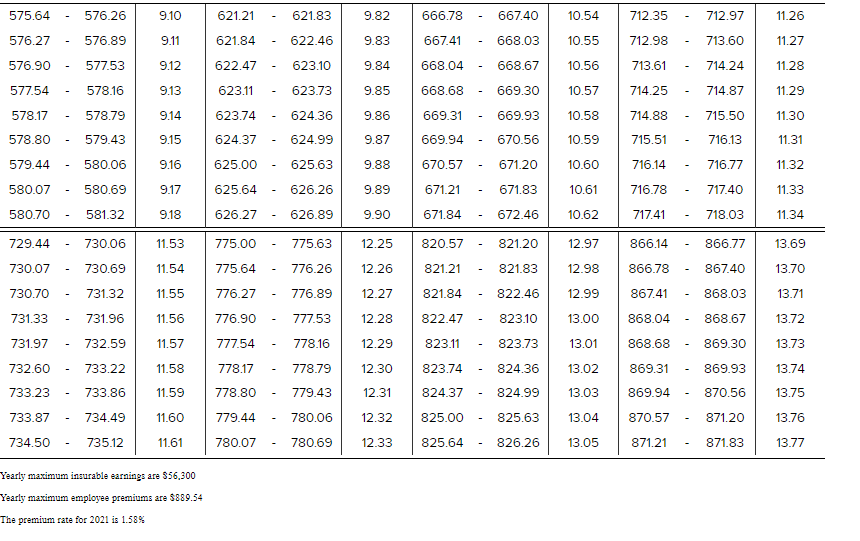

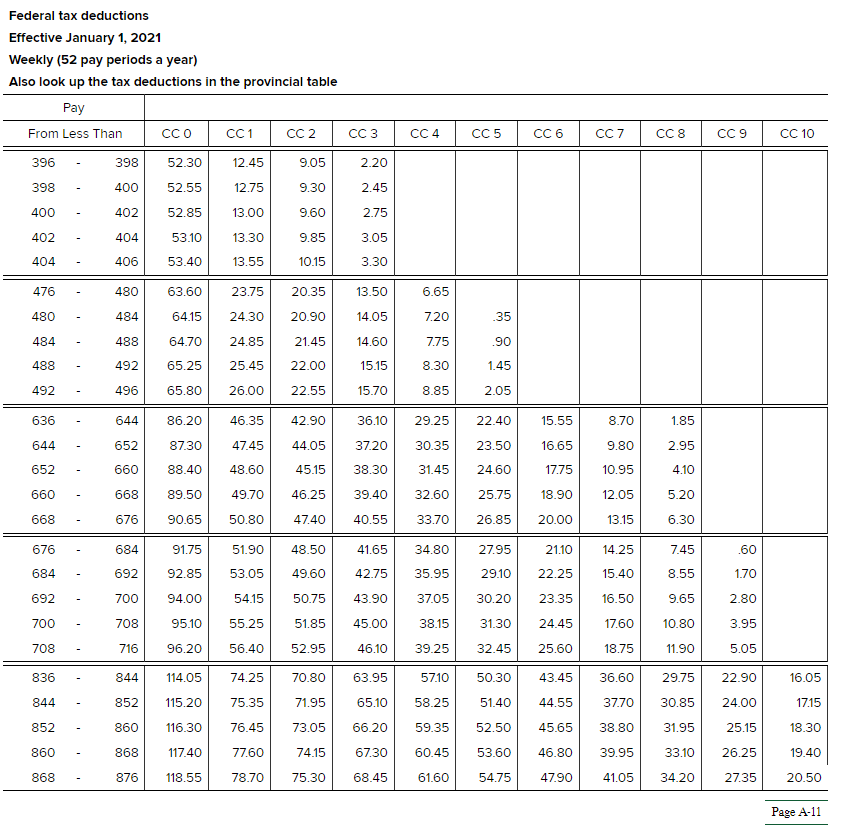

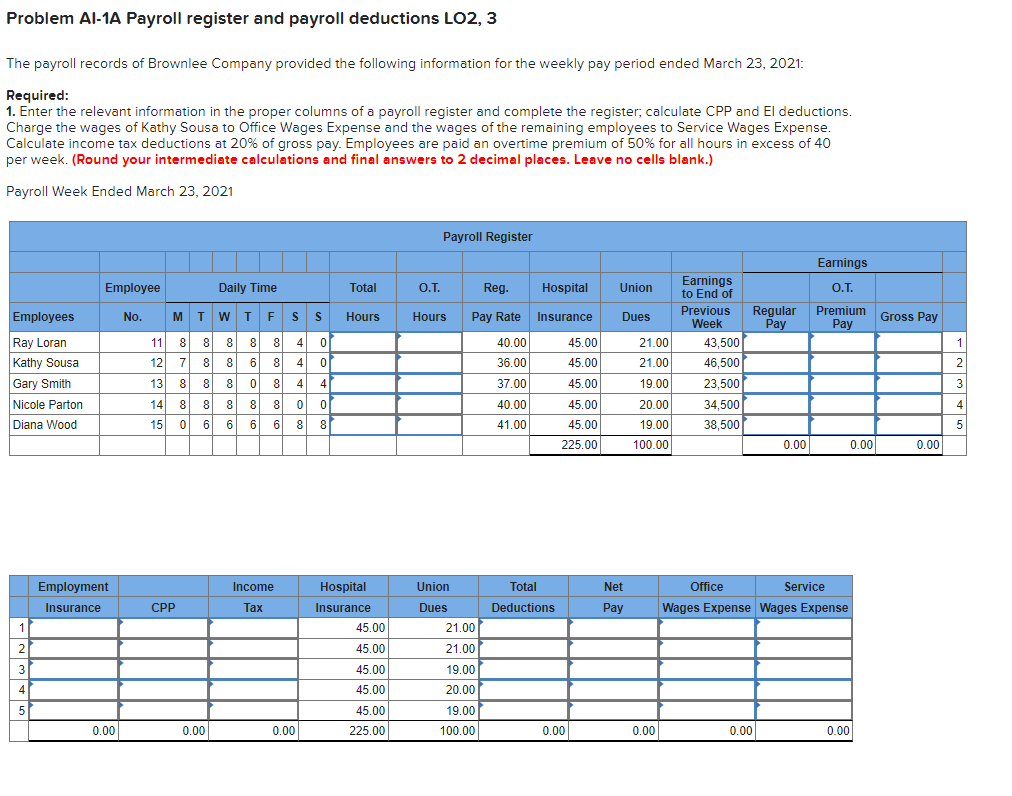

2. Prepare General Journal entries to record the payroll register information, including the employer's expenses. (Round your intermediate calculations and final answers to 2 decimal places.) View transaction list Journal entry worksheet 2 > Record the payroll register for the pay period ending March 23. Note: Enter debits before credits. Date General Journal Debit Credit Mar 23 Record entry Clear entry View general journalEXHIBIT AI.3 Excerpts from CPP, El, and Income Tax Tables Effective January 1, 2021 Canada Pension Plan Contributions Weekly (52 pay periods a year) Pay Pay Pay Pay CPF From CPP To CPP From CPF From To From To 425.56 425.74 19.53 385.93 386.10 17.37 399.14 399.31 18.09 412.35 412.52 18.81 18.10 412.53 412.71 18.82 425.75 425.92 19.54 386.11 386.29 17.38 399.32 399.50 412.72 412.89 18.83 425.93 426.10 19.55 17.39 399.51 18.11 386.30 386.47 399.68 426.29 9.56 386.65 17.40 399.69 399.86 18.12 412.90 413.07 8.84 426.11 386.48 413.08 113.26 18.85 426.30 426.47 19.57 386.66 386.84 17.41 399.87 400.05 18.13 413.44 18.86 426.48 426.65 19.58 386.85 387.02 17.42 400.06 400.23 18.14 413.27 400.24 400.41 18.15 413.45 413.63 18.87 426.66 426.84 19.59 387.03 387.20 17.43 18.88 426.85 427.02 19.60 387.21 387.39 17.44 400.42 400.60 8.16 413.64 413.81 413.82 413.99 18.89 427.03 427.20 19.61 387.40 387.57 17.45 400.61 400.78 18.17 179.87 480.05 22.49 440.24 440.41 20.33 453.45 453.63 21.05 466.66 466.84 21.77 21.78 480.06 480.23 22.50 440.42 440.60 20.34 453.64 453.81 21.06 466.85 467.02 480.24 480.41 22.51 440.61 440.78 20.35 453.82 453.99 21.07 467.03 467.20 21.79 480.60 22.52 440.79 440.96 20.36 154.00 454.18 21.08 467.21 467.39 21.80 480.42 454.36 21.09 467.40 467.57 21.81 480.61 480.78 22.53 440.97 441.15 20.37 454.19 20.38 454.37 454.54 21.10 467.58 467.75 21.82 480.79 480.96 22.54 441.16 441.33 481.15 22.55 441.34 441.52 20.39 454.55 454.73 21.11 467.76 467.94 21.83 480.97 454.91 21.12 467.95 468.12 21.84 481.16 481.33 22.56 441.53 441.70 20.40 454.74 441.88 20.41 454.92 455.09 21.13 468.13 468.30 21.85 481.34 481.52 22.57 441.71 22.58 441.89 442.07 20.42 455.10 455.28 21.14 468.31 468.49 21.86 481.53 481.70 617.29 29.97 630.33 630.51 30.69 643.54 643.72 31.41 603.91 604.08 29.25 617.12 630.69 30.70 643.73 643.90 31.42 604.09 604.27 29.20 617.30 617.48 29.98 630.52 31.43 604.28 604.45 29.27 617.49 617.66 29.99 630.70 630.87 30.71 643.91 644.08 617.85 80.00 630.88 631.06 30.72 644.09 644.27 31.44 604.46 604.63 29.28 617.67 29.29 617.86 618.03 30.01 631.07 631.24 30.73 644.28 644.45 31.45 604.64 604.82 30.74 644.46 644.63 31.46 604.83 605.00 29.30 618.04 618.21 30.02 531.25 631.42 618.22 618.40 30.03 631.43 631.61 30.75 644.64 644.82 31.47 605.01 605.18 29.31 631.79 30.76 644.83 645.00 31.48 605.19 605.37 29.32 618.41 618.58 30.04 631.62 31.49 29.33 618.59 618.76 30.05 631.80 631.97 30.7 645.01 645.18 605.38 605.55 689.96 3.93 650.15 650.32 31.7 63.36 663.53 32.49 676.57 676.74 33.21 689.78 690.14 650.51 663.54 32.50 33.22 33.94 676.75 676.93 650.33 31.78 663.72 689.97 690.32 33.95 32.51 676.94 677.11 33.23 690.15 650.52 650.69 31.79 663.73 663.9033.93 650.15 650.32 31.77 663.36 663.53 32.49 676.57 676.74 33.21 689.78 689.96 650.51 31.78 663.54 663.72 32.50 676.75 676.93 33.22 689.97 690.14 33.94 650.33 650.52 650.69 31.79 663.73 663.90 32.51 676.94 677.11 33.23 690.15 690.32 33.95 31.80 663.91 664.08 32.52 677.12 677.29 33.24 690.33 690.51 33.96 650.70 650.87 650.88 651.06 31.81 664.09 664.27 32.53 677.30 677.48 33.25 690.52 690.69 33.97 651.07 651.24 31.82 664.28 664.45 32.54 677.49 677.66 33.26 690.70 690.87 33.98 651.25 651.42 31.83 664.46 664.63 32.55 677.67 677.85 33.27 690.88 691.06 33.99 651.43 651.61 31.84 664.64 664.82 32.56 677.86 678.03 33.28 691.07 691.24 34.00 651.62 651.79 31.85 664.83 665.00 32.57 678.04 678.21 33.29 691.25 691.42 34.01 866.85 867.02 43.58 880.06 880.23 44.30 893.27 893.44 45.02 906.48 906.65 45.74 867.03 867.20 43.59 880.24 880.41 44.31 893.45 893.63 45.03 906.66 906.84 45.75 867.21 867.39 43.60 880.42 880.60 44.32 893.64 893.81 45.04 906.85 907.02 45.76 45.77 867.40 867.57 43.61 880.61 880.78 44.33 893.82 893.99 45.05 907.03 907.20 867.58 867.75 43.62 880.79 880.96 44.34 894.00 894.18 45.06 907.21 907.39 45.78 867.76 867.94 43.63 880.97 881.15 44.35 894.19 894.36 45.07 907.40 907.57 45.79 867.95 868.12 43.64 881.16 881.33 44.36 894.37 894.54 45.08 907.58 907.75 45.80 868.13 868.30 43.65 881.34 881.52 44.37 894.55 894.73 45.09 907.76 907.94 45.81 868.31 868.49 43.66 881.53 881.70 44.38 894.74 894.91 45.10 907.95 908.12 45.82 868.50 868.67 43.67 881.71 881.88 44.39 894.92 895.09 45.11 908.13 908.30 45.83 868.68 868.85 43.68 881.89 882.07 44.40 895.10 895.28 45.12 908.31 908.49 45.84 868.86 869.04 43.69 882.08 882.25 44.41 895.29 895.46 45.13 908.50 908.67 45.85 869.05 869.22 43.70 882.26 882.43 44.42 895.47 895.64 45.14 908.68 908.85 45.86 869.23 869.40 43.71 882.44 882.62 44.43 895.65 895.83 45.15 908.86 909.04 45.87 869.59 43.72 882.63 882.80 44.44 895.84 896.01 45.16 909.05 909.22 45.88 869.41 869.60 869.77 43.73 882.81 882.98 44.45 896.02 896.19 45.17 909.23 909.40 45.89 45.90 869.78 869.96 43.74 882.99 883.17 44.46 896.20 896.38 45.18 909.41 909.59 869.97 43.75 883.18 896.56 45.91 870.14 883.35 44.47 896.39 45.19 909.60 909.77 Employee's maximum CPP contribution for the year 2021 is $3,166.45Employment Insurance Premiums Insurable Earnings Insurable Earnings Insurable Earnings Insurable Earnings FI EI FI El To premium From To premium From To premium From To premium From 524.99 3.29 387.66 388.29 6.13 433.23 433.86 6.85 478.80 479.43 7.57 524.37 525.63 8.30 388.30 388.92 6.14 433.87 434.49 6.86 479.44 480.06 7.58 525.00 525.64 526.26 8.31 388.93 389.55 6.15 434.50 435.12 6.87 480.07 480.69 7.59 7.60 526.27 526.89 8.32 389.56 390.18 5.16 435.13 435.75 6.88 480.70 481.32 833 390.19 390.82 6.17 435.76 436.39 6.8 481.33 481.96 7.61 526.90 527.53 8.34 390.83 391.45 6.18 436.40 437.02 6.90 481.97 482.59 7.62 527.54 528.16 3.35 391.46 392.08 6.19 437.03 437.65 6.91 482.60 483.22 7.63 528.17 528.79 3.36 392.09 392.72 6.20 437.66 438.29 6.92 483.23 483.86 7.64 528.80 529.43 7.65 529.44 530.06 8.37 392.73 393.35 6.21 438.30 438.92 6.93 483.87 484.49 438.93 439.55 6.9 184.50 7.66 393.98 485.12 530.07 530.69 8.38 393.36 5.22 8.39 393.99 394.62 5.23 439.56 440.18 6.95 485.13 485.75 7.67 530.70 531.32 395.25 5.24 440.19 440.82 6.96 485.76 486.39 7.68 531.33 531.96 8.40 394.63 395.26 395.88 6.25 440.83 441.45 6.97 486.40 487.02 7.69 531.97 532.59 8.41 487.03 487.65 7.70 532.60 533.22 8.42 395.89 396.51 5.26 441.46 442.08 6.98 396.52 39715 6.27 442.09 442.72 6.99 487.66 488.29 7.71 533.23 533.86 8.43 442.73 443.35 700 488.30 488.92 7.72 533.87 534.49 8.44 397.16 397.78 6.28 7.73 534.50 535.12 8.45 397.79 398.41 5.29 443.36 443.98 7.01 488.93 489.55 490.18 174 535.13 398.42 399.05 6.30 443.99 444.62 702 489.56 535.75 3.46 536.39 8.47 399.06 399.68 6.31 444.63 445.25 7.03 490.19 490.82 7.75 535.76 491.45 7.76 536.40 537.02 8.48 399.69 400.31 6.32 445.26 445.88 7.04 490.83 10.90 552.85 553.48 8.74 598.42 599.05 9.46 643.99 644.62 0.18 689.56 690.18 645.25 10.91 3.75 599.06 599.68 9.47 690.19 690.82 553.49 554.11 644.63 0.19 691.45 10.92 554.12 554.74 8.76 599.69 600.31 9 48 645.26 645.88 10.20 690.83 10.21 691.46 692.08 10.93 554.75 555.37 8.77 600.32 600.94 9.49 645.89 646.51 10.94 555.38 556.01 8.78 600.95 601.58 3.50 646.52 647.15 10.22 692.09 692.72 601.59 602.21 647.16 647.78 10.23 692.73 693.35 10.95 556.02 556.64 8.79 693.36 693.98 10.96 556.65 557.27 8.80 602.22 602.84 9.52 647.79 648.41 10.24 648.42 - 649.05 10.25 693.99 694.62 10.97 557.28 557.91 8.81 602.85 603.48 3.53 10.26 694.63 695.25 10.98 557.92 558.54 3 87 603.49 604.11 9.54 649.06 - 649.68 9.10 9.82 10.54 712.97 576.26 621.21 666.78 667.40 11.26 575.64 621.83 712.35 10.55 712.98 713.60 11.27 576.27 576.89 9.11 621.84 622.46 9.8. 667.41 668.03 10.56 713.61 - 714.24 11.28 576.90 - 577.53 9.12 622.47 623.10 9.84 668.04 - 668.67575.64 - 576.26 9.10 621.21 - 621.83 9.82 666.78 - 667.40 10.54 712.35 - 712.97 11.26 576.27 - 576.89 9.11 621.84 - 622.46 9.83 667.41 668.03 10.55 712.98 - 713.60 11.27 576.90 577.53 9.12 622.47 - 623.10 9.84 668.04 - 668.67 10.56 713.61 - 714.24 11.28 577.54 - 578.16 9.13 623.11 - 623.73 9.85 668.68 - 669.30 10.57 714.25 - 714.87 11.29 578.17 578.79 9.14 623.74 - 624.36 9.86 669.31 669.93 10.58 714.88 715.50 11.30 578.80 579.43 9.15 624.37 - 624.99 9.87 669.94 670.56 10.59 715.51 716.13 11.31 579.44 580.06 9.16 625.00 - 625.63 9.88 670.57 - 671.20 10.60 716.14 - 716.77 11.32 580.07 580.69 9.17 625.64 - 626.26 9.89 671.21 - 671.83 10.61 716.78 - 717.40 11.33 580.70 - 581.32 9.18 626.27 - 626.89 9.90 671.84 672.46 10.62 717.41 - 718.03 11.34 729.44 730.06 11.53 775.00 775.63 12.25 820.57 821.20 12.97 866.14 - 866.77 13.69 730.07 730.69 11.54 775.64 - 776.26 12.26 821.21 - 821.83 12.98 866.78 - 867.40 13.70 730.70 - 731.32 11.55 776.27 776.89 12.27 821.84 - 822.46 12.99 867.41 - 868.03 13.71 731.33 731.96 11.56 776.90 777.53 12.28 822.47 823.10 13.00 868.04 868.67 13.72 731.97 732.59 11.57 777.54 778.16 12.29 823.11 823.73 13.01 868.68 869.30 13.73 732.60 733.22 11.58 778.17 778.79 12.30 823.74 - 824.36 13.02 869.31 - 869.93 13.74 733.23 - 733.86 11.59 778.80 - 779.43 12.31 824.37 - 824.99 13.03 869.94 - 870.56 13.75 733.87 734.49 11.60 779.44 - 780.06 12.32 825.00 - 825.63 13.04 870.57 - 871.20 13.76 734.50 735.12 11.61 780.07 780.69 12.33 825.64 826.26 13.05 871.21 871.83 13.77 Yearly maximum insurable earnings are $56,300 Yearly maximum employee premiums are $889.54 The premium rate for 2021 is 1.58%Federal tax deductions Effective January 1, 2021 Weekly (52 pay periods a year) Also look up the tax deductions in the provincial table Pay CC 10 CC 1 CC 2 CC 3 CC 4 CC 5 CC 6 CC 7 CC 8 CC 9 From Less Than CCO 396 398 52.30 12.45 9.05 2.20 52.55 2.45 398 400 12.75 9.30 400 402 52.85 13.00 9.61 2.75 404 53.10 13.30 9.83 3.05 402 3.3 404 40 53.40 13.5 10.15 480 63.60 20.35 6.65 476 23.75 13.50 484 64.15 24.30 20.90 14.05 7.20 35 180 488 64.70 24.85 21.45 14.60 7.75 .90 484 492 65.25 22.00 488 25.45 15.15 3.30 1.45 496 65.80 26.00 22.55 15.70 8.85 2.05 492 29.25 22.40 15.55 8.70 1.85 46.35 36.10 644 86.20 42.90 636 23.50 16.65 9.80 2.95 644 652 87.30 47.45 44.05 37.20 30.35 24.60 17.75 10.95 4.10 45.15 38.30 31.45 652 660 88.40 48.60 12.05 5.20 89.50 49.70 46.25 39.40 32.60 25.75 18.90 660 899 $3.70 26.85 20.00 13.15 6.30 668 676 90.6 50.80 47.40 40.5 21.10 14.25 7.45 60 676 684 91.75 51.90 48.50 41.65 34.80 27.95 29.10 22.25 15.40 8.55 170 684 692 92.85 53.05 49.60 42.75 35.95 .65 50.75 13.90 37.05 30.20 23.35 16.50 2.80 54.15 692 700 94.00 17.60 10.80 3.95 708 95.10 55.25 51.85 45.00 38.15 31.30 24.45 700 18.75 1.90 5.05 96.2 56.4 52.95 46.10 39.25 32.45 25.60 708 716 50.30 43.45 36.60 29.75 22.90 16.05 844 70.80 57.10 836 114.05 74.25 63.95 44.55 37.70 30.85 24.00 17.15 852 115.20 75.35 71.95 65.10 58.25 51.40 844 31.95 25.15 18.30 116.30 76.45 73.05 66.20 59.35 52.50 45.65 38.80 852 860 46.80 39.95 33.10 26.25 19.40 60.45 53.60 860 868 117.40 77.60 74.15 67.30 41.05 34.20 27.35 20.50 868 876 118.5 78.70 75.30 68.45 61.60 54.75 47.90 Page A-11Problem Al-1A Payroll register and payroll deductions LO2, 3 The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2021: Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register, calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.) Payroll Week Ended March 23, 2021 Payroll Register Earnings Earnings Employee Daily Time Total O. T. Reg Hospital Union to End of O.T. Previous Regular Premium Employees No. MTWTFSS Hours Hours Pay Rate Insurance Dues Week Gross Pay Pay Pay Ray Loran 11 8 8 8 8 8 4 0 10.00 45.00 21.00 43,500 1 Kathy Sousa 12 7 8 8 6 8 4 36.00 45.0 21.00 46,500 2 Gary Smith 13 8 8 8 0 8 4 4 37.00 15.00 19.00 23,500 3 Nicole Parton 14 8 8 8 8 8 0 0 40.0 45.00 20.00 34,500 Diana Wood 15 0 6 6 6 6 8 8 41.00 45.0 19.00 38,500 225.00 100.00 0.00 0.00 0.00 Employment Income Hospital Union Total Net Office Service Insurance CPP Tax Insurance Dues Deductions Pay Wages Expense | Wages Expense 45.00 21.00 45.00 21.00 45.00 19.00 UI A W N 45.00 20.00 45.00 19.00 0.00 0.00 0.00 225.00 100.00 0.00 0.00 0.00 0.00