Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Prepare T Account ( Ledgers ) 1. Tom Pines decided to open a bed and breakfast in his hometown. Prepare journal entries to record

2. Prepare T Account ( Ledgers )

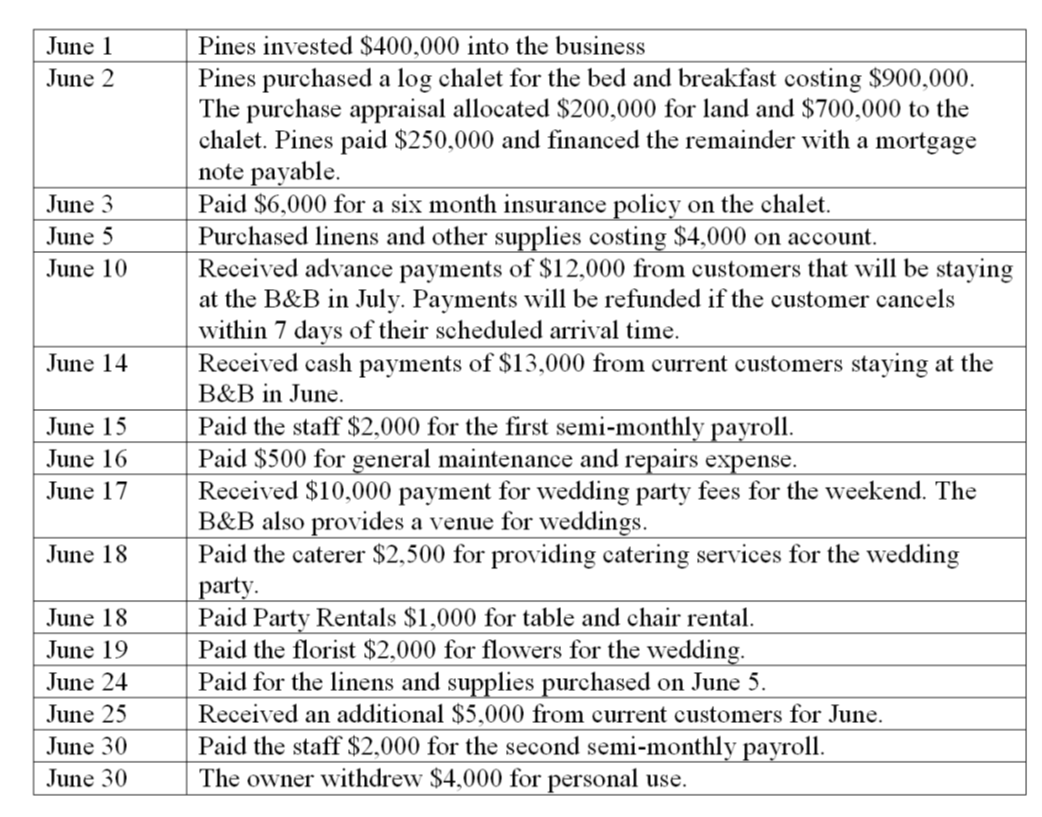

1. Tom Pines decided to open a bed and breakfast in his hometown. Prepare journal entries to record the following transactions.

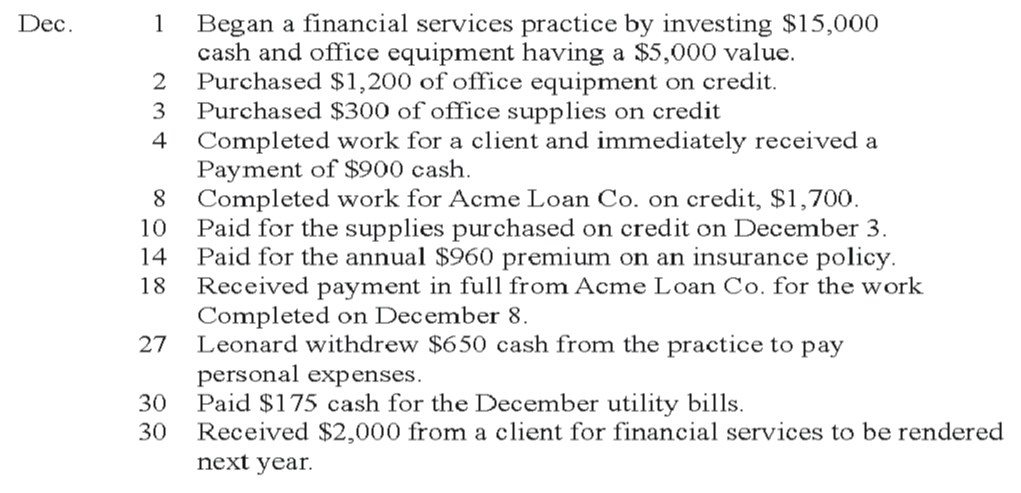

Leonard Matson completed these transactions during December of the current year 2020:

\begin{tabular}{|l|l|} \hline June 1 & Pines invested $400,000 into the business \\ \hline June 2 & Pines purchased a log chalet for the bed and breakfast costing $900,000. The purchase appraisal allocated $200,000 for land and $700,000 to the chalet. Pines paid $250,000 and financed the remainder with a mortgage note payable. \\ \hline June 3 & Paid $6,000 for a six month insurance policy on the chalet. \\ \hline June 5 & Purchased linens and other supplies costing $4,000 on account. \\ \hline June 10 & Received advance payments of $12,000 from customers that will be staying at the B\&B in July. Payments will be refunded if the customer cancels within 7 days of their scheduled arrival time. \\ \hline June 14 & Received cash payments of $13,000 from current customers staying at the B\&B in June. \\ \hline June 15 & Paid the staff $2,000 for the first semi-monthly payroll. \\ \hline June 16 & Paid $500 for general maintenance and repairs expense. \\ \hline June 17 & Received $10,000 payment for wedding party fees for the weekend. The B\&B also provides a venue for weddings. \\ \hline June 18 & Paid the caterer $2,500 for providing catering services for the wedding party. \\ \hline June 18 & Paid Party Rentals $1,000 for table and chair rental. \\ \hline June 19 & Paid the florist $2,000 for flowers for the wedding. \\ \hline June 24 & Paid for the linens and supplies purchased on June 5. \\ \hline June 25 & Received an additional $5,000 from current customers for June. \\ \hline June 30 & Paid the staff $2,000 for the second semi-monthly payroll. \\ \hline June 30 & The owner withdrew $4,000 for personal use. \\ \hline \end{tabular} 1 Began a financial services practice by investing $15,000 cash and office equipment having a $5,000 value. 2 Purchased $1,200 of office equipment on credit. 3 Purchased $300 of office supplies on credit 4 Completed work for a client and immediately received a Payment of $900 cash. 8 Completed work for Acme Loan Co. on credit, $1,700. 10 Paid for the supplies purchased on credit on December 3. 14 Paid for the annual $960 premium on an insurance policy. 18 Received payment in full from Acme Loan Co. for the work Completed on December 8. 27 Leonard withdrew $650 cash from the practice to pay personal expenses. 30 Paid $175 cash for the December utility bills. 30 Received $2,000 from a client for financial services to be rendere next year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started