Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Prepare the journal entries to show how Pipa would record this transaction assuming there is no commercial substance. (If no entry is required for

2. Prepare the journal entries to show how Pipa would record this transaction assuming there is no commercial substance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

- Record the exchange of equipment, whose net book value was $54,000 (cost $202,000) and a fair value of $71,000, for purchase of a Truck for $13,100 assuming there was no commercial substance.

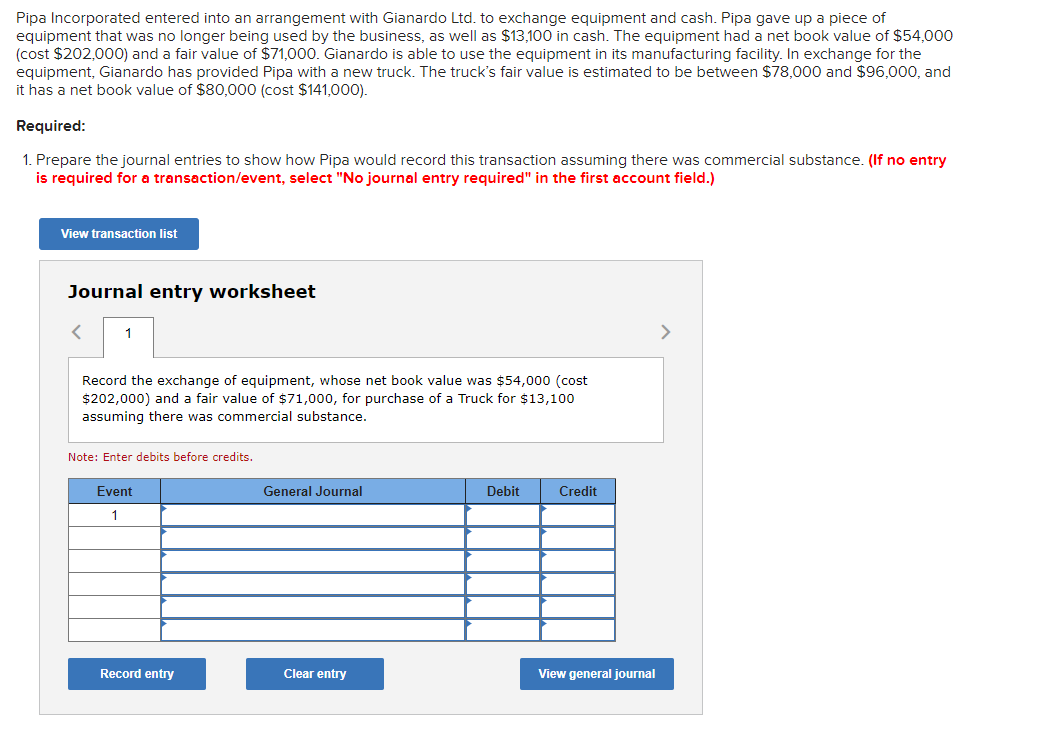

Pipa Incorporated entered into an arrangement with Gianardo Ltd. to exchange equipment and cash. Pipa gave up a piece of equipment that was no longer being used by the business, as well as $13,100 in cash. The equipment had a net book value of $54,000 (cost $202,000 ) and a fair value of $71,000. Gianardo is able to use the equipment in its manufacturing facility. In exchange for the equipment, Gianardo has provided Pipa with a new truck. The truck's fair value is estimated to be between $78,000 and $96,000, and it has a net book value of $80,000 (cost $141,000) ). Required: 1. Prepare the journal entries to show how Pipa would record this transaction assuming there was commercial substance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the exchange of equipment, whose net book value was $54,000 (cost $202,000) and a fair value of $71,000, for purchase of a Truck for $13,100 assuming there was commercial substance. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started