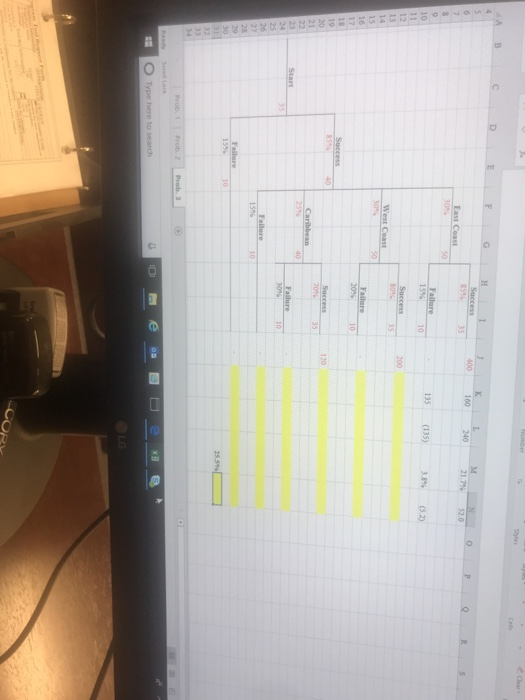

2. present valuing the Net Cash Flow excluding those purchase prices. This calculation will include Cap Ex for years 3-15 as they are part of the normal operation of the gates and are unrelated to the purchase price 3. using the Black-Scholes Option Pricing formula to come up with option's price assuming a 3-year maturity and a 10% price volatility for gate prices 4 you compare the price of the call option as calculated using the BSO formula with the NPV in the No Real Options scenario. With this, you can decide whether or not the $1M option is worth it or not. Is it? Problem 3 - Decision Tree JTM really liked your work on the option pricing of the gates, so they ask you to look at their 3 phase expansion at their home airport. The three phases are: 1 upon purchase of the new gates, start a marketing program to promote JTM's routes to the East Coast, West Coast, and the Caribbean it all goes well and the market is receptive, they will go on to phase 2 2 phase 2 has JTM invest in newtoutes to the three sets of destinations listed. If at any time, JTM finds that this is not going to work, they will pull the plug on phase 2 and scratch the project 3 phase 3 has JTM start the new routes to the destinations listed of things don't go well on any of the three destinations, they will pull the plug on phase 3 and scratch that destination out After much work with other departments, you generate enough data to calculate the NPV of the 3-phase expansion. Before you have a chance to save all your work, there is a power spike in the building and you lose part of your work. You have to go back and complete it so you can present it to your manager. Please use the template to complete problem 3 Problem Set 1 Rubric (3) Criteria Ratings Pts Description of creion 100.0 pts Excellent 90.0 pts Above Average 800 pts Average 70.0 pts Below average 100 0 pts Success 400 160 200 217% 520 East Coast 135 (135) 3.8% (52) & RARA O Type here to search CORY 2. present valuing the Net Cash Flow excluding those purchase prices. This calculation will include Cap Ex for years 3-15 as they are part of the normal operation of the gates and are unrelated to the purchase price 3. using the Black-Scholes Option Pricing formula to come up with option's price assuming a 3-year maturity and a 10% price volatility for gate prices 4 you compare the price of the call option as calculated using the BSO formula with the NPV in the No Real Options scenario. With this, you can decide whether or not the $1M option is worth it or not. Is it? Problem 3 - Decision Tree JTM really liked your work on the option pricing of the gates, so they ask you to look at their 3 phase expansion at their home airport. The three phases are: 1 upon purchase of the new gates, start a marketing program to promote JTM's routes to the East Coast, West Coast, and the Caribbean it all goes well and the market is receptive, they will go on to phase 2 2 phase 2 has JTM invest in newtoutes to the three sets of destinations listed. If at any time, JTM finds that this is not going to work, they will pull the plug on phase 2 and scratch the project 3 phase 3 has JTM start the new routes to the destinations listed of things don't go well on any of the three destinations, they will pull the plug on phase 3 and scratch that destination out After much work with other departments, you generate enough data to calculate the NPV of the 3-phase expansion. Before you have a chance to save all your work, there is a power spike in the building and you lose part of your work. You have to go back and complete it so you can present it to your manager. Please use the template to complete problem 3 Problem Set 1 Rubric (3) Criteria Ratings Pts Description of creion 100.0 pts Excellent 90.0 pts Above Average 800 pts Average 70.0 pts Below average 100 0 pts Success 400 160 200 217% 520 East Coast 135 (135) 3.8% (52) & RARA O Type here to search CORY