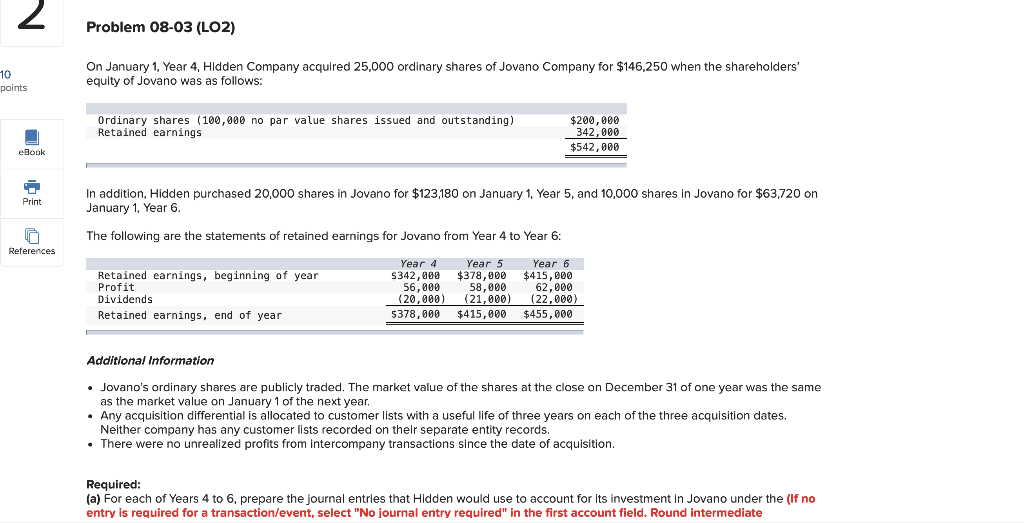

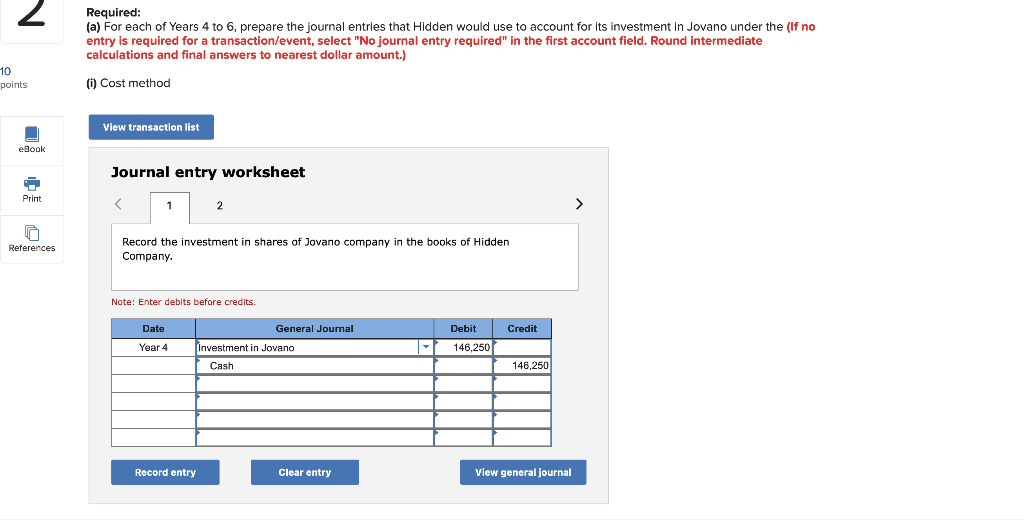

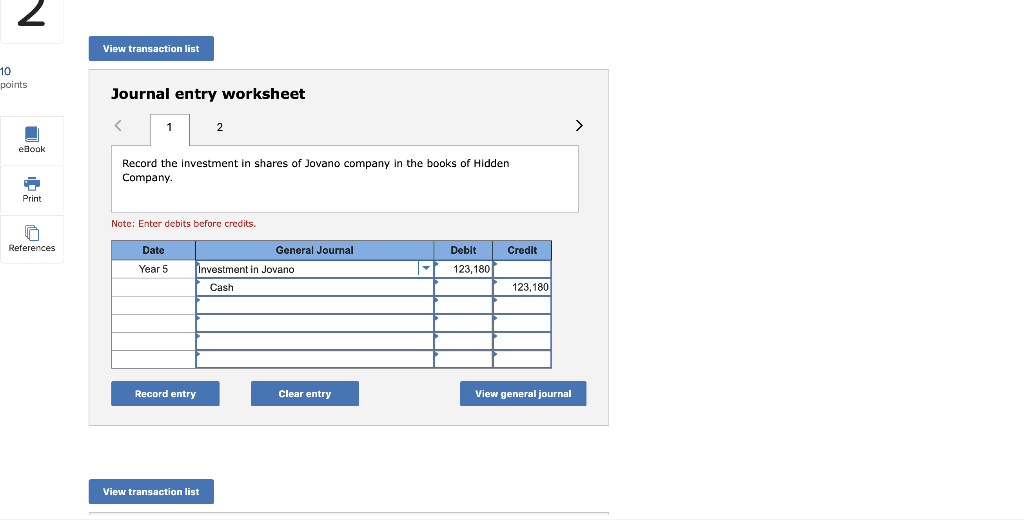

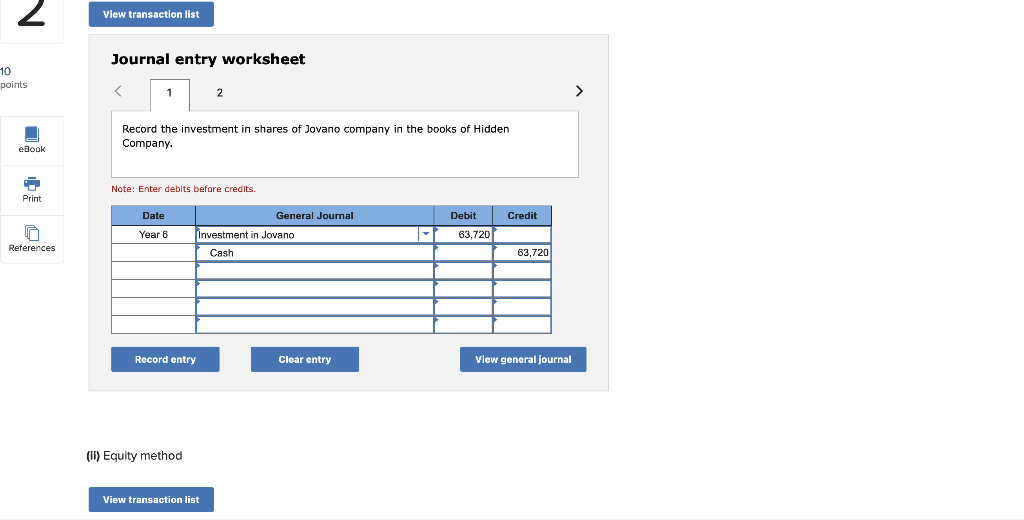

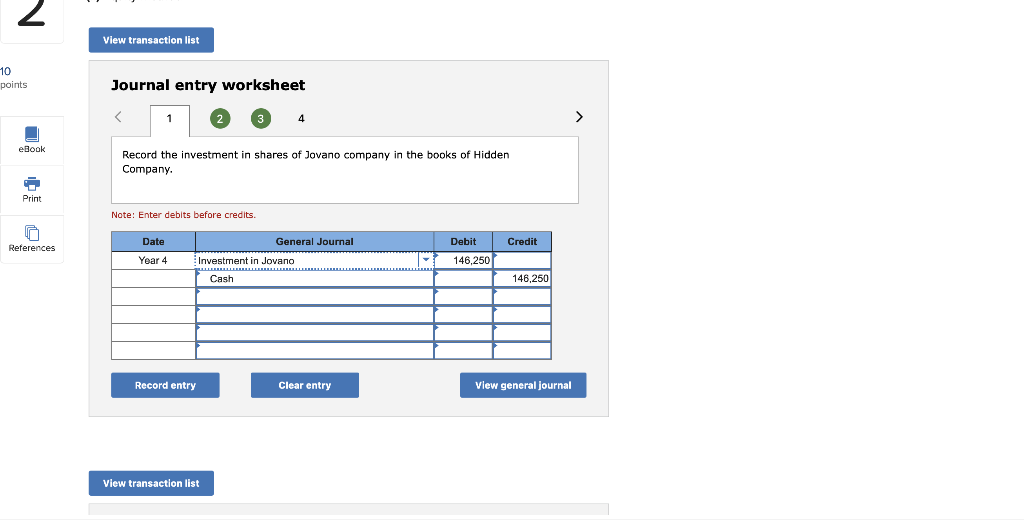

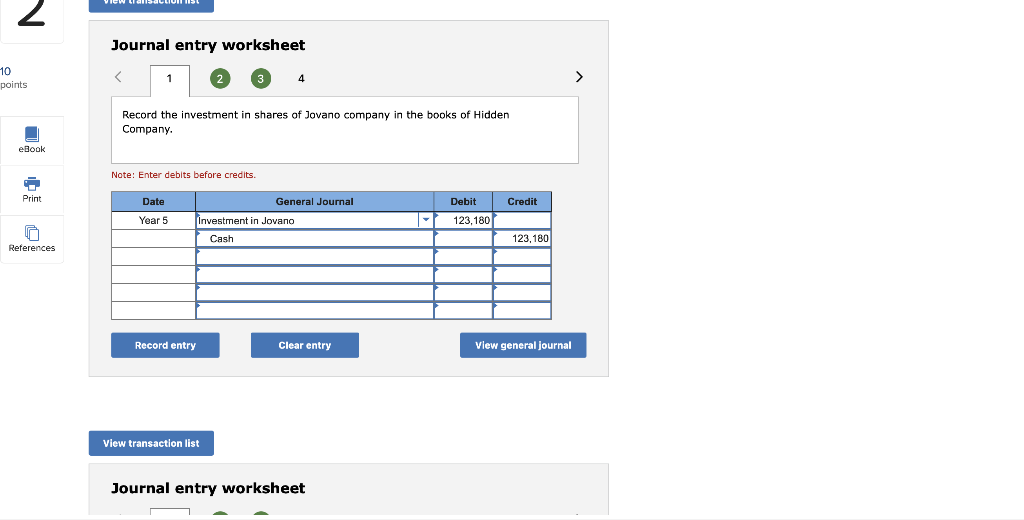

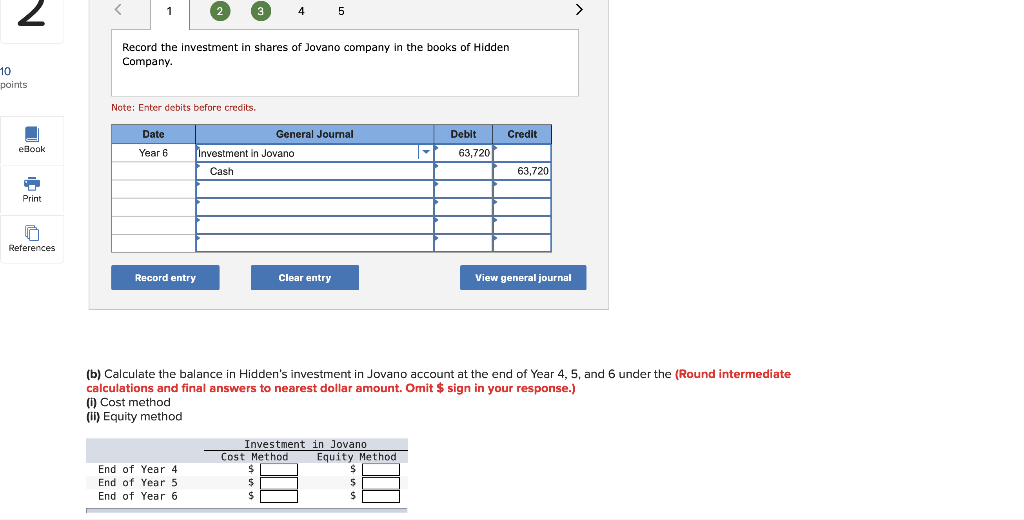

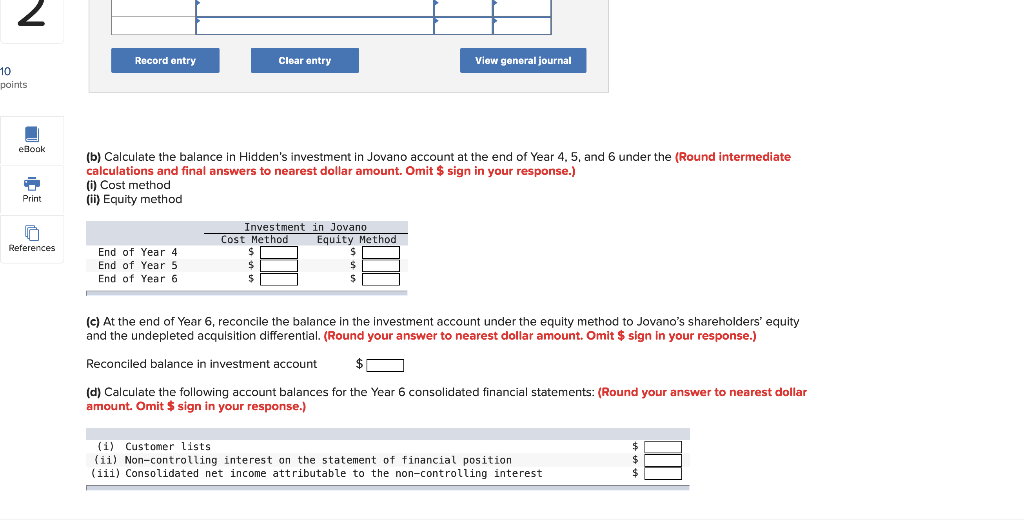

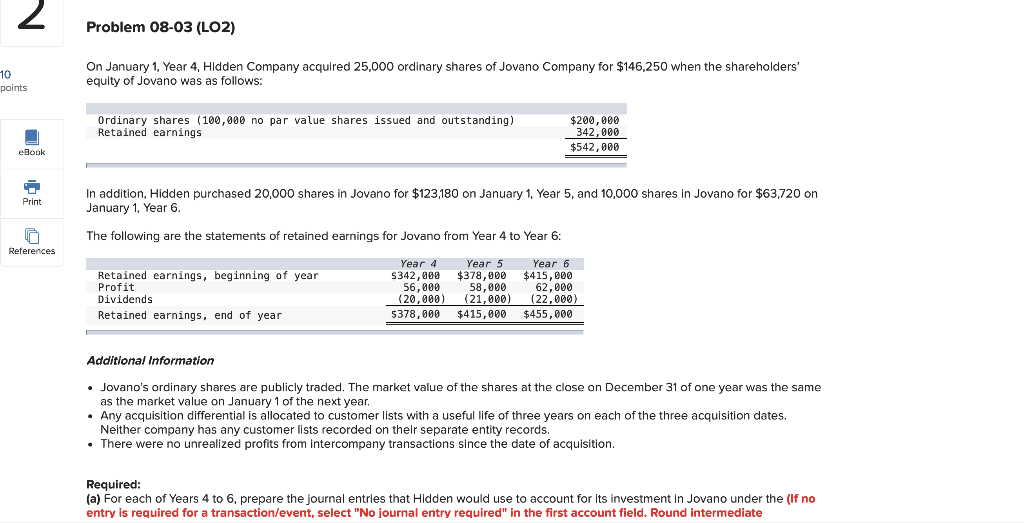

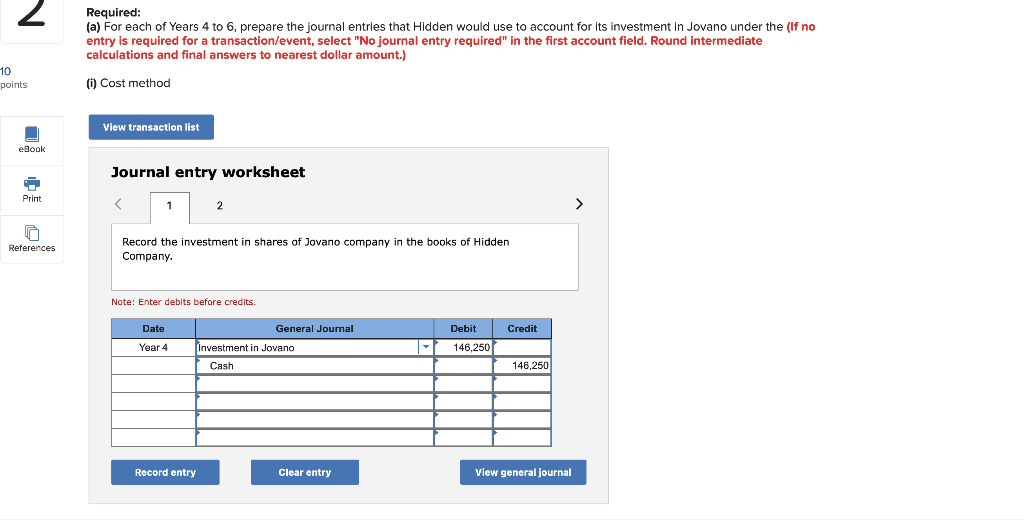

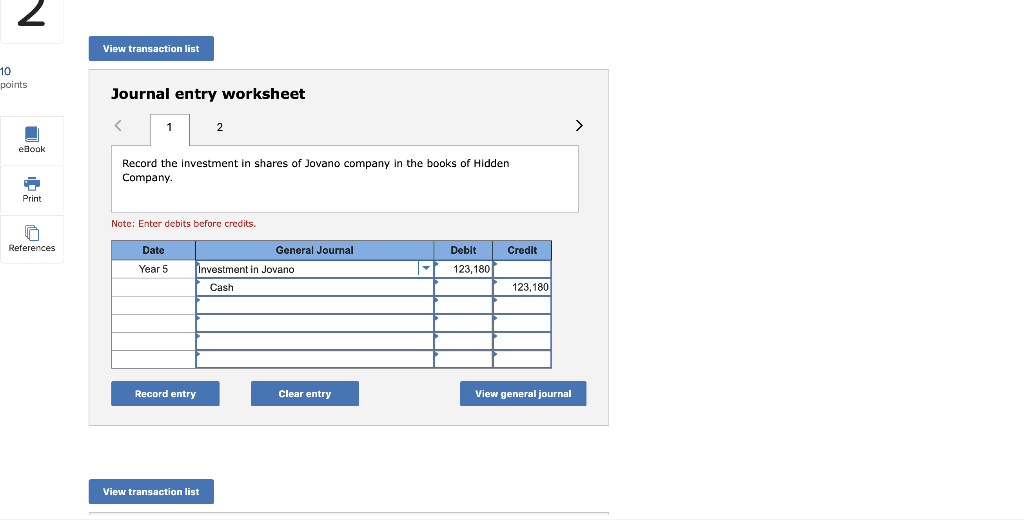

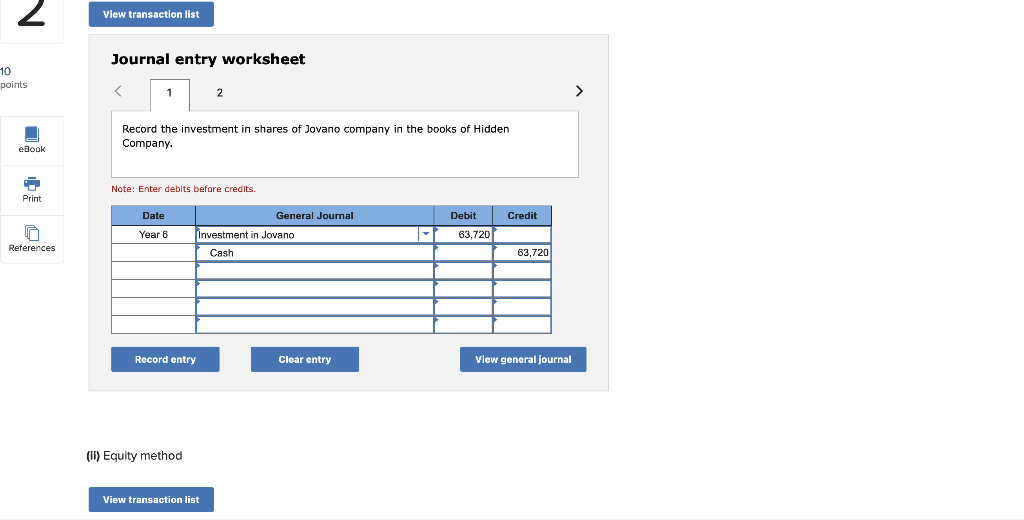

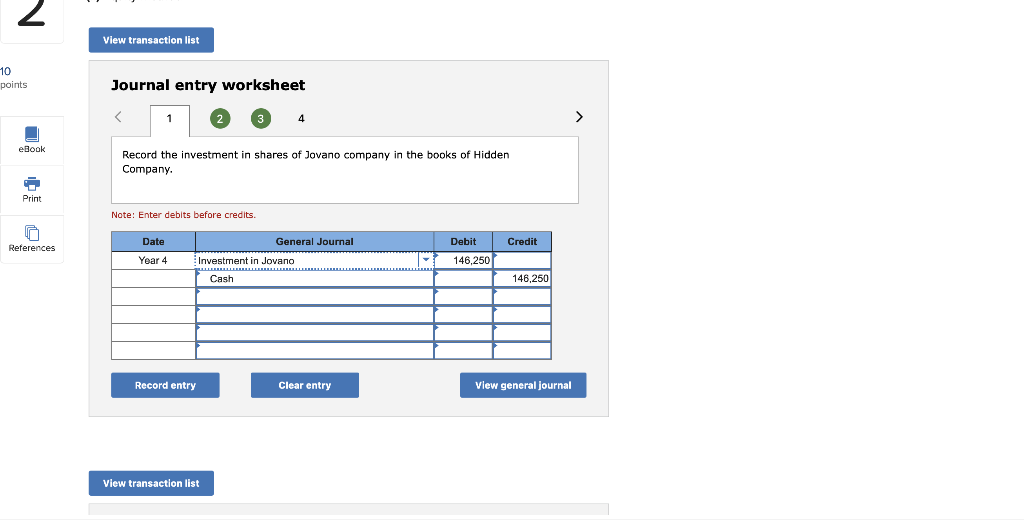

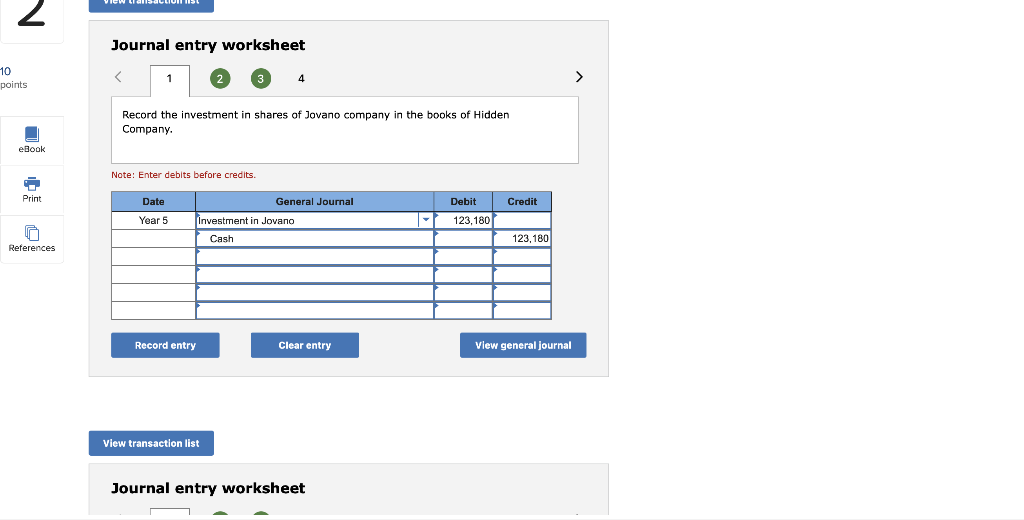

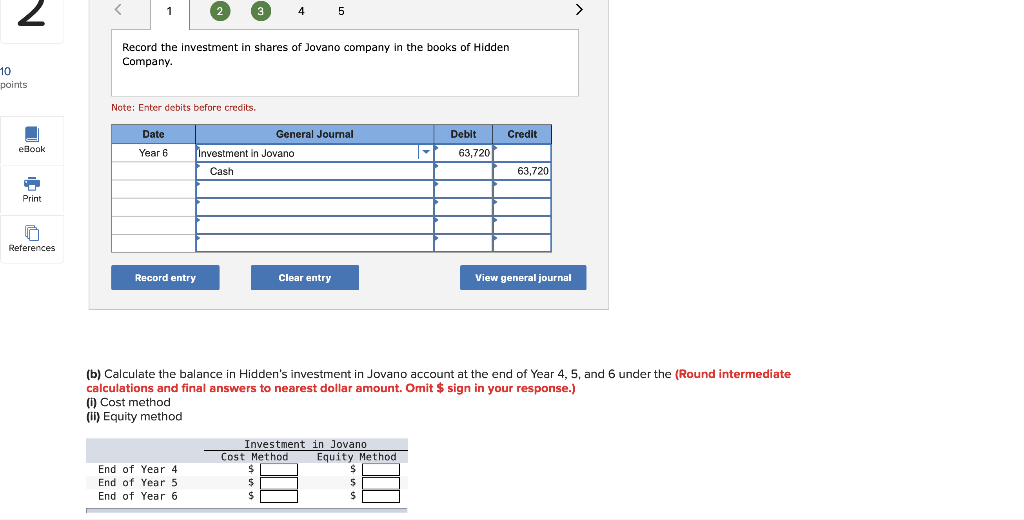

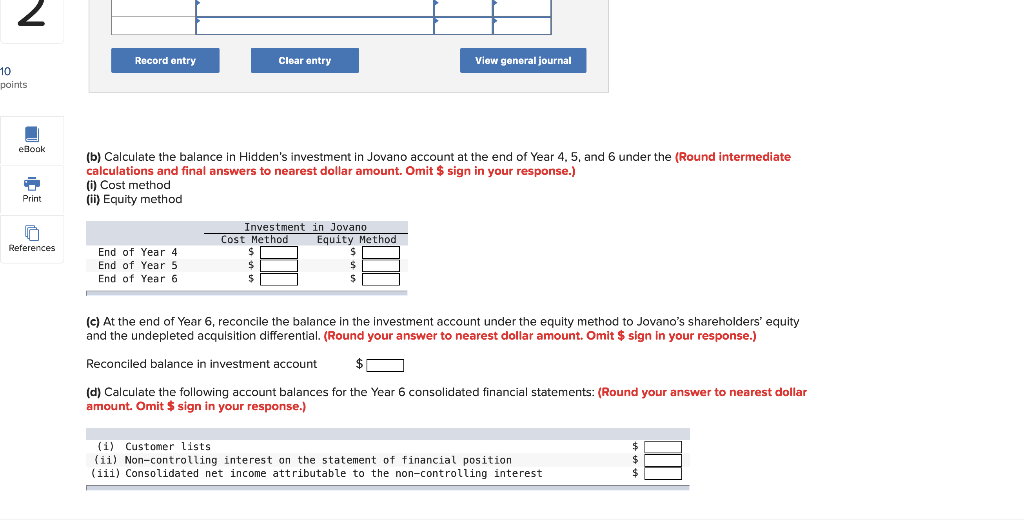

2 Problem 08-03 (LO2) 10 points On January 1, Year 4, Hidden Company acquired 25,000 ordinary shares of Jovano Company for $146,250 when the shareholders' equity of Jovano was as follows: Ordinary shares (100,000 no par value shares issued and outstanding) Retained earnings $200,000 342,000 $542,000 eBook Print In addition, Hidden purchased 20,000 shares in Jovano for $123,180 on January 1, Year 5, and 10,000 shares in Jovano for $63,720 on January 1, Year 6. The following are the statements of retained earnings for Jovano from Year 4 to Year 6: References Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Year 4 Year 5 $342,000 $378,900 56,000 58,000 (20,000) (21,000) 5378,000 $415,000 Year 6 $415,000 62,000 (22,000) $455,000 Additional Information Jovano's ordinary shares are publicly traded. The market value of the shares at the close on December 31 of one year was the same as the market value on January 1 of the next year. Any acquisition differential is allocated to customer lists with a useful life of three years on each of the three acquisition dates. Neither company has any customer lists recorded on their separate entity records. There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) For each of Years 4 to 6, prepare the journal entries that Hidden would use to account for its investment in Jovano under the (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate 2 Required: (a) For each of Years 4 to 6, prepare the journal entries that Hidden would use to account for its investment in Jovano under the (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to nearest dollar amount.) 10 points O Cost method View transaction list eBook Journal entry worksheet Print References Record the investment in shares of Jovano company in the books of Hidden Company. Note: Enter debits before credits. Debit Credit Date Year 4 General Journal Investment in Jovano 146,250 Cash 146,250 Record entry Clear entry View general journal 2 View transaction list 10 points Journal entry worksheet eBook Record the investment in shares of Jovano company in the books of Hidden Company Print Note: Enter debits before credits. References General Journal Credit Date Year 5 Debit 123,180 Investment in Jovano Cash 123, 180 Record entry Clear entry View general journal View transaction list 2 View transaction list Journal entry worksheet 10 points eBook Record the investment in shares of Jovano company in the books of Hidden Company. . Print Note: Enter debits before credits. General Journal Credit References Date Year 4 Debit 146,250 Investment in Jovano Cash 146.250 Record entry Clear entry View general journal View transaction list 2 Journal entry worksheet 10 points Record the investment in shares of Jovano company in the books of Hidden Company eBook Note: Enter debits before credits Print Date General Journal Credit Debit 123,180 Year 5 Investment in Jovano Cash 123,180 References Record entry Clear entry View general journal View transaction list Journal entry worksheet 2 4 5 > Record the investment in shares of Jovano company in the books of Hidden Company. 10 points Note: Enter debits before credits Credit Date Year 6 Debit 63,720 eBook General Journal Investment in Jovano Cash 63,720 Print References Record entry Clear entry View general journal (b) Calculate the balance in Hidden's investment in Jovano account at the end of Year 4, 5, and 6 under the (Round intermediate calculations and final answers to nearest dollar amount. Omit $ sign in your response.) ) Cost method (Tl) Equity method Investment in Jovano Cost Method Equity Method End of Year 4 End of Year 5 End of Year 6 5 $ $ $ 2 Record entry Clear entry View general journal 10 points eBook (b) Calculate the balance in Hidden's investment in Jovano account at the end of Year 4,5, and 6 under the (Round intermediate calculations and final answers to nearest dollar amount. Omit $ sign in your response.) Cost method (ii) Equity method Print References End of Year 4 End of Year 5 End of Year 6 Investment in Jovano Cost Method Equity Method $ $ $ 5 (c) At the end of Year 6, reconcile the balance in the investment account under the equity method to Jovano's shareholders' equity and the undepleted acquisition differential. (Round your answer to nearest dollar amount. Omit $ sign in your response.) Reconciled balance in investment account (d) Calculate the following account balances for the Year 6 consolidated financial statements: (Round your answer to nearest dollar amount. Omit $ sign in your response.) (i) Customer lists (ii) Non-controlling interest on the statement of financial position (iii) Consolidated net income attributable to the non-controlling interest 2 Problem 08-03 (LO2) 10 points On January 1, Year 4, Hidden Company acquired 25,000 ordinary shares of Jovano Company for $146,250 when the shareholders' equity of Jovano was as follows: Ordinary shares (100,000 no par value shares issued and outstanding) Retained earnings $200,000 342,000 $542,000 eBook Print In addition, Hidden purchased 20,000 shares in Jovano for $123,180 on January 1, Year 5, and 10,000 shares in Jovano for $63,720 on January 1, Year 6. The following are the statements of retained earnings for Jovano from Year 4 to Year 6: References Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Year 4 Year 5 $342,000 $378,900 56,000 58,000 (20,000) (21,000) 5378,000 $415,000 Year 6 $415,000 62,000 (22,000) $455,000 Additional Information Jovano's ordinary shares are publicly traded. The market value of the shares at the close on December 31 of one year was the same as the market value on January 1 of the next year. Any acquisition differential is allocated to customer lists with a useful life of three years on each of the three acquisition dates. Neither company has any customer lists recorded on their separate entity records. There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) For each of Years 4 to 6, prepare the journal entries that Hidden would use to account for its investment in Jovano under the (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate 2 Required: (a) For each of Years 4 to 6, prepare the journal entries that Hidden would use to account for its investment in Jovano under the (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to nearest dollar amount.) 10 points O Cost method View transaction list eBook Journal entry worksheet Print References Record the investment in shares of Jovano company in the books of Hidden Company. Note: Enter debits before credits. Debit Credit Date Year 4 General Journal Investment in Jovano 146,250 Cash 146,250 Record entry Clear entry View general journal 2 View transaction list 10 points Journal entry worksheet eBook Record the investment in shares of Jovano company in the books of Hidden Company Print Note: Enter debits before credits. References General Journal Credit Date Year 5 Debit 123,180 Investment in Jovano Cash 123, 180 Record entry Clear entry View general journal View transaction list 2 View transaction list Journal entry worksheet 10 points eBook Record the investment in shares of Jovano company in the books of Hidden Company. . Print Note: Enter debits before credits. General Journal Credit References Date Year 4 Debit 146,250 Investment in Jovano Cash 146.250 Record entry Clear entry View general journal View transaction list 2 Journal entry worksheet 10 points Record the investment in shares of Jovano company in the books of Hidden Company eBook Note: Enter debits before credits Print Date General Journal Credit Debit 123,180 Year 5 Investment in Jovano Cash 123,180 References Record entry Clear entry View general journal View transaction list Journal entry worksheet 2 4 5 > Record the investment in shares of Jovano company in the books of Hidden Company. 10 points Note: Enter debits before credits Credit Date Year 6 Debit 63,720 eBook General Journal Investment in Jovano Cash 63,720 Print References Record entry Clear entry View general journal (b) Calculate the balance in Hidden's investment in Jovano account at the end of Year 4, 5, and 6 under the (Round intermediate calculations and final answers to nearest dollar amount. Omit $ sign in your response.) ) Cost method (Tl) Equity method Investment in Jovano Cost Method Equity Method End of Year 4 End of Year 5 End of Year 6 5 $ $ $ 2 Record entry Clear entry View general journal 10 points eBook (b) Calculate the balance in Hidden's investment in Jovano account at the end of Year 4,5, and 6 under the (Round intermediate calculations and final answers to nearest dollar amount. Omit $ sign in your response.) Cost method (ii) Equity method Print References End of Year 4 End of Year 5 End of Year 6 Investment in Jovano Cost Method Equity Method $ $ $ 5 (c) At the end of Year 6, reconcile the balance in the investment account under the equity method to Jovano's shareholders' equity and the undepleted acquisition differential. (Round your answer to nearest dollar amount. Omit $ sign in your response.) Reconciled balance in investment account (d) Calculate the following account balances for the Year 6 consolidated financial statements: (Round your answer to nearest dollar amount. Omit $ sign in your response.) (i) Customer lists (ii) Non-controlling interest on the statement of financial position (iii) Consolidated net income attributable to the non-controlling interest