Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Problem 18-05 (Pricing Stock Issues in an IPO) Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric,

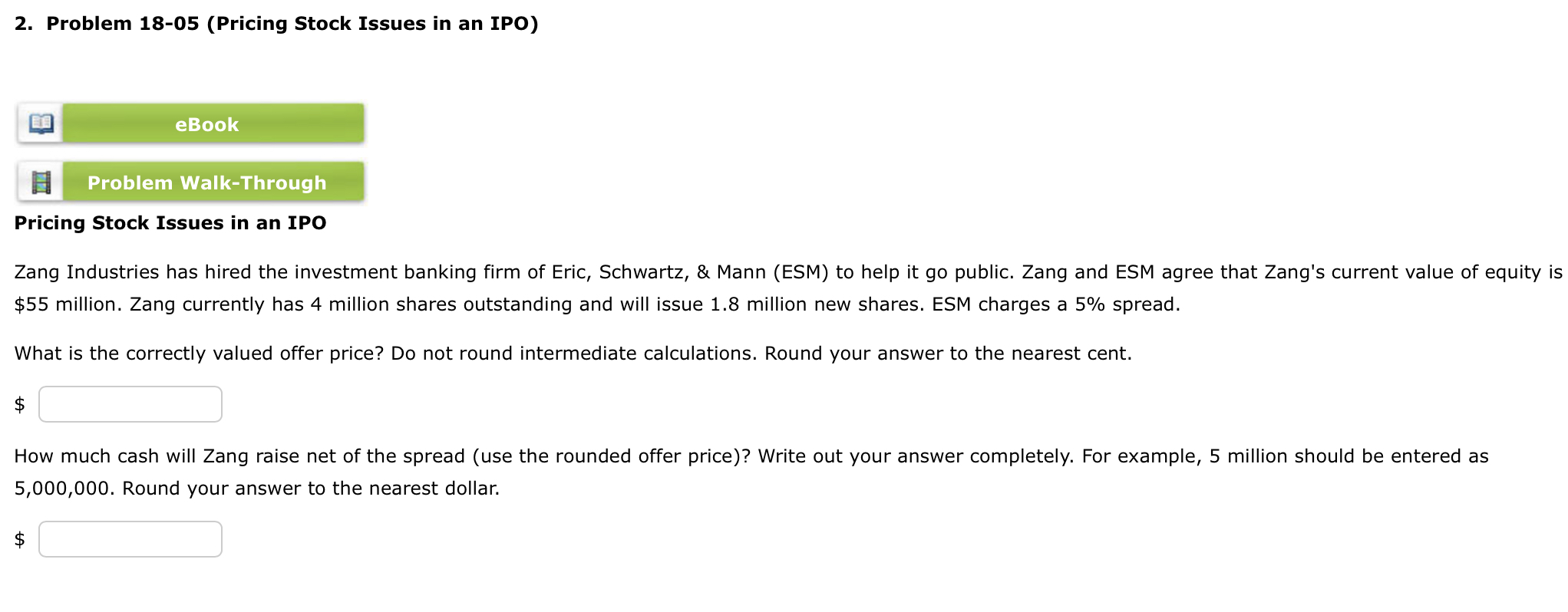

2. Problem 18-05 (Pricing Stock Issues in an IPO) Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric, Schwartz, \& Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity $55 million. Zang currently has 4 million shares outstanding and will issue 1.8 million new shares. ESM charges a 5% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $

2. Problem 18-05 (Pricing Stock Issues in an IPO) Pricing Stock Issues in an IPO Zang Industries has hired the investment banking firm of Eric, Schwartz, \& Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity $55 million. Zang currently has 4 million shares outstanding and will issue 1.8 million new shares. ESM charges a 5% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started