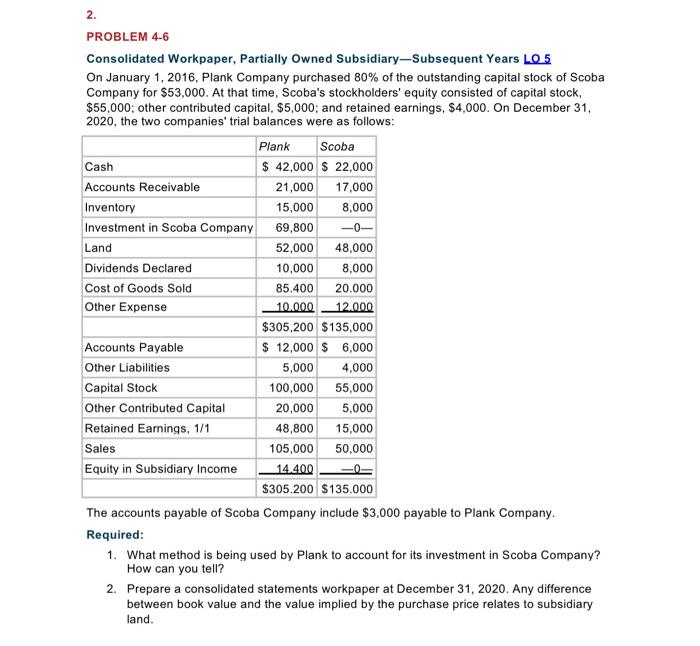

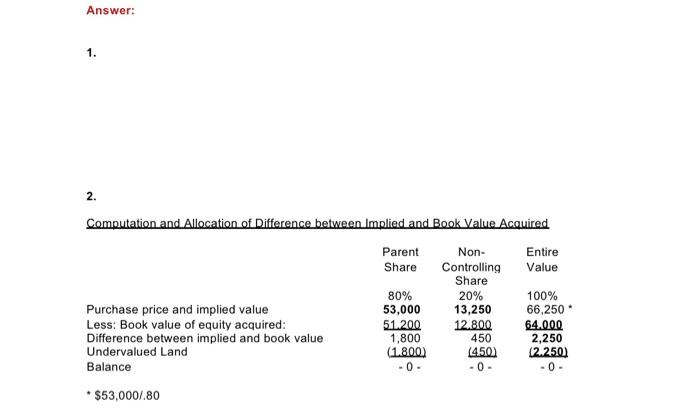

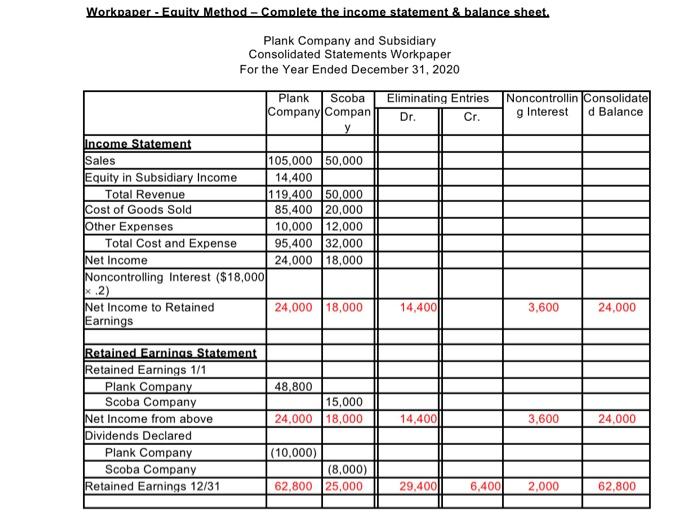

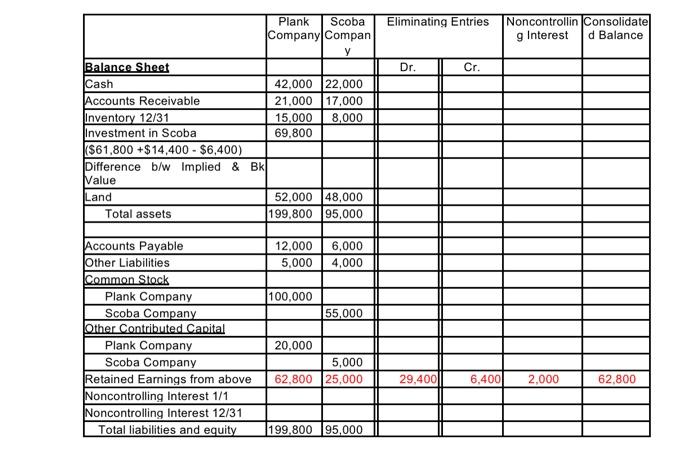

2. PROBLEM 4-6 Consolidated Workpaper, Partially Owned Subsidiary-Subsequent Years LO 5 On January 1, 2016, Plank Company purchased 80% of the outstanding capital stock of Scoba Company for $53,000. At that time, Scoba's stockholders' equity consisted of capital stock, $55,000; other contributed capital, $5,000; and retained earnings, $4,000. On December 31, 2020, the two companies' trial balances were as follows: Plank Scoba Cash $ 42,000 $ 22,000 Accounts Receivable 21,000 17,000 Inventory 15,000 8,000 Investment in Scoba Company 69,800 -0- Land 52,000 48,000 Dividends Declared 10,000 8,000 Cost of Goods Sold 85.400 20.000 Other Expense 10.000 12.000 $305,200 $135,000 Accounts Payable $ 12,000 $ 6,000 Other Liabilities 5,000 4,000 Capital Stock 100,000 55,000 Other Contributed Capital 20,000 5,000 Retained Earnings, 1/1 48,800 15,000 Sales 105,000 50,000 Equity in Subsidiary Income 14.400 $305.200 $135.000 The accounts payable of Scoba Company include $3,000 payable to Plank Company. Required: 1. What method is being used by Plank to account for its investment in Scoba Company? How can you tell? 2. Prepare a consolidated statements workpaper at December 31, 2020. Any difference between book value and the value implied by the purchase price relates to subsidiary land. Answer: 1. . 2. Computation and Allocation of Difference between Implied and Book Value Acquired Parent Non- Entire Share Controlling Value Share 80% 20% 100% Purchase price and implied value 53,000 13,250 66,250 Less: Book value of equity acquired: 51.200 12.800 64.000 Difference between implied and book value 1,800 450 2,250 Undervalued Land (1.800) 1450) (2.250) Balance -0- -0- -0- * $53,000/.80 Workpaper - Equity Method - Complete the income statement & balance sheet. Plank Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2020 Plank Scoba Company Compan Eliminating Entries Cr. Noncontrollin Consolidate g Interest d Balance Dr. Income Statement Sales 105,000 50,000 Equity in Subsidiary Income 14,400 Total Revenue 119.400 50,000 Cost of Goods Sold 85,400 20,000 Other Expenses 10,000 12,000 Total Cost and Expense 95,400 32,000 Net Income 24,000 18,000 Noncontrolling Interest ($18,000 K2) Net Income to Retained 24,000 18,000 Earnings 14,4001 3.600 24,000 Retained Earnings Statement Retained Earnings 1/1 Plank Company Scoba Company Net Income from above Dividends Declared Plank Company Scoba Company Retained Earnings 12/31 48,800 15,000 24,000 18.000 14.400 3,600 24,000 (10,000) (8,000) 62,800 25,000 29,400 6,400 2,000 62,800 Eliminating Entries Noncontrollin Consolidate g Interest d Balance Dr. Cr. Plank Scoba Company Compan Balance Sheet Cash 42,000 22,000 Accounts Receivable 21.000 17,000 Inventory 12/31 15,000 8,000 Investment in Scoba 69.800 ($61,800 +$ 14,400 - $6,400) Difference b/w Implied & Bk Value Land 52,000 48,000 Total assets 199.800 95.000 12.000 6,000 5,000 4,000 100,000 55,000 Accounts Payable Other Liabilities Common Stock Plank Company Scoba Company Other Contributed Capital Plank Company Scoba Company Retained Earnings from above Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 Total liabilities and equity 20.000 5,000 62.800 25,000 29,400 6,400 2.000 62.800 199.800 95,000 2. PROBLEM 4-6 Consolidated Workpaper, Partially Owned Subsidiary-Subsequent Years LO 5 On January 1, 2016, Plank Company purchased 80% of the outstanding capital stock of Scoba Company for $53,000. At that time, Scoba's stockholders' equity consisted of capital stock, $55,000; other contributed capital, $5,000; and retained earnings, $4,000. On December 31, 2020, the two companies' trial balances were as follows: Plank Scoba Cash $ 42,000 $ 22,000 Accounts Receivable 21,000 17,000 Inventory 15,000 8,000 Investment in Scoba Company 69,800 -0- Land 52,000 48,000 Dividends Declared 10,000 8,000 Cost of Goods Sold 85.400 20.000 Other Expense 10.000 12.000 $305,200 $135,000 Accounts Payable $ 12,000 $ 6,000 Other Liabilities 5,000 4,000 Capital Stock 100,000 55,000 Other Contributed Capital 20,000 5,000 Retained Earnings, 1/1 48,800 15,000 Sales 105,000 50,000 Equity in Subsidiary Income 14.400 $305.200 $135.000 The accounts payable of Scoba Company include $3,000 payable to Plank Company. Required: 1. What method is being used by Plank to account for its investment in Scoba Company? How can you tell? 2. Prepare a consolidated statements workpaper at December 31, 2020. Any difference between book value and the value implied by the purchase price relates to subsidiary land. Answer: 1. . 2. Computation and Allocation of Difference between Implied and Book Value Acquired Parent Non- Entire Share Controlling Value Share 80% 20% 100% Purchase price and implied value 53,000 13,250 66,250 Less: Book value of equity acquired: 51.200 12.800 64.000 Difference between implied and book value 1,800 450 2,250 Undervalued Land (1.800) 1450) (2.250) Balance -0- -0- -0- * $53,000/.80 Workpaper - Equity Method - Complete the income statement & balance sheet. Plank Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2020 Plank Scoba Company Compan Eliminating Entries Cr. Noncontrollin Consolidate g Interest d Balance Dr. Income Statement Sales 105,000 50,000 Equity in Subsidiary Income 14,400 Total Revenue 119.400 50,000 Cost of Goods Sold 85,400 20,000 Other Expenses 10,000 12,000 Total Cost and Expense 95,400 32,000 Net Income 24,000 18,000 Noncontrolling Interest ($18,000 K2) Net Income to Retained 24,000 18,000 Earnings 14,4001 3.600 24,000 Retained Earnings Statement Retained Earnings 1/1 Plank Company Scoba Company Net Income from above Dividends Declared Plank Company Scoba Company Retained Earnings 12/31 48,800 15,000 24,000 18.000 14.400 3,600 24,000 (10,000) (8,000) 62,800 25,000 29,400 6,400 2,000 62,800 Eliminating Entries Noncontrollin Consolidate g Interest d Balance Dr. Cr. Plank Scoba Company Compan Balance Sheet Cash 42,000 22,000 Accounts Receivable 21.000 17,000 Inventory 12/31 15,000 8,000 Investment in Scoba 69.800 ($61,800 +$ 14,400 - $6,400) Difference b/w Implied & Bk Value Land 52,000 48,000 Total assets 199.800 95.000 12.000 6,000 5,000 4,000 100,000 55,000 Accounts Payable Other Liabilities Common Stock Plank Company Scoba Company Other Contributed Capital Plank Company Scoba Company Retained Earnings from above Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 Total liabilities and equity 20.000 5,000 62.800 25,000 29,400 6,400 2.000 62.800 199.800 95,000