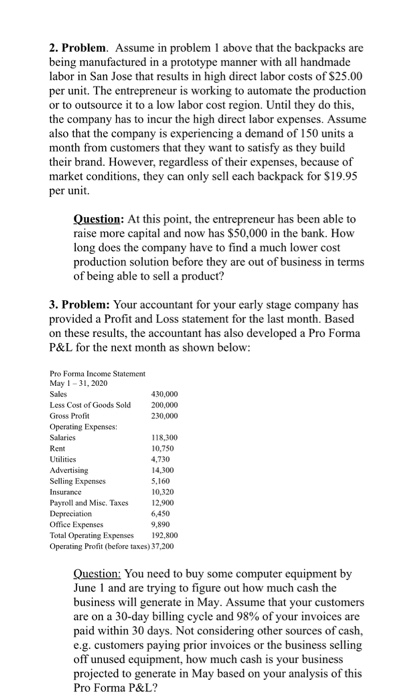

2. Problem. Assume in problem 1 above that the backpacks are being manufactured in a prototype manner with all handmade labor in San Jose that results in high direct labor costs of $25.00 per unit. The entrepreneur is working to automate the production or to outsource it to a low labor cost region. Until they do this, the company has to incur the high direct labor expenses. Assume also that the company is experiencing a demand of 150 units a month from customers that they want to satisfy as they build their brand. However, regardless of their expenses, because of market conditions, they can only sell each backpack for $19.95 per unit. Question: At this point, the entrepreneur has been able to raise more capital and now has $50,000 in the bank. How long does the company have to find a much lower cost production solution before they are out of business in terms of being able to sell a product? 3. Problem: Your accountant for your early stage company has provided a Profit and Loss statement for the last month. Based on these results, the accountant has also developed a Pro Forma P&L for the next month as shown below: Sales Pro Forma Income Statement May 1-11. 2020 410.000 Less Cost of Goods Sold 200.000 Gross Profit 200.000 Operating Expenses: Salaries HIR 100 Rent 10,750 Utilities 4,730 Advertising 14.300 Selling Expenses 5.160 Insurance 10.320 Payroll and Misc. Taxes 12.900 Depreciation 6,450 Office Expenses 9,890 Total Operating Expenses 192,800 Operating Profit before taxes) 37,200 Question: You need to buy some computer equipment by June 1 and are trying to figure out how much cash the business will generate in May. Assume that your customers are on a 30-day billing cycle and 98% of your invoices are paid within 30 days. Not considering other sources of cash, e.g. customers paying prior invoices or the business selling off unused equipment, how much cash is your business projected to generate in May based on your analysis of this Pro Forma P&L? 1. Problem: An entrepreneur is trying to conduct a break-even analysis for an innovative design of a student backpack they intend to sell on university campuses. Each backpack will sell for a price of $19.95. The entrepreneur has estimated the following costs: Rent of $1,000 per month Direct labor of $3.00 per backpack Raw Materials of $2.00 per backpack Salaries of $500 per week Questions: A. Calculate the contribution margin for each backpack sold. B. Calculate the monthly breakeven point on both a sales and per unit basis. c. If the entrepreneur has $15,000 in the bank, would this make any difference in your calculations? Yes No _Why