Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2 PROBLEM V (Miscellaneous-3 points each) invest in a $100 face value 0%, 30-yr bond at a price of 30. a) What is the ytm

#2

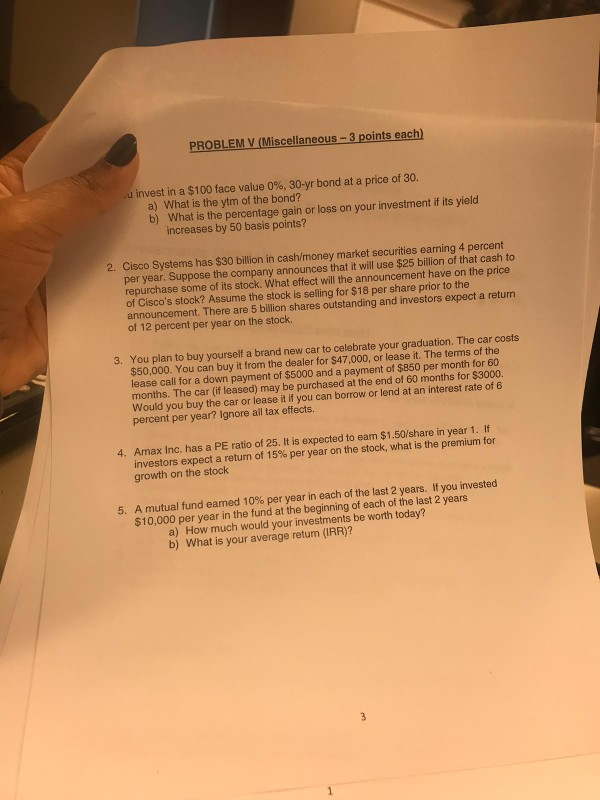

PROBLEM V (Miscellaneous-3 points each) invest in a $100 face value 0%, 30-yr bond at a price of 30. a) What is the ytm of the bond? b) What is the percentage gain or loss on your investment if its yield increases by 50 basis points? 2. Cisco Systems has $30 billion in cash/money market securities eaning 4 percent per year. Suppose the company announces that it will use $25 billion of that cash to repurchase some of its stock. What effect will the announcement have on the price of Cisco's stock? Assume the stock is selling for $18 per share prior to the announcement. There are 5 billion shares outstanding and investors expect a return of 12 percent per year on the stock. 3. You plan to buy yourself a brand new car to celebrate your graduation. The car costs $50,000. You can buy it from the dealer for $47,000, or lease it. The terms of the lease call for a down payment of $5000 and a payment of $850 per month for 60 months. The car (if leased) may be purchased at the end of 60 months for $3000 Would you buy the car or lease it if you can borrow or lend at an interest rate of 6 percent per year? Ignore all tax effects. Amax Inc. has a PE ratio of 25. It is expected to eam $1.50/share in year 1. If investors expect a return of 15% per year on the stock, what is the premium for growth on the stock 4. if you invested 5. A mutual fund earned 10% per year in each of the last 2 years $10,000 per year in the fund at the beginning of each of the last 2 years a) How much would your investments be worth today? b) What is your average retum (IRR)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started