Answered step by step

Verified Expert Solution

Question

1 Approved Answer

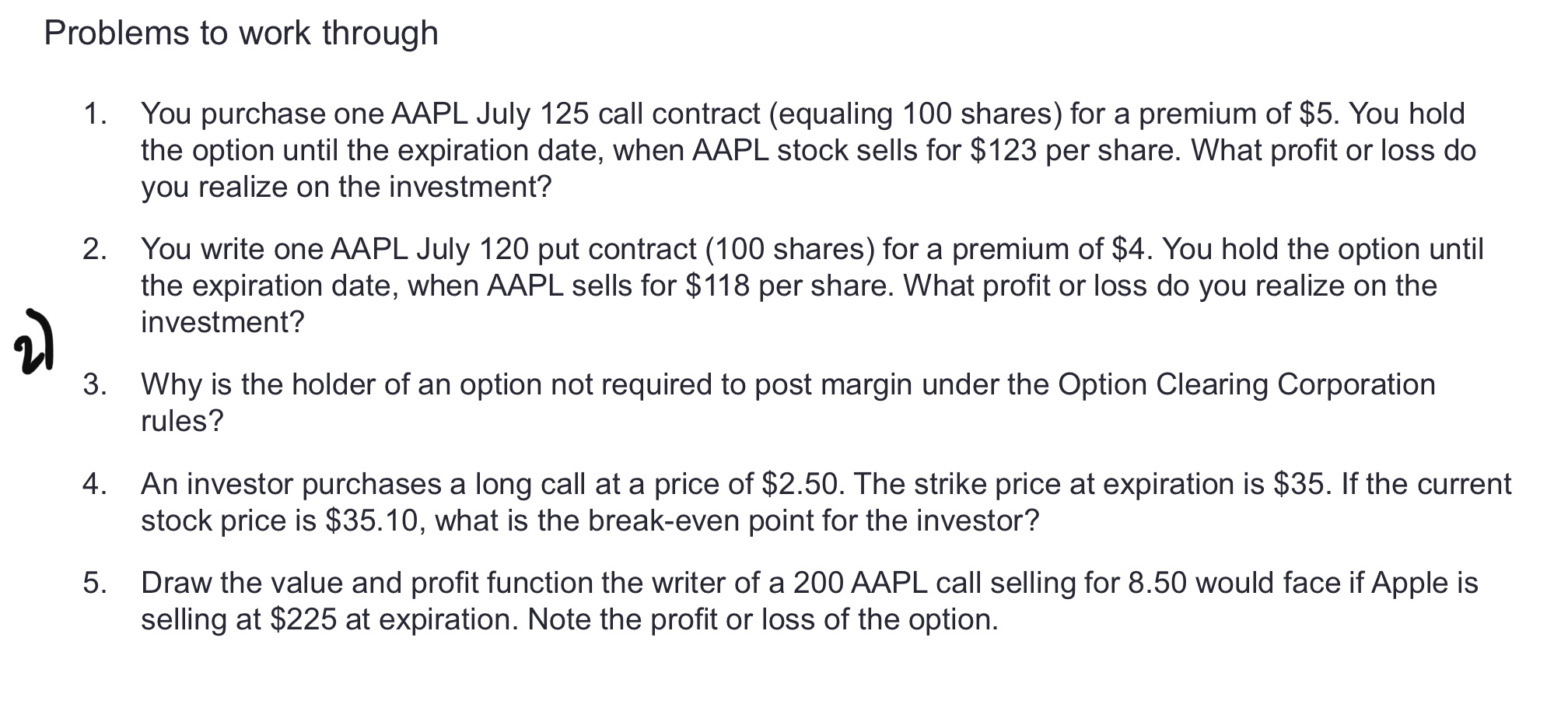

2) Problems to work through 1. You purchase one AAPL July 125 call contract (equaling 100 shares) for a premium of $5. You hold

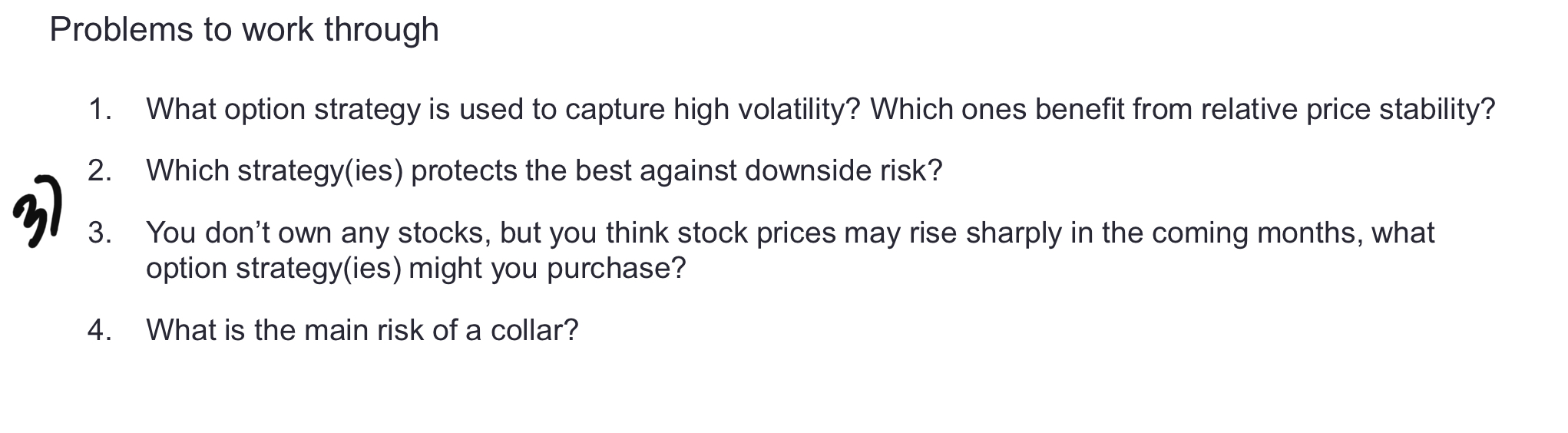

2) Problems to work through 1. You purchase one AAPL July 125 call contract (equaling 100 shares) for a premium of $5. You hold the option until the expiration date, when AAPL stock sells for $123 per share. What profit or loss do you realize on the investment? 2. You write one AAPL July 120 put contract (100 shares) for a premium of $4. You hold the option until the expiration date, when AAPL sells for $118 per share. What profit or loss do you realize on the investment? 3. 4. 5. Why is the holder of an option not required to post margin under the Option Clearing Corporation rules? An investor purchases a long call at a price of $2.50. The strike price at expiration is $35. If the current stock price is $35.10, what is the break-even point for the investor? Draw the value and profit function the writer of a 200 AAPL call selling for 8.50 would face if Apple is selling at $225 at expiration. Note the profit or loss of the option. Problems to work through 31 1. What option strategy is used to capture high volatility? Which ones benefit from relative price stability? 2. Which strategy(ies) protects the best against downside risk? 3. You don't own any stocks, but you think stock prices may rise sharply in the coming months, what option strategy(ies) might you purchase? 4. What is the main risk of a collar?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started