Answered step by step

Verified Expert Solution

Question

1 Approved Answer

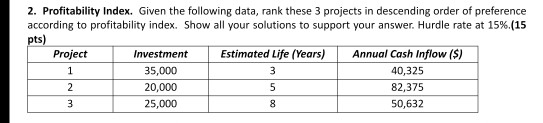

2. Profitability Index. Given the following data, rank these 3 projects in descending order of preference according to profitability index. Show all your solutions to

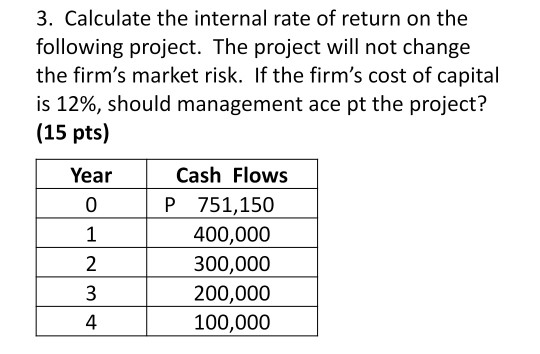

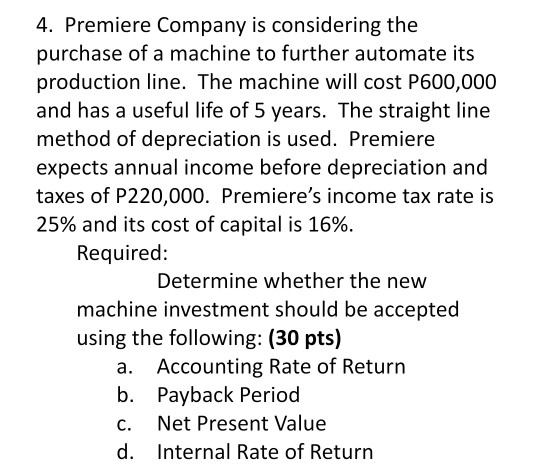

2. Profitability Index. Given the following data, rank these 3 projects in descending order of preference according to profitability index. Show all your solutions to support your answer. Hurdle rate at 15%.(15 pts) Project Investment Estimated Life (Years) Annual Cash Inflow ($) 1 35,000 3 40,325 2 20,000 5 82,375 3 25,000 8 50,632 3. Calculate the internal rate of return on the following project. The project will not change the firm's market risk. If the firm's cost of capital is 12%, should management ace pt the project? (15 pts) Year 0 Cash Flows P751,150 400,000 300,000 200,000 100,000 2 3 4 4. Premiere Company is considering the purchase of a machine to further automate its production line. The machine will cost P600,000 and has a useful life of 5 years. The straight line method of depreciation is used. Premiere expects annual income before depreciation and taxes of P220,000. Premiere's income tax rate is 25% and its cost of capital is 16%. Required: Determine whether the new machine investment should be accepted using the following: (30 pts) a. Accounting Rate of Return b. Payback Period C. Net Present Value d. Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started