Question

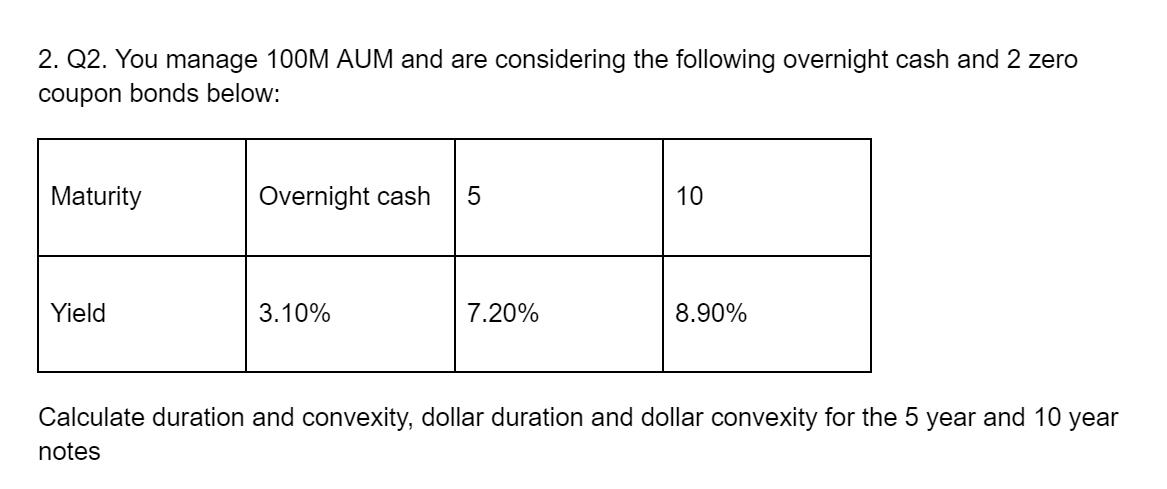

2. Q2. You manage 100M AUM and are considering the following overnight cash and 2 zero coupon bonds below: Maturity Yield Overnight cash 3.10%

2. Q2. You manage 100M AUM and are considering the following overnight cash and 2 zero coupon bonds below: Maturity Yield Overnight cash 3.10% 5 7.20% 10 8.90% Calculate duration and convexity, dollar duration and dollar convexity for the 5 year and 10 year notes

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the duration and convexity for the 5year and 10year zero coupon bonds we need to understand the formulas and definitions of these measures Here are the formulas well use 1 Duration ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management For Decision Makers

Authors: Peter Atrill, Paul Hurley

2nd Canadian Edition

138011605, 978-0138011604

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App