Answered step by step

Verified Expert Solution

Question

1 Approved Answer

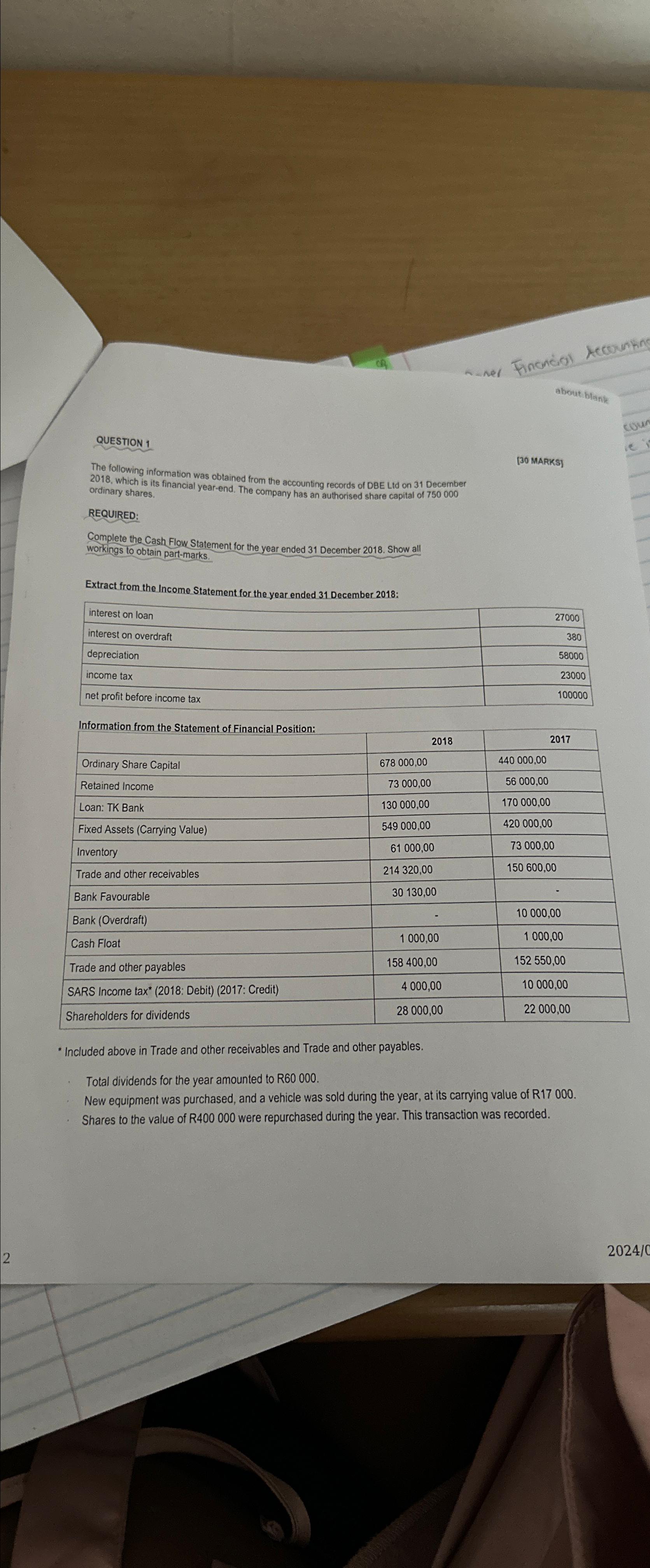

2 QUESTION 1 The following information was obtained from the accounting records of DBE Ltd on 31 December 2018, which is its financial year-end.

2 QUESTION 1 The following information was obtained from the accounting records of DBE Ltd on 31 December 2018, which is its financial year-end. The company has an authorised share capital of 750 000 ordinary shares. REQUIRED: Complete the Cash Flow Statement for the year ended 31 December 2018. Show all workings to obtain part-marks. Extract from the Income Statement for the year ended 31 December 2018: interest on loan interest on overdraft depreciation income tax Financial Accounting about blank [30 MARKS] 27000 380 58000 23000 100000 Cou net profit before income tax Information from the Statement of Financial Position: 2018 2017 Ordinary Share Capital 678 000,00 440 000,00 Retained Income 73 000,00 56 000,00 Loan: TK Bank 130 000,00 170 000,00 Fixed Assets (Carrying Value) 549 000,00 420 000,00 61 000,00 Inventory Trade and other receivables 214 320,00 73 000,00 150 600,00 Bank Favourable 30 130,00 10 000,00 Bank (Overdraft) 1 000,00 1 000,00 Cash Float Trade and other payables 158 400,00 152 550,00 SARS Income tax* (2018: Debit) (2017: Credit) 4 000,00 10 000,00 Shareholders for dividends 28 000,00 22 000,00 Included above in Trade and other receivables and Trade and other payables. Total dividends for the year amounted to R60 000. New equipment was purchased, and a vehicle was sold during the year, at its carrying value of R17 000. Shares to the value of R400 000 were repurchased during the year. This transaction was recorded. 2024/0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started