Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Question 2 (34%) Palm Tree Resorts plc operates holiday resorts, hotels, air line and shipping ticketing, and other related businesses. However, its businesses were

2

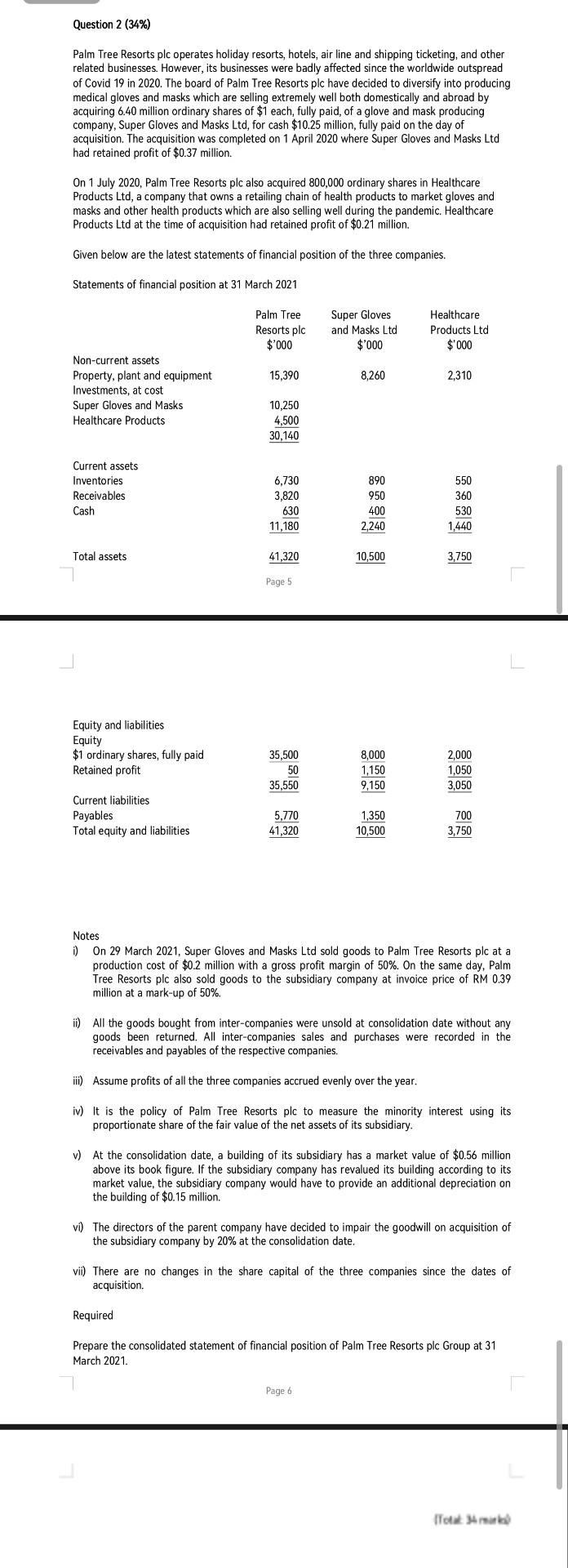

Question 2 (34%) Palm Tree Resorts plc operates holiday resorts, hotels, air line and shipping ticketing, and other related businesses. However, its businesses were badly affected since the worldwide outspread of Covid 19 in 2020. The board of Palm Tree Resorts plc have decided to diversify into producing medical gloves and masks which are selling extremely well both domestically and abroad by acquiring 6.40 million ordinary shares of $1 each, fully paid, of a glove and mask producing company, Super Gloves and Masks Ltd, for cash $10.25 million, fully paid on the day of acquisition. The acquisition was completed on 1 April 2020 where Super Gloves and Masks Ltd had retained profit of $0.37 million. On 1 July 2020, Palm Tree Resorts plc also acquired 800,000 ordinary shares in Healthcare Products Ltd, a company that owns a retailing chain of health products to market gloves and masks and other health products which are also selling well during the pandemic. Healthcare Products Ltd at the time of acquisition had retained profit of $0.21 million. Given below are the latest statements of financial position of the three companies. Statements of financial position at 31 March 2021 Palm Tree Resorts plc $'000 Super Gloves and Masks Ltd $'000 Healthcare Products Ltd $'000 15,390 8,260 2,310 Non-current assets Property, plant and equipment Investments, at cost Super Gloves and Masks Healthcare Products 10,250 4,500 30,140 Current assets Inventories Receivables Cash 6,730 3,820 630 11,180 890 950 400 2,240 550 360 530 1,440 Total assets 41,320 10,500 3.750 Page 5 Equity and liabilities Equity $1 ordinary shares, fully paid Retained profit 35,500 50 35,550 8,000 1,150 9,150 2,000 1,050 3,050 Current liabilities Payables Total equity and liabilities 5,770 41,320 1,350 10,500 700 3,750 Notes 0 On 29 March 2021, Super Gloves and Masks Ltd sold goods to Palm Tree Resorts plc at a production cost of $0.2 million with a gross profit margin of 50%. On the same day, Palm Tree Resorts plc also sold goods to the subsidiary company at invoice price of RM 0.39 million at a mark-up of 50%. ii) All the goods bought from inter-companies were unsold at consolidation date without any goods been returned. All inter-companies sales and purchases were recorded in the ceivables payables of the respective companies. iii) Assume profits of all the three companies accrued evenly over the year. iv) It is the policy of Palm Tree Resorts plc to measure the minority interest using its proportionate share of the fair value of the net assets of its subsidiary. v) At the consolidation date, a building of its subsidiary has a market value of $0.56 million above its book figure. If the subsidiary company has revalued its building according to its market value, the subsidiary company would have to provide an additional depreciation on the building of $0.15 million. vi) The directors of the parent company have decided to impair the goodwill on acquisition of the subsidiary company by 20% at the consolidation date. vii) There are no changes in the share capital of the three companies since the dates of acquisition Required Prepare the consolidated statement of financial position of Palm Tree Resorts plc Group at 31 March 2021. Page 6 Total Question 2 (34%) Palm Tree Resorts plc operates holiday resorts, hotels, air line and shipping ticketing, and other related businesses. However, its businesses were badly affected since the worldwide outspread of Covid 19 in 2020. The board of Palm Tree Resorts plc have decided to diversify into producing medical gloves and masks which are selling extremely well both domestically and abroad by acquiring 6.40 million ordinary shares of $1 each, fully paid, of a glove and mask producing company, Super Gloves and Masks Ltd, for cash $10.25 million, fully paid on the day of acquisition. The acquisition was completed on 1 April 2020 where Super Gloves and Masks Ltd had retained profit of $0.37 million. On 1 July 2020, Palm Tree Resorts plc also acquired 800,000 ordinary shares in Healthcare Products Ltd, a company that owns a retailing chain of health products to market gloves and masks and other health products which are also selling well during the pandemic. Healthcare Products Ltd at the time of acquisition had retained profit of $0.21 million. Given below are the latest statements of financial position of the three companies. Statements of financial position at 31 March 2021 Palm Tree Resorts plc $'000 Super Gloves and Masks Ltd $'000 Healthcare Products Ltd $'000 15,390 8,260 2,310 Non-current assets Property, plant and equipment Investments, at cost Super Gloves and Masks Healthcare Products 10,250 4,500 30,140 Current assets Inventories Receivables Cash 6,730 3,820 630 11,180 890 950 400 2,240 550 360 530 1,440 Total assets 41,320 10,500 3.750 Page 5 Equity and liabilities Equity $1 ordinary shares, fully paid Retained profit 35,500 50 35,550 8,000 1,150 9,150 2,000 1,050 3,050 Current liabilities Payables Total equity and liabilities 5,770 41,320 1,350 10,500 700 3,750 Notes 0 On 29 March 2021, Super Gloves and Masks Ltd sold goods to Palm Tree Resorts plc at a production cost of $0.2 million with a gross profit margin of 50%. On the same day, Palm Tree Resorts plc also sold goods to the subsidiary company at invoice price of RM 0.39 million at a mark-up of 50%. ii) All the goods bought from inter-companies were unsold at consolidation date without any goods been returned. All inter-companies sales and purchases were recorded in the ceivables payables of the respective companies. iii) Assume profits of all the three companies accrued evenly over the year. iv) It is the policy of Palm Tree Resorts plc to measure the minority interest using its proportionate share of the fair value of the net assets of its subsidiary. v) At the consolidation date, a building of its subsidiary has a market value of $0.56 million above its book figure. If the subsidiary company has revalued its building according to its market value, the subsidiary company would have to provide an additional depreciation on the building of $0.15 million. vi) The directors of the parent company have decided to impair the goodwill on acquisition of the subsidiary company by 20% at the consolidation date. vii) There are no changes in the share capital of the three companies since the dates of acquisition Required Prepare the consolidated statement of financial position of Palm Tree Resorts plc Group at 31 March 2021. Page 6 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started