Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Question 2. Information BNN is a Chinese company and is considering issuing a to further raise AUD 20m for its growth in the next

2

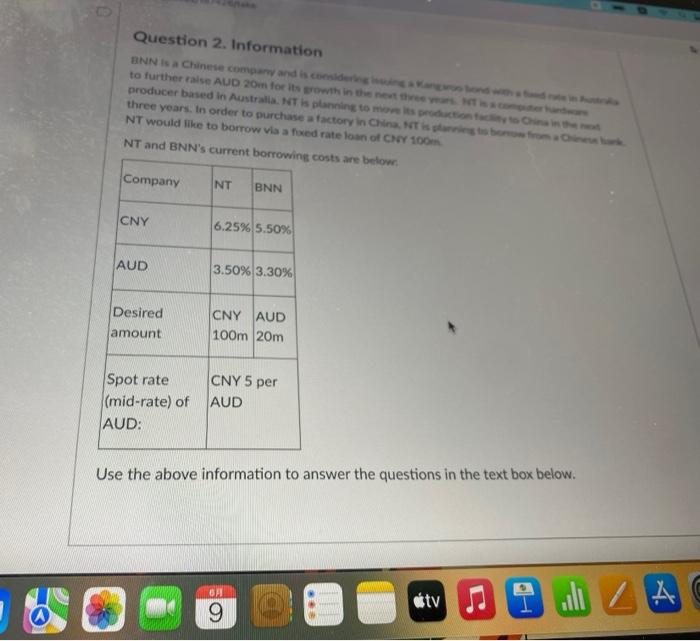

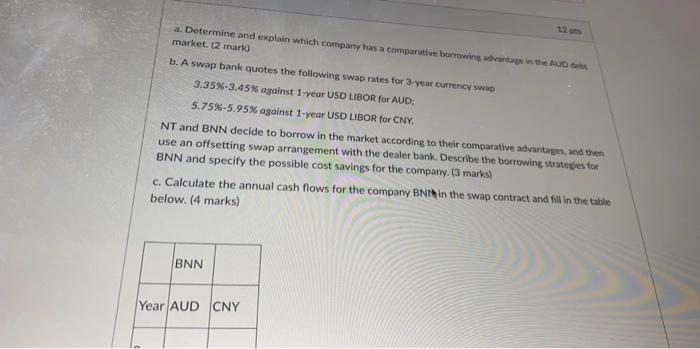

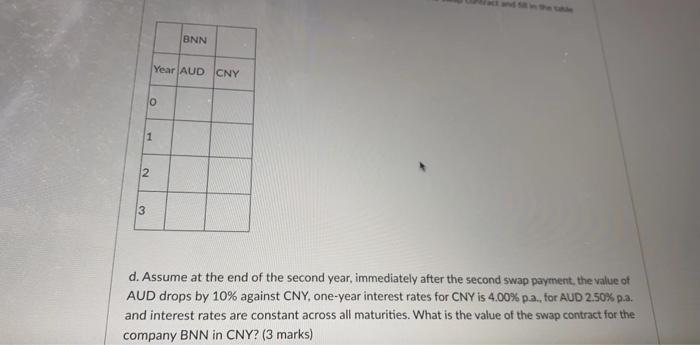

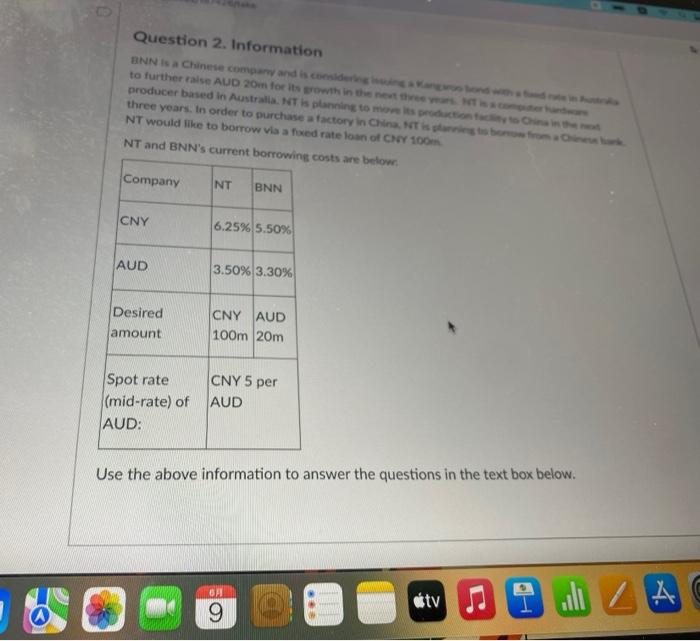

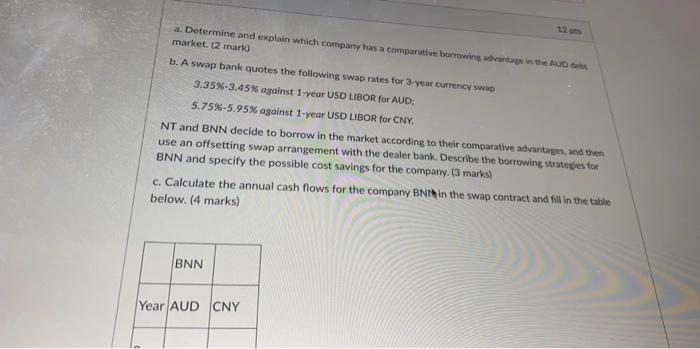

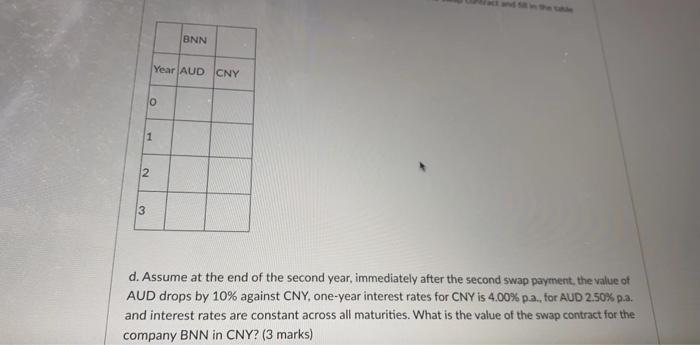

Question 2. Information BNN is a Chinese company and is considering issuing a to further raise AUD 20m for its growth in the next three years NT is a computer hardware producer based in Australia. NT is planning to move its production facility to China in the next three years. In order to purchase a factory in China, NT is p NT would like to borrow via a foxed rate loan of CNY 100m NT and BNN's current borrowing costs are below. Company NT BNN CNY 6.25% 5.50% AUD 3.50% 3.30% Desired CNY AUD amount 100m 20m Spot rate CNY 5 per (mid-rate) of AUD AUD: Use the above information to answer the questions in the text box below. 6A tv 9 all 4 a. Determine and explain which company has a comparative borrowing advantage in the AUD debt market. (2 mark) b. A swap bank quotes the following swap rates for 3-year currency swap 3.35%-3.45% against 1-year USD LIBOR for AUD; 5.75%-5.95% against 1-year USD LIBOR for CNY. NT and BNN decide to borrow in the market according to their comparative advantages, and then use an offsetting swap arrangement with the dealer bank. Describe the borrowing strategies for BNN and specify the possible cost savings for the company. (3 marks) c. Calculate the annual cash flows for the company BNN in the swap contract and fill in the table below. (4 marks) BNN Year AUD CNY O 1 2 BNN Year AUD CNY 3 d. Assume at the end of the second year, immediately after the second swap payment, the value of AUD drops by 10% against CNY, one-year interest rates for CNY is 4.00% p.a., for AUD 2.50% p.a. and interest rates are constant across all maturities. What is the value of the swap contract for the company BNN in CNY? (3 marks) Question 2. Information BNN is a Chinese company and is considering issuing a to further raise AUD 20m for its growth in the next three years NT is a computer hardware producer based in Australia. NT is planning to move its production facility to China in the next three years. In order to purchase a factory in China, NT is p NT would like to borrow via a foxed rate loan of CNY 100m NT and BNN's current borrowing costs are below. Company NT BNN CNY 6.25% 5.50% AUD 3.50% 3.30% Desired CNY AUD amount 100m 20m Spot rate CNY 5 per (mid-rate) of AUD AUD: Use the above information to answer the questions in the text box below. 6A tv 9 all 4 a. Determine and explain which company has a comparative borrowing advantage in the AUD debt market. (2 mark) b. A swap bank quotes the following swap rates for 3-year currency swap 3.35%-3.45% against 1-year USD LIBOR for AUD; 5.75%-5.95% against 1-year USD LIBOR for CNY. NT and BNN decide to borrow in the market according to their comparative advantages, and then use an offsetting swap arrangement with the dealer bank. Describe the borrowing strategies for BNN and specify the possible cost savings for the company. (3 marks) c. Calculate the annual cash flows for the company BNN in the swap contract and fill in the table below. (4 marks) BNN Year AUD CNY O 1 2 BNN Year AUD CNY 3 d. Assume at the end of the second year, immediately after the second swap payment, the value of AUD drops by 10% against CNY, one-year interest rates for CNY is 4.00% p.a., for AUD 2.50% p.a. and interest rates are constant across all maturities. What is the value of the swap contract for the company BNN in CNY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started