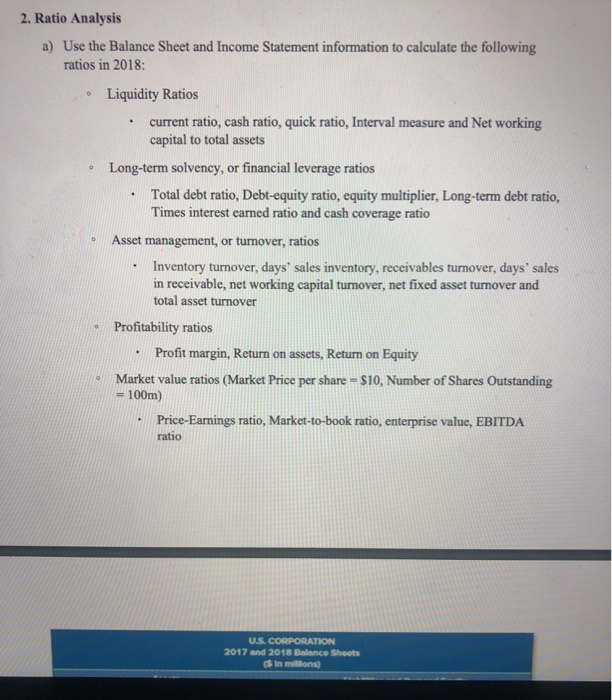

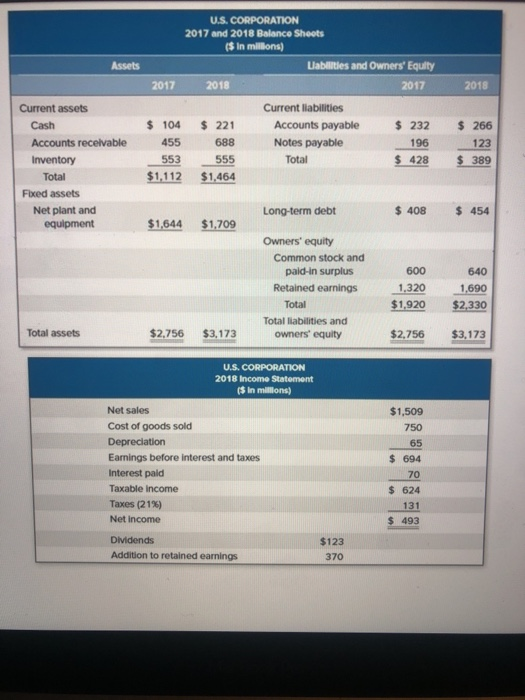

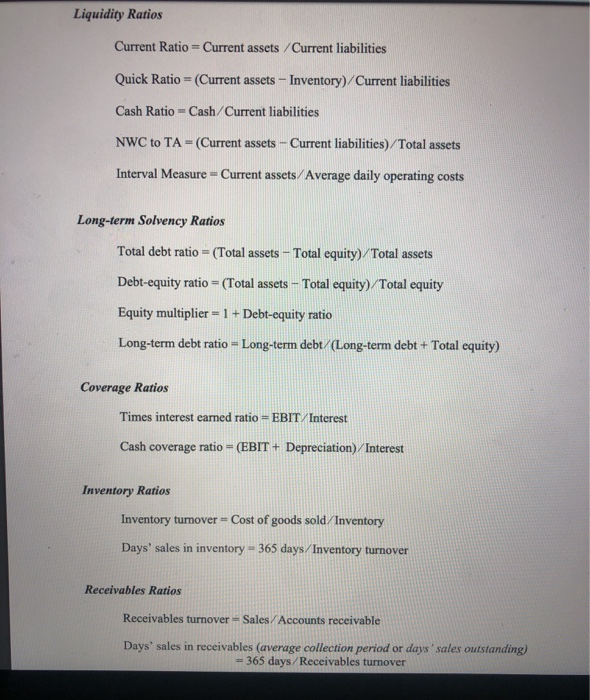

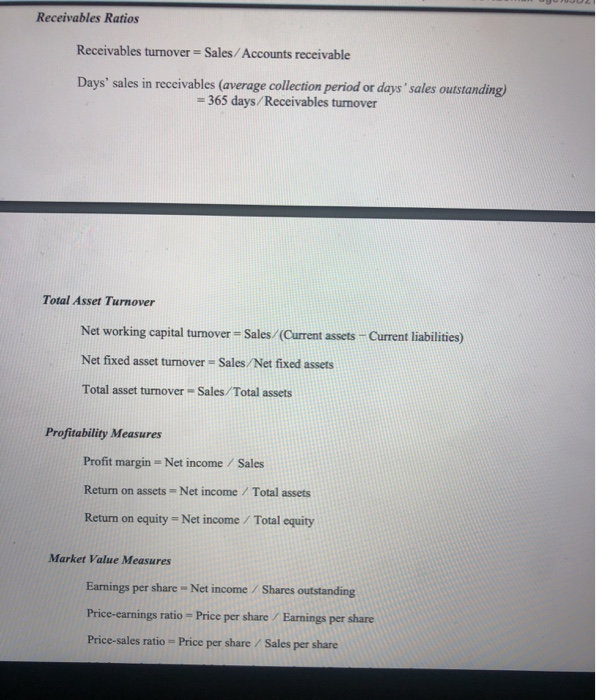

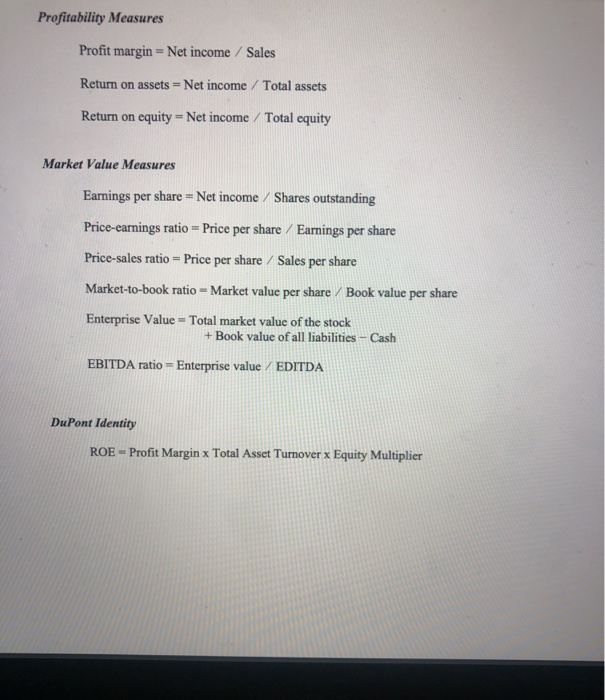

. . 2. Ratio Analysis a) Use the Balance Sheet and Income Statement information to calculate the following ratios in 2018: Liquidity Ratios current ratio, cash ratio, quick ratio, Interval measure and Net working capital to total assets Long-term solvency, or financial leverage ratios Total debt ratio, Debt-equity ratio, equity multiplier, Long-term debt ratio, Times interest earned ratio and cash coverage ratio Asset management, or turnover, ratios Inventory turnover, days' sales inventory, receivables turnover, days' sales in receivable, net working capital tumover, net fixed asset turnover and total asset turnover Profitability ratios Profit margin, Return on assets, Return on Equity Market value ratios (Market Price per share - $10, Number of Shares Outstanding 100m) Price-Earnings ratio, Market-to-book ratio, enterprise value, EBITDA ratio U.S. CORPORATION 2017 and 2018 Balance Sheets ($ In moms) Assets 2018 U.S. CORPORATION 2017 and 2018 Balance Shoots ($ In millions) Labilities and Owners' Equity 2017 2018 2017 Current liabilities $ 104 $ 221 Accounts payable $ 232 455 688 Notes payable 196 553 555 $ 428 $1,112 $1,464 $ 266 123 $ 389 Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total Long-term debt $ 408 $ 454 $1,644 $1,709 640 Owners' equity Common stock and pald-in surplus Retained earnings Total Total liabilities and owners' equity 600 1,320 $1,920 1,690 $2,330 Total assets $2,756 $3,173 $2,756 $3,173 U.S. CORPORATION 2018 Income Statement ($ in millons) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest pald Taxable income Taxes (21%) Net Income $1,509 750 65 $ 694 70 $ 624 131 $ 493 Dividends Addition to retained earnings $123 370 Liquidity Ratios Current Ratio = Current assets Current liabilities Quick Ratio - (Current assets - Inventory)/Current liabilities Cash Ratio - Cash/Current liabilities NWC to TA- (Current assets - Current liabilities) Total assets Interval Measure - Current assets/Average daily operating costs Long-term Solvency Ratios Total debt ratio = (Total assets - Total equity) Total assets Debt-equity ratio = (Total assets - Total equity) Total equity Equity multiplier - 1 + Debt-equity ratio Long-term debt ratio = Long-term debt/(Long-term debt + Total equity) Coverage Ratios Times interest earned ratio = EBIT/Interest Cash coverage ratio - (EBIT + Depreciation) Interest Inventory Ratios Inventory turnover - Cost of goods sold Inventory Days' sales in inventory - 365 days/Inventory turnover Receivables Ratios Receivables turnover - Sales/Accounts receivable Days' sales in receivables (average collection period or days'sales outstanding) = 365 days/Receivables turnover Receivables Ratios Receivables turnover = Sales / Accounts receivable Days' sales in receivables (average collection period or days' sales outstanding) = 365 days/Receivables turnover Total Asser Turnover Net working capital turnover = Sales (Current assets - Current liabilities) Net fixed asset turnover Sales Net fixed assets Total asset turnover - Sales/Total assets Profitability Measures Profit margin = Net income Sales Return on assets=Net income / Total assets Return on equity = Net income / Total equity Market Value Measures Earnings per share - Net income / Shares outstanding Price-earnings ratio = Price per share/Earnings per share Price-sales ratio = Price per share / Sales per share Profitability Measures Profit margin = Net income Sales Return on assets = Net income / Total assets Return on equity = Net income / Total equity Market Value Measures Earnings per share = Net income /Shares outstanding Price-earnings ratio = Price per share Earnings per share Price-sales ratio = Price per share / Sales per share Market-to-book ratio - Market value per share Book value per share Enterprise Value = Total market value of the stock + Book value of all liabilities - Cash EBITDA ratio = Enterprise value EDITDA DuPont Identity ROE - Profit Margin x Total Asset Turnover x Equity Multiplier