Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as

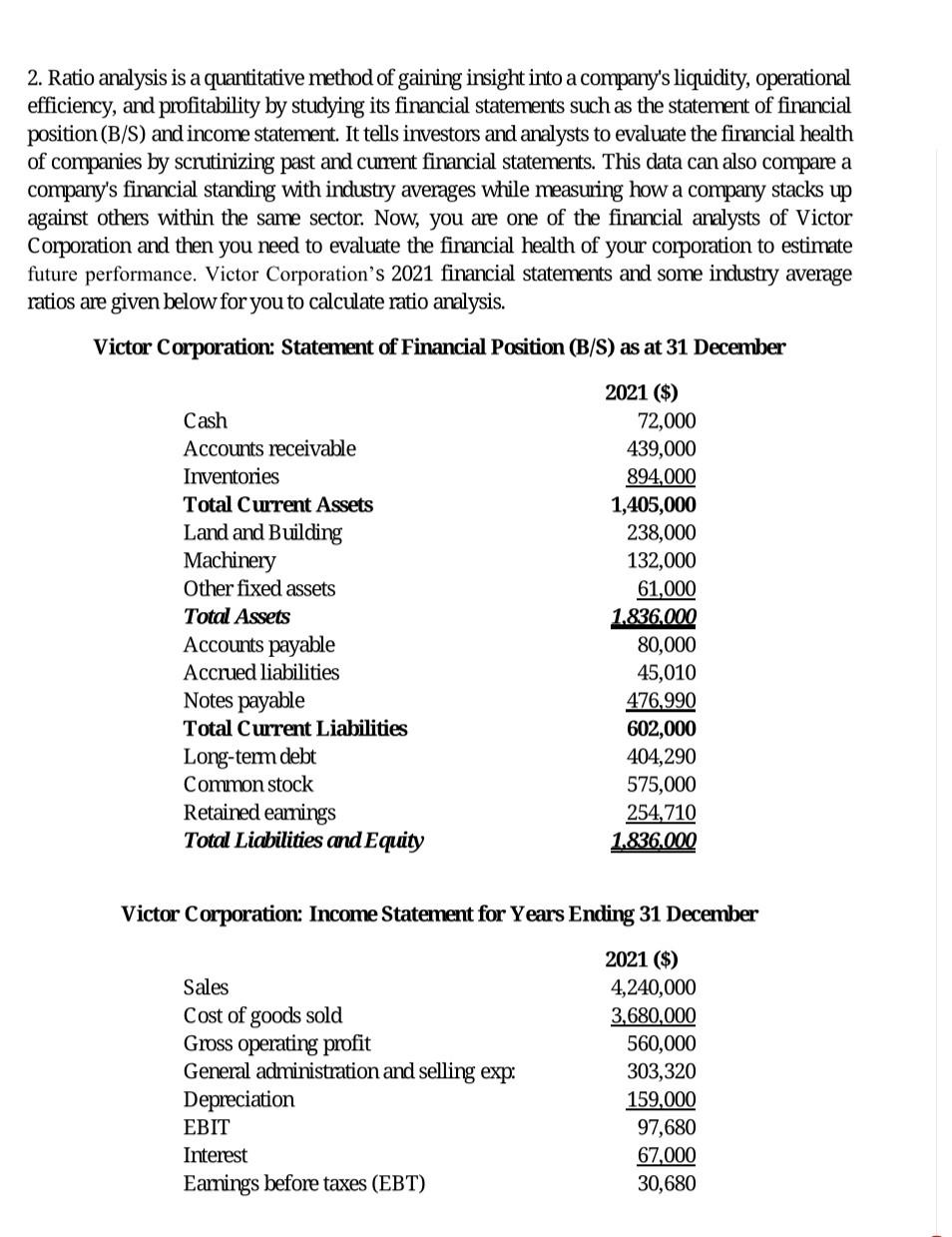

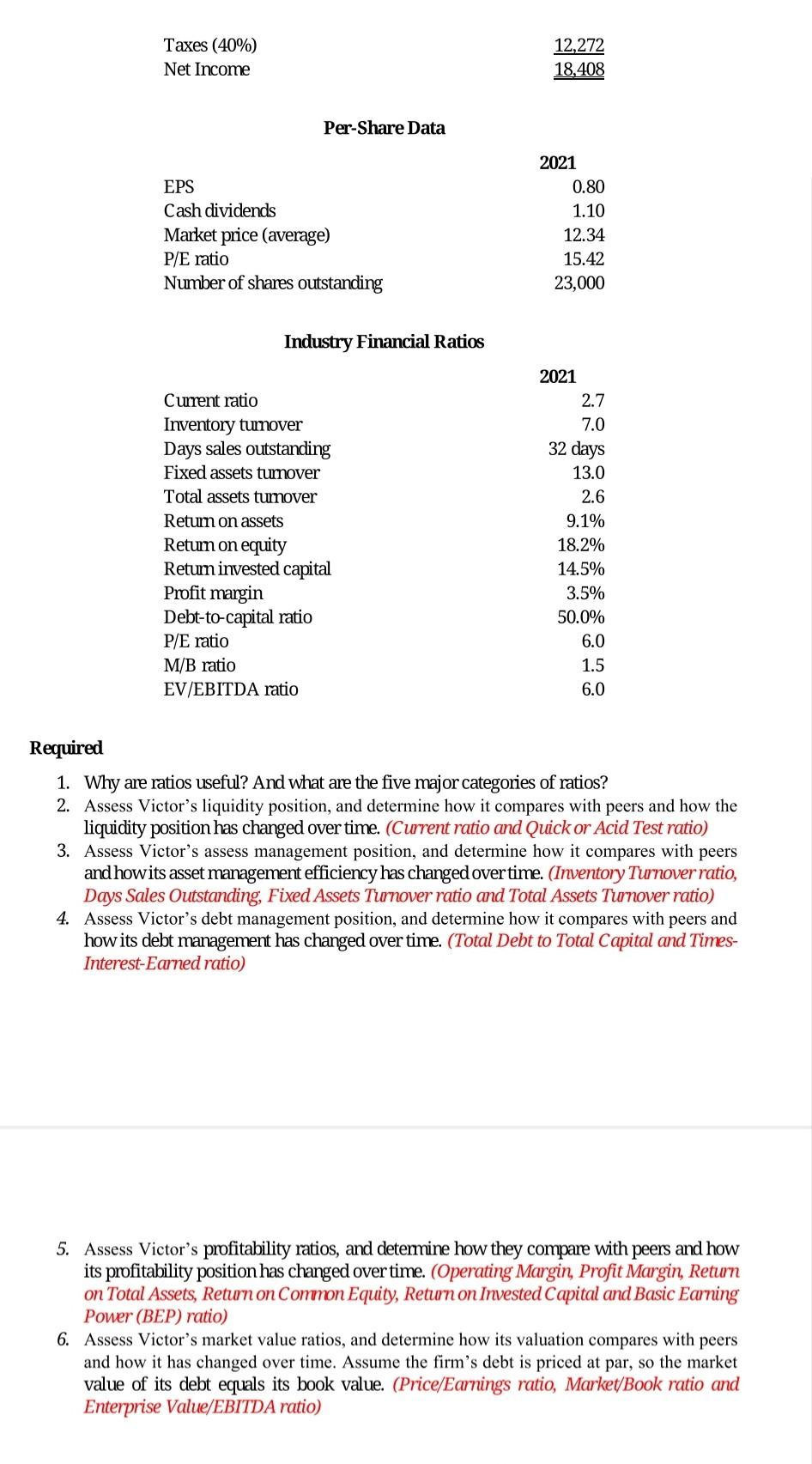

2. Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as the statement of financial position (B/S) and income statement. It tells investors and analysts to evaluate the financial health of companies by scrutinizing past and current financial statements. This data can also compare a company's financial standing with industry averages while measuring how a company stacks up against others within the same sector. Now, you are one of the financial analysts of Victor Corporation and then you need to evaluate the financial health of your corporation to estimate future performance. Victor Corporation's 2021 financial statements and some industry average ratios are given below for you to calculate ratio analysis. Victor Corporation: Statement of Financial Position (B/S) as at 31 December Cash Accounts receivable Inventories Total Current Assets Land and Building Machinery Other fixed assets Total Assets Accounts payable Accrued liabilities Notes payable Total Current Liabilities Long-term debt Common stock Retained earnings Total Liabilities and Equity 2021 ($) 72,000 439,000 894,000 1,405,000 238,000 132,000 61,000 1.836.000 80,000 45,010 476,990 602,000 404,290 575,000 254,710 1.836.000 Victor Corporation: Income Statement for Years Ending 31 December Sales Cost of goods sold Gross operating profit General administration and selling exp: Depreciation EBIT Interest Earnings before taxes (EBT) 2021 ($) 4,240,000 3,680,000 560,000 303,320 159,000 97,680 67,000 30,680 Taxes (40%) Net Income 12,272 18,408 Per-Share Data EPS Cash dividends Market price (average) P/E ratio Number of shares outstanding 2021 0.80 1.10 12.34 15.42 23,000 Industry Financial Ratios Current ratio Inventory tumover Days sales outstanding Fixed assets tumover Total assets turnover Return on assets Retum on equity Return invested capital Profit margin Debt-to-capital ratio P/E ratio M/B ratio EV/EBITDA ratio 2021 2.7 7.0 32 days 13.0 2.6 9.1% 18.2% 14.5% 3.5% 50.0% 6.0 1.5 6.0 Required 1. Why are ratios useful? And what are the five major categories of ratios? 2. Assess Victor's liquidity position, and determine how it compares with peers and how the liquidity position has changed over time. (Current ratio and Quick or Acid Test ratio) 3. Assess Victor's assess management position, and determine how it compares with peers and howits asset management efficiency has changed overtime. (Inventory Turnover ratio, Days Sales Outstanding, Fixed Assets Turnover ratio and Total Assets Turnover ratio) 4. Assess Victor's debt management position, and determine how it compares with peers and how its debt management has changed over time. (Total Debt to Total Capital and Times- Interest-Earned ratio) 5. Assess Victor's profitability ratios, and determine how they compare with peers and how its profitability position has changed over time. (Operating Margin, Profit Margin, Return on Total Assets, Return on Common Equity, Return on Invested Capital and Basic Earning Power (BEP) ratio) 6. Assess Victor's market value ratios, and determine how its valuation compares with peers and how it has changed over time. Assume the firm's debt is priced at par, so the market value of its debt equals its book value. (Price/Earnings ratio, Market/Book ratio and Enterprise Value/EBITDA ratio)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started