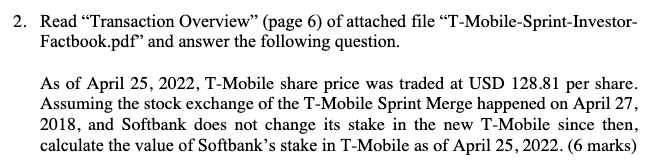

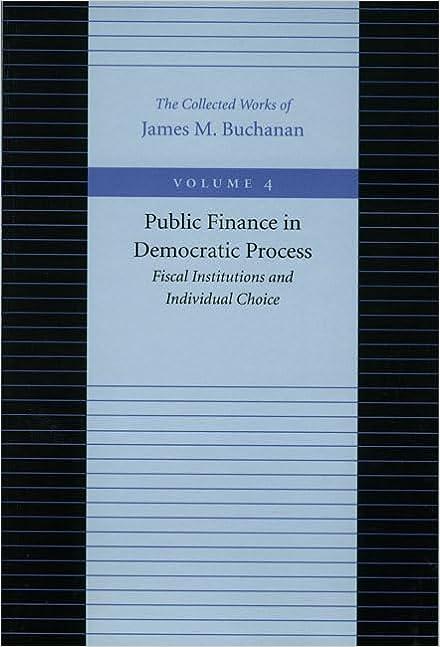

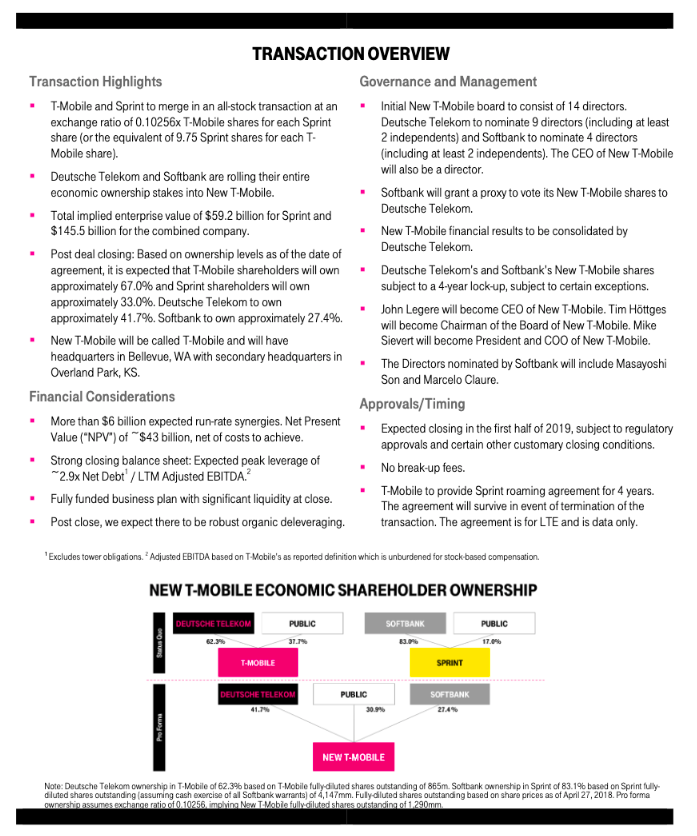

2. Read "Transaction Overview" (page 6) of attached file "T-Mobile-Sprint-Investor- Factbook.pdf" and answer the following question. As of April 25, 2022, T-Mobile share price was traded at USD 128.81 per share. Assuming the stock exchange of the T-Mobile Sprint Merge happened on April 27, 2018, and Softbank does not change its stake in the new T-Mobile since then, calculate the value of Softbank's stake in T-Mobile as of April 25, 2022. (6 marks) TRANSACTION OVERVIEW Transaction Highlights Governance and Management T-Mobile and Sprint to merge in an all-stock transaction at an exchange ratio of 0.10256x T-Mobile shares for each Sprint share (or the equivalent of 9.75 Sprint shares for each T- Mobile share). Initial New T-Mobile board to consist of 14 directors. Deutsche Telekom to nominate 9 directors (including at least 2 independents) and Softbank to nominate 4 directors (including at least 2 independents). The CEO of New T-Mobile will also be a director. Deutsche Telekom and Softbank are rolling their entire economic ownership stakes into New T-Mobile. Softbank will grant a proxy to vote its New T-Mobile shares to Deutsche Telekom. Total implied enterprise value of $59.2 billion for Sprint and $145.5 billion for the combined company. New T-Mobile financial results to be consolidated by Deutsche Telekom. Post deal closing: Based on ownership levels as of the date of agreement, it is expected that T-Mobile shareholders will own approximately 67.0% and Sprint shareholders will own approximately 33.0%. Deutsche Telekom to own approximately 41.7%. Softbank to own approximately 27.4%. Deutsche Telekom's and Softbank's New T-Mobile shares subject to a 4-year lock-up, subject to certain exceptions. John Legere will become CEO of New T-Mobile. Tim Httges will become Chairman of the Board of New T-Mobile. Mike Sievert will become President and COO of New T-Mobile. New T-Mobile will be called T-Mobile and will have headquarters in Bellevue, WA with secondary headquarters in Overland Park, KS. The Directors nominated by Softbank will include Masayoshi Son and Marcelo Claure. Financial Considerations Approvals/Timing More than $6 billion expected run-rate synergies. Net Present Value ("NPV") of $43 billion, net of costs to achieve. Expected closing in the first half of 2019, subject to regulatory approvals and certain other customary closing conditions. Strong closing balance sheet: Expected peak leverage of ~2.9x Net Debt/LTM Adjusted EBITDA. No break-up fees. Fully funded business plan with significant liquidity at close. T-Mobile to provide Sprint roaming agreement for 4 years. The agreement will survive in event of termination of the transaction. The agreement is for LTE and is data only. Post close, we expect there to be robust organic deleveraging. 'Excludes tower obligations.* Adjusted EBITDA based on T-Mobile's as reported definition which is unburdened for stock-based compensation. NEW T-MOBILE ECONOMIC SHAREHOLDER OWNERSHIP DEUTSCHE TELEKOM PUBLIC SOFTBANK PUBLIC 37.7% 17.0% T-MOBILE SPRINT DEUTSCHE TELEKOM PUBLIC SOFTBANK 27.4% 30.9% NEW T-MOBILE Note: Deutsche Telekom ownership in T-Mobile of 62.3% based on T-Mobile fully-diluted shares outstanding of 865m. Softbank ownership in Sprint of 83.1% based on Sprint fully- diluted shares outstanding (assuming cash exercise of all Softbank warrants) of 4,147mm. Fully-diluted shares outstanding based on share prices as of April 27, 2018. Pro forma ownership assumes exchange ratio of 0.10256, imphing New T-Mobile fully-diluted shares outstanding of 1.290mm. Status Que 2. Read "Transaction Overview" (page 6) of attached file "T-Mobile-Sprint-Investor- Factbook.pdf" and answer the following question. As of April 25, 2022, T-Mobile share price was traded at USD 128.81 per share. Assuming the stock exchange of the T-Mobile Sprint Merge happened on April 27, 2018, and Softbank does not change its stake in the new T-Mobile since then, calculate the value of Softbank's stake in T-Mobile as of April 25, 2022. (6 marks) TRANSACTION OVERVIEW Transaction Highlights Governance and Management T-Mobile and Sprint to merge in an all-stock transaction at an exchange ratio of 0.10256x T-Mobile shares for each Sprint share (or the equivalent of 9.75 Sprint shares for each T- Mobile share). Initial New T-Mobile board to consist of 14 directors. Deutsche Telekom to nominate 9 directors (including at least 2 independents) and Softbank to nominate 4 directors (including at least 2 independents). The CEO of New T-Mobile will also be a director. Deutsche Telekom and Softbank are rolling their entire economic ownership stakes into New T-Mobile. Softbank will grant a proxy to vote its New T-Mobile shares to Deutsche Telekom. Total implied enterprise value of $59.2 billion for Sprint and $145.5 billion for the combined company. New T-Mobile financial results to be consolidated by Deutsche Telekom. Post deal closing: Based on ownership levels as of the date of agreement, it is expected that T-Mobile shareholders will own approximately 67.0% and Sprint shareholders will own approximately 33.0%. Deutsche Telekom to own approximately 41.7%. Softbank to own approximately 27.4%. Deutsche Telekom's and Softbank's New T-Mobile shares subject to a 4-year lock-up, subject to certain exceptions. John Legere will become CEO of New T-Mobile. Tim Httges will become Chairman of the Board of New T-Mobile. Mike Sievert will become President and COO of New T-Mobile. New T-Mobile will be called T-Mobile and will have headquarters in Bellevue, WA with secondary headquarters in Overland Park, KS. The Directors nominated by Softbank will include Masayoshi Son and Marcelo Claure. Financial Considerations Approvals/Timing More than $6 billion expected run-rate synergies. Net Present Value ("NPV") of $43 billion, net of costs to achieve. Expected closing in the first half of 2019, subject to regulatory approvals and certain other customary closing conditions. Strong closing balance sheet: Expected peak leverage of ~2.9x Net Debt/LTM Adjusted EBITDA. No break-up fees. Fully funded business plan with significant liquidity at close. T-Mobile to provide Sprint roaming agreement for 4 years. The agreement will survive in event of termination of the transaction. The agreement is for LTE and is data only. Post close, we expect there to be robust organic deleveraging. 'Excludes tower obligations.* Adjusted EBITDA based on T-Mobile's as reported definition which is unburdened for stock-based compensation. NEW T-MOBILE ECONOMIC SHAREHOLDER OWNERSHIP DEUTSCHE TELEKOM PUBLIC SOFTBANK PUBLIC 37.7% 17.0% T-MOBILE SPRINT DEUTSCHE TELEKOM PUBLIC SOFTBANK 27.4% 30.9% NEW T-MOBILE Note: Deutsche Telekom ownership in T-Mobile of 62.3% based on T-Mobile fully-diluted shares outstanding of 865m. Softbank ownership in Sprint of 83.1% based on Sprint fully- diluted shares outstanding (assuming cash exercise of all Softbank warrants) of 4,147mm. Fully-diluted shares outstanding based on share prices as of April 27, 2018. Pro forma ownership assumes exchange ratio of 0.10256, imphing New T-Mobile fully-diluted shares outstanding of 1.290mm. Status Que