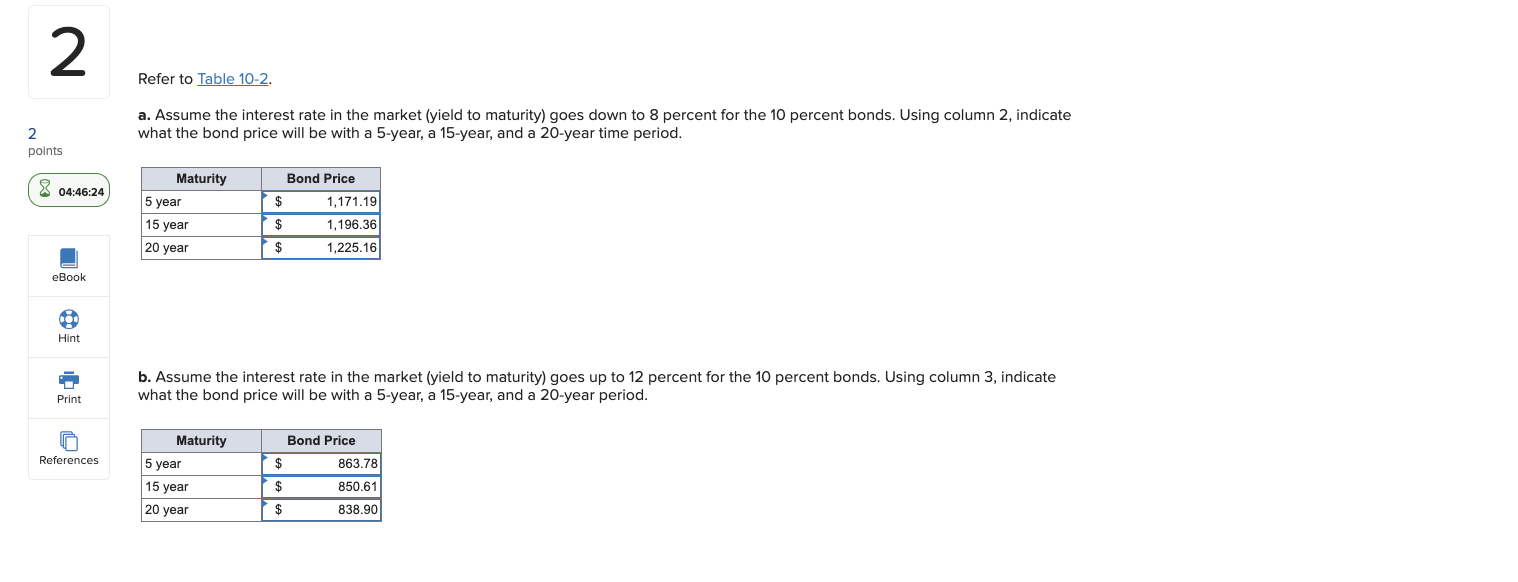

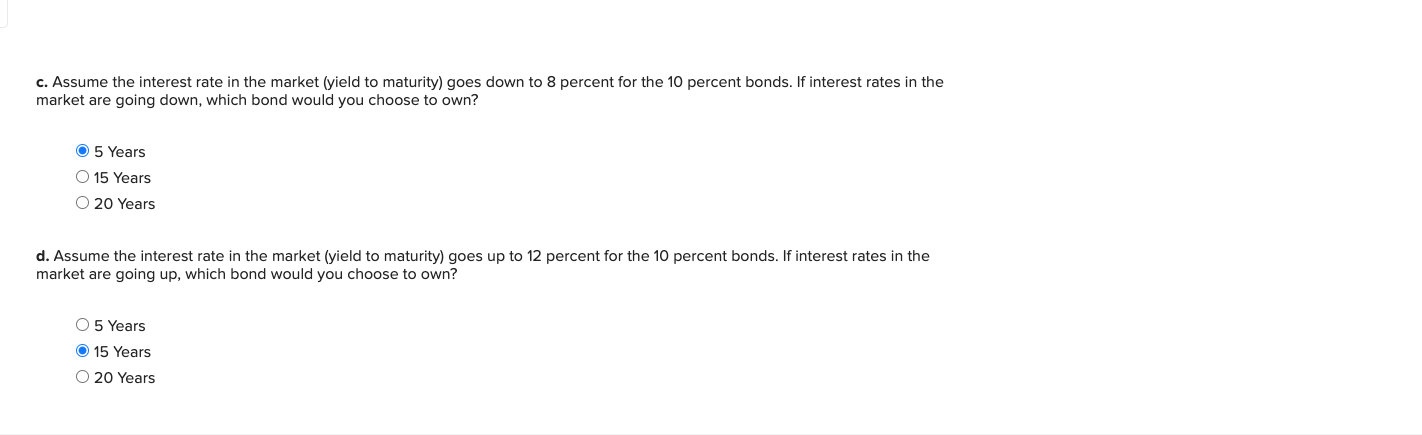

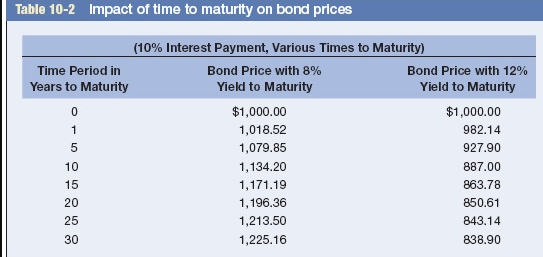

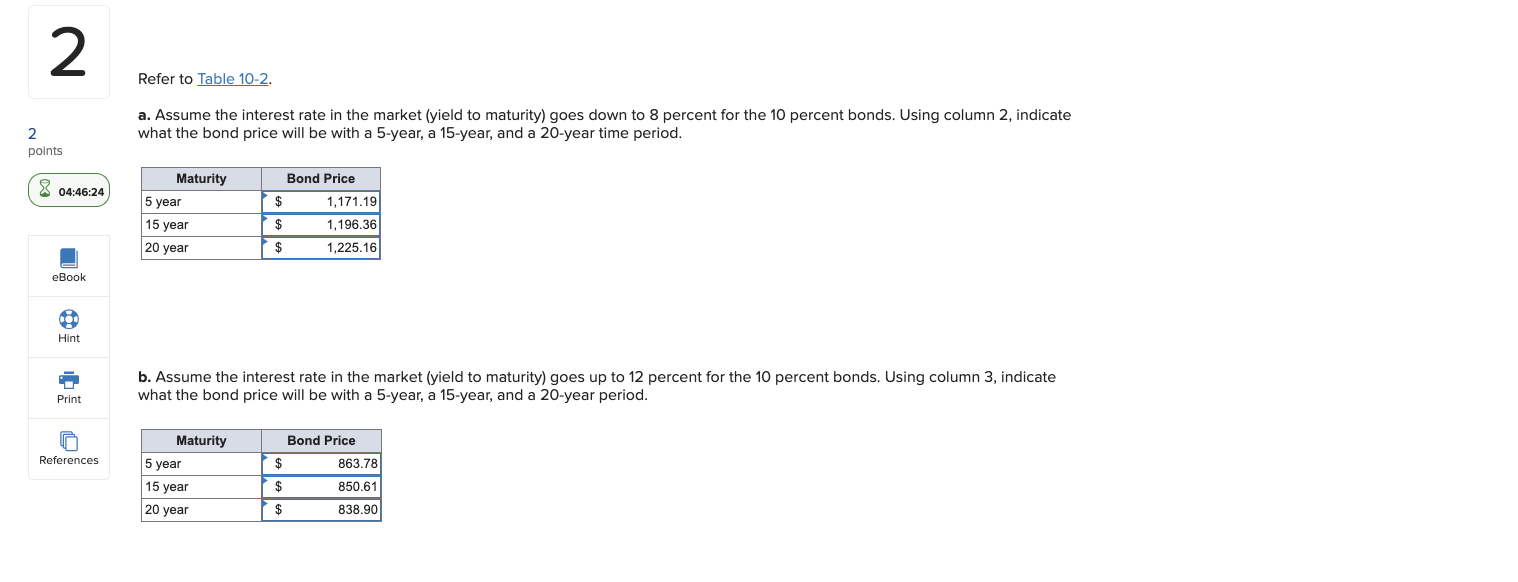

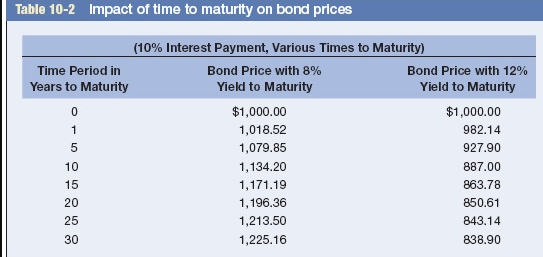

2 Refer to Table 10-2. 2 points a. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. Using column 2, indicate what the bond price will be with a 5-year, a 15-year, and a 20-year time period. 8 04:46:24 Maturity 5 year Bond Price $ 1,171.19 $ 1,196.36 $ 1,225.16 15 year 20 year eBook Hint b. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. Using column 3, indicate what the bond price will be with a 5-year, a 15-year, and a 20-year period. Print Maturity 5 year Bond Price $ 863.78 References 15 year $ 850.61 20 year $ 838.90 c. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. If interest rates in the market are going down, which bond would you choose to own? O 5 Years O 15 Years O 20 Years d. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. If interest rates in the market are going up, which bond would you choose to own? O 5 Years O 15 Years O 20 Years Table 10-2 Impact of time to maturity on bond prices (10% Interest Payment, Various Times to Maturity) Time Period in Bond Price with 8% Bond Price with 12% Years to Maturity Yield to Maturity Yield to Maturity 0 $1,000.00 $1,000.00 1 1,018.52 982.14 5 1,079.85 927.90 10 1,134.20 887.00 15 1,171.19 863.78 20 1,196.36 850.61 25 1,213.50 843.14 30 1,225.16 838.90 2 Refer to Table 10-2. 2 points a. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. Using column 2, indicate what the bond price will be with a 5-year, a 15-year, and a 20-year time period. 8 04:46:24 Maturity 5 year Bond Price $ 1,171.19 $ 1,196.36 $ 1,225.16 15 year 20 year eBook Hint b. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. Using column 3, indicate what the bond price will be with a 5-year, a 15-year, and a 20-year period. Print Maturity 5 year Bond Price $ 863.78 References 15 year $ 850.61 20 year $ 838.90 c. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. If interest rates in the market are going down, which bond would you choose to own? O 5 Years O 15 Years O 20 Years d. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. If interest rates in the market are going up, which bond would you choose to own? O 5 Years O 15 Years O 20 Years Table 10-2 Impact of time to maturity on bond prices (10% Interest Payment, Various Times to Maturity) Time Period in Bond Price with 8% Bond Price with 12% Years to Maturity Yield to Maturity Yield to Maturity 0 $1,000.00 $1,000.00 1 1,018.52 982.14 5 1,079.85 927.90 10 1,134.20 887.00 15 1,171.19 863.78 20 1,196.36 850.61 25 1,213.50 843.14 30 1,225.16 838.90