Question

2. Robert Redrick, without obtaining an extension, filed his calendar year 2021 federal tax return on July 20, 2022. His delinquency was not due

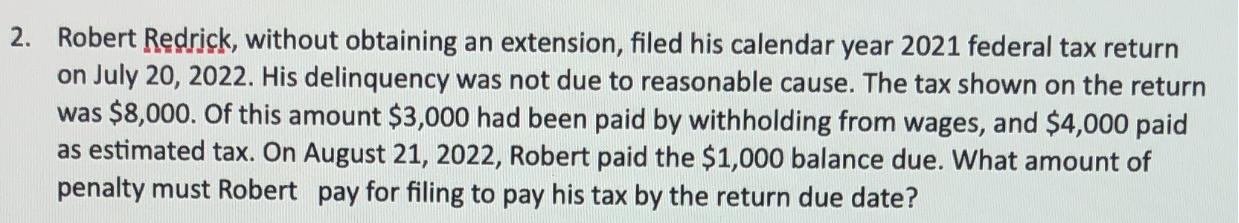

2. Robert Redrick, without obtaining an extension, filed his calendar year 2021 federal tax return on July 20, 2022. His delinquency was not due to reasonable cause. The tax shown on the return was $8,000. Of this amount $3,000 had been paid by withholding from wages, and $4,000 paid as estimated tax. On August 21, 2022, Robert paid the $1,000 balance due. What amount of penalty must Robert pay for filing to pay his tax by the return due date?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the penalty for failing to pay tax by the due date we need to determine the number of d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2023 Comprehensive Volume

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

46th Edition

0357719689, 9780357719688

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App