Answered step by step

Verified Expert Solution

Question

1 Approved Answer

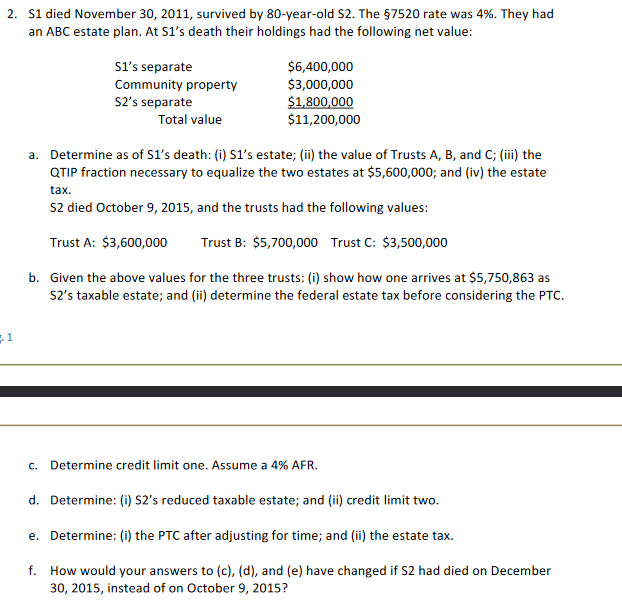

2. S1 died November 30, 2011, survived by 80-year-old S2. The 7520 rate was 4%. They had an ABC estate plan. At S1's death

2. S1 died November 30, 2011, survived by 80-year-old S2. The 7520 rate was 4%. They had an ABC estate plan. At S1's death their holdings had the following net value: S1's separate $6,400,000 Community property $3,000,000 S2's separate $1,800,000 Total value $11,200,000 1 a. Determine as of S1's death: (i) S1's estate; (ii) the value of Trusts A, B, and C; (iii) the QTIP fraction necessary to equalize the two estates at $5,600,000; and (iv) the estate tax. S2 died October 9, 2015, and the trusts had the following values: Trust A: $3,600,000 Trust B: $5,700,000 Trust C: $3,500,000 b. Given the above values for the three trusts: (i) show how one arrives at $5,750,863 as S2's taxable estate; and (ii) determine the federal estate tax before considering the PTC. c. Determine credit limit one. Assume a 4% AFR. d. Determine: (i) S2's reduced taxable estate; and (ii) credit limit two. e. Determine: (i) the PTC after adjusting for time; and (ii) the estate tax. f. How would your answers to (c), (d), and (e) have changed if S2 had died on December 30, 2015, instead of on October 9, 2015?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started