Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Sheila earned a $88,000 bonus which she would like to invest in the stock market. She is planning to buy shares of AMI

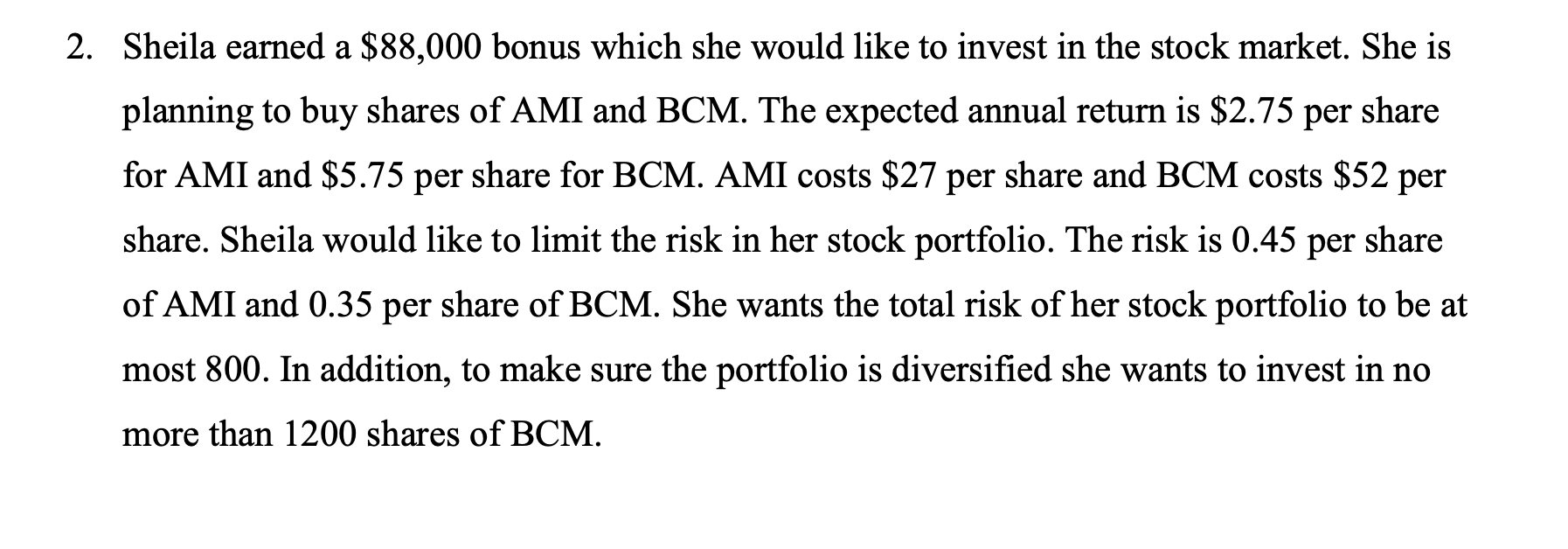

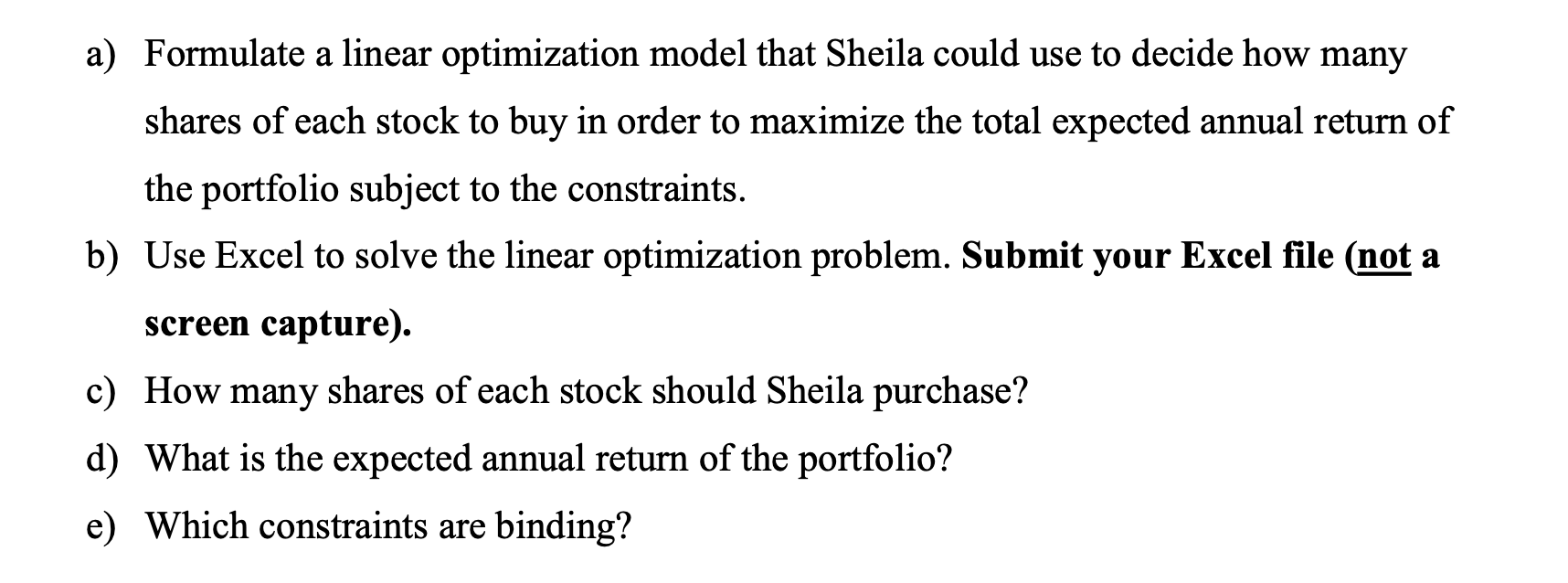

2. Sheila earned a $88,000 bonus which she would like to invest in the stock market. She is planning to buy shares of AMI and BCM. The expected annual return is $2.75 per share for AMI and $5.75 per share for BCM. AMI costs $27 per share and BCM costs $52 per share. Sheila would like to limit the risk in her stock portfolio. The risk is 0.45 per share of AMI and 0.35 per share of BCM. She wants the total risk of her stock portfolio to be at most 800. In addition, to make sure the portfolio is diversified she wants to invest in no more than 1200 shares of BCM. a) Formulate a linear optimization model that Sheila could use to decide how many shares of each stock to buy in order to maximize the total expected annual return of the portfolio subject to the constraints. b) Use Excel to solve the linear optimization problem. Submit your Excel file (not a screen capture). c) How many shares of each stock should Sheila purchase? d) What is the expected annual return of the portfolio? e) Which constraints are binding?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started