Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Simon Pty Ltd (Simon) manufactures coffee lollies which they sell directly to the public from their shop front. They also sell wholesale directly

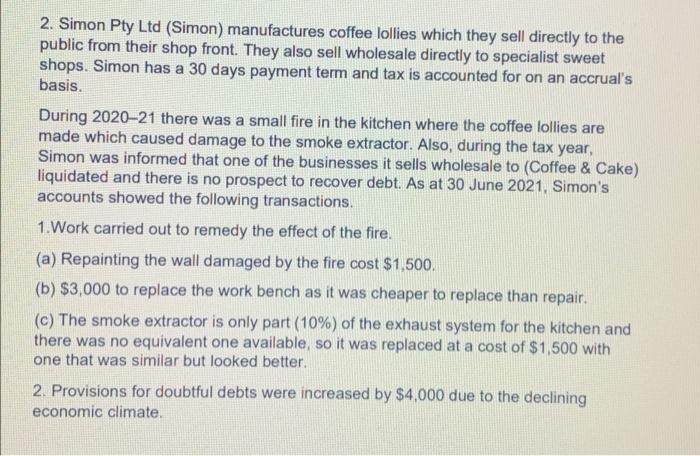

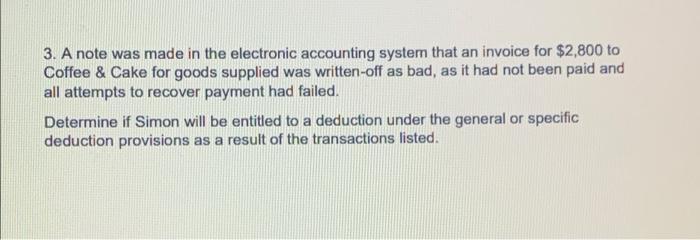

2. Simon Pty Ltd (Simon) manufactures coffee lollies which they sell directly to the public from their shop front. They also sell wholesale directly to specialist sweet shops. Simon has a 30 days payment term and tax is accounted for on an accrual's basis. During 2020-21 there was a small fire in the kitchen where the coffee lollies are made which caused damage to the smoke extractor. Also, during the tax year, Simon was informed that one of the businesses it sells wholesale to (Coffee & Cake) liquidated and there is no prospect to recover debt. As at 30 June 2021, Simon's accounts showed the following transactions. 1.Work carried out to remedy the effect of the fire. (a) Repainting the wall damaged by the fire cost $1,500. (b) $3,000 to replace the work bench as it was cheaper to replace than repair. (c) The smoke extractor is only part (10%) of the exhaust system for the kitchen and there was no equivalent one available, so it was replaced at a cost of $1,500 with one that was similar but looked better. 2. Provisions for doubtful debts were increased by $4,000 due to the declining economic climate. 3. A note was made in the electronic accounting system that an invoice for $2,800 to Coffee & Cake for goods supplied was written-off as bad, as it had not been paid and all attempts to recover payment had failed. Determine if Simon will be entitled to a deduction under the general or specific deduction provisions as a result of the transactions listed.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Work carried out to remedy the effect of the fire a Repainting the wall damaged by the fire cost 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started