Answered step by step

Verified Expert Solution

Question

1 Approved Answer

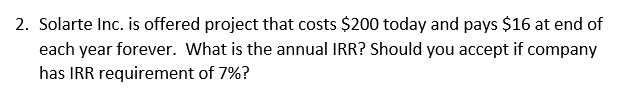

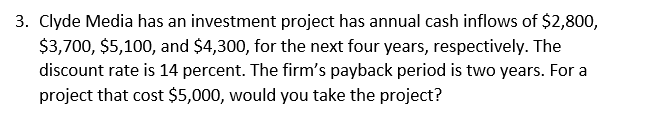

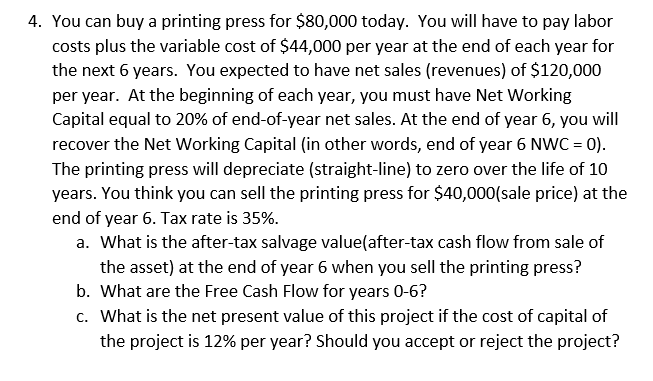

2. Solarte Inc. is offered project that costs $200 today and pays $16 at end of each year forever. What is the annual IRR?

2. Solarte Inc. is offered project that costs $200 today and pays $16 at end of each year forever. What is the annual IRR? Should you accept if company has IRR requirement of 7%? 3. Clyde Media has an investment project has annual cash inflows of $2,800, $3,700, $5,100, and $4,300, for the next four years, respectively. The discount rate is 14 percent. The firm's payback period is two years. For a project that cost $5,000, would you take the project? 4. You can buy a printing press for $80,000 today. You will have to pay labor costs plus the variable cost of $44,000 per year at the end of each year for the next 6 years. You expected to have net sales (revenues) of $120,000 per year. At the beginning of each year, you must have Net Working Capital equal to 20% of end-of-year net sales. At the end of year 6, you will recover the Net Working Capital (in other words, end of year 6 NWC = 0). The printing press will depreciate (straight-line) to zero over the life of 10 years. You think you can sell the printing press for $40,000(sale price) at the end of year 6. Tax rate is 35%. a. What is the after-tax salvage value(after-tax cash flow from sale of the asset) at the end of year 6 when you sell the printing press? b. What are the Free Cash Flow for years 0-6? c. What is the net present value of this project if the cost of capital of the project is 12% per year? Should you accept or reject the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each question one by one 1 Solarte Inc Project The project costs 200 today and pays 16 at the end of each year forever To calculate the Internal Rate of Return IRR we need to find the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started