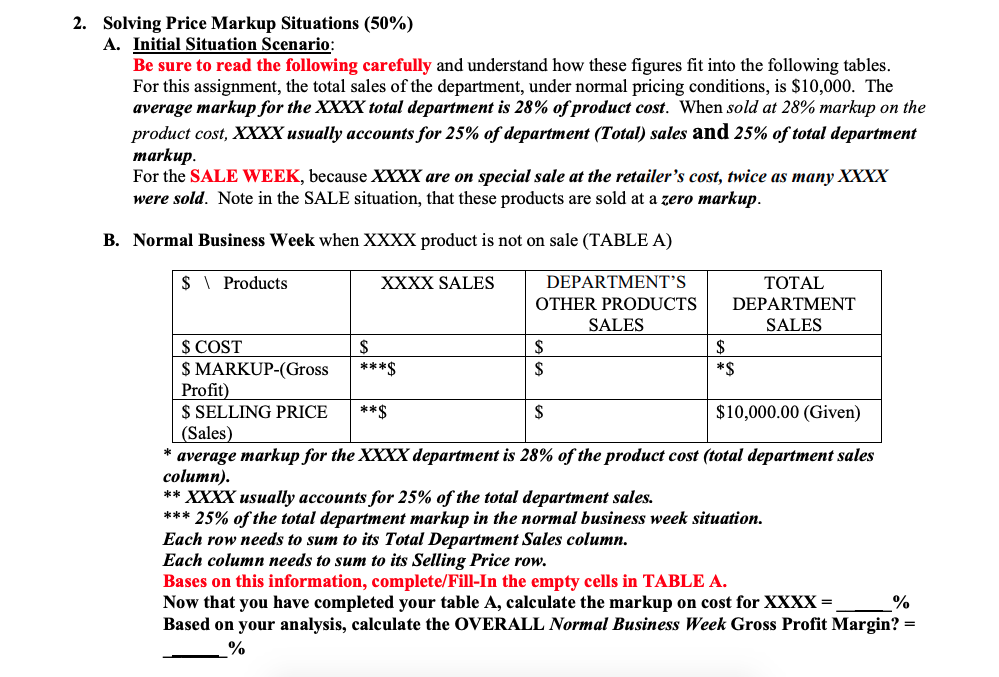

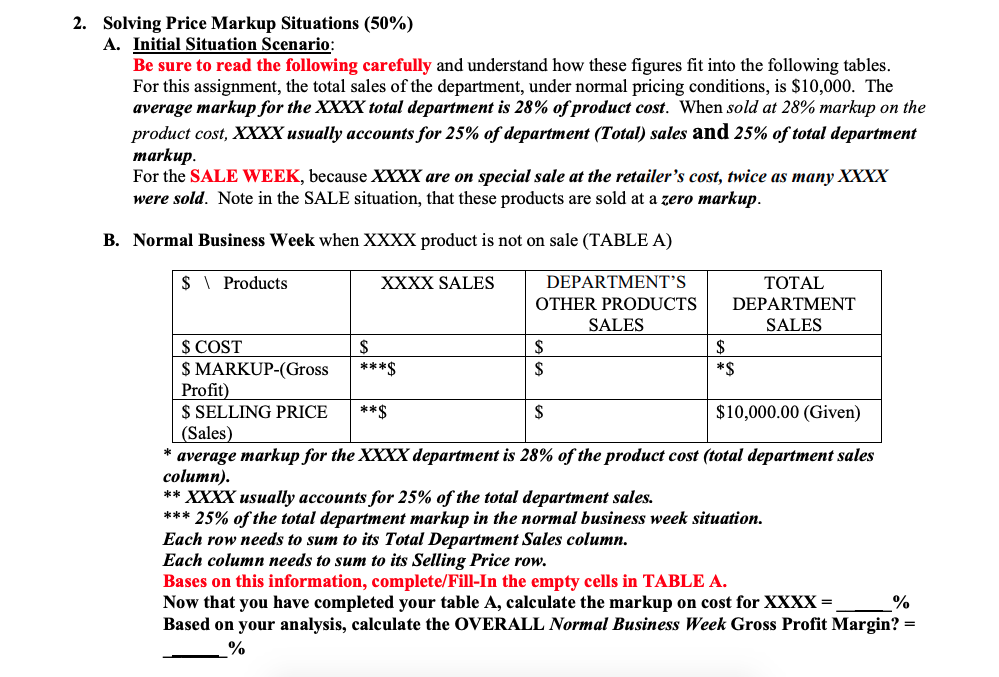

2. Solving Price Markup Situations (50%) A. Initial Situation Scenario: Be sure to read the following carefully and understand how these figures fit into the following tables. For this assignment, the total sales of the department, under normal pricing conditions, is $10,000. The average markup for the XXXX total department is 28% of product cost. When sold at 28% markup on the product cost, XXXX usually accounts for 25% of department (Total) sales and 25% of total department markup. For the SALE WEEK, because XXXX are on special sale at the retailer's cost, twice as many XXXX were sold. Note in the SALE situation, that these products are sold at a zero markup. B. Normal Business Week when XXXX product is not on sale (TABLE A) $ \ Products XXXX SALES DEPARTMENT'S TOTAL OTHER PRODUCTS DEPARTMENT SALES SALES $ COST $ S $ $ MARKUP-(Gross ***$ $ *$ Profit) $ SELLING PRICE **$ $ $10,000.00 (Given) (Sales) * average markup for the XXXX department is 28% of the product cost (total department sales column). ** XXXX usually accounts for 25% of the total department sales. *** 25% of the total department markup in the normal business week situation. Each row needs to sum to its Total Department Sales column. Each column needs to sum to its Selling Price row. Bases on this information, complete/Fill-In the empty cells in TABLE A. Now that you have completed your table A, calculate the markup on cost for XXXX = Based on your analysis, calculate the OVERALL Normal Business Week Gross Profit Margin? = % % 2. Solving Price Markup Situations (50%) A. Initial Situation Scenario: Be sure to read the following carefully and understand how these figures fit into the following tables. For this assignment, the total sales of the department, under normal pricing conditions, is $10,000. The average markup for the XXXX total department is 28% of product cost. When sold at 28% markup on the product cost, XXXX usually accounts for 25% of department (Total) sales and 25% of total department markup. For the SALE WEEK, because XXXX are on special sale at the retailer's cost, twice as many XXXX were sold. Note in the SALE situation, that these products are sold at a zero markup. B. Normal Business Week when XXXX product is not on sale (TABLE A) $ \ Products XXXX SALES DEPARTMENT'S TOTAL OTHER PRODUCTS DEPARTMENT SALES SALES $ COST $ S $ $ MARKUP-(Gross ***$ $ *$ Profit) $ SELLING PRICE **$ $ $10,000.00 (Given) (Sales) * average markup for the XXXX department is 28% of the product cost (total department sales column). ** XXXX usually accounts for 25% of the total department sales. *** 25% of the total department markup in the normal business week situation. Each row needs to sum to its Total Department Sales column. Each column needs to sum to its Selling Price row. Bases on this information, complete/Fill-In the empty cells in TABLE A. Now that you have completed your table A, calculate the markup on cost for XXXX = Based on your analysis, calculate the OVERALL Normal Business Week Gross Profit Margin? = % %