Question

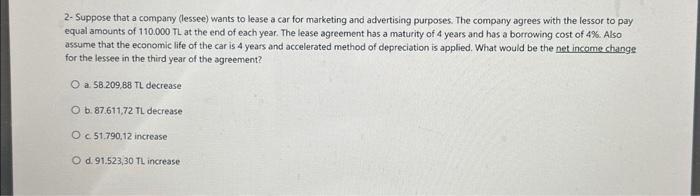

2- Suppose that a company (lessee) wants to lease a car for marketing and advertising purposes. The company agrees with the lessor to pay

2- Suppose that a company (lessee) wants to lease a car for marketing and advertising purposes. The company agrees with the lessor to pay equal amounts of 110.000 TL at the end of each year. The lease agreement has a maturity of 4 years and has a borrowing cost of 4%. Also assume that the economic life of the car is 4 years and accelerated method of depreciation is applied. What would be the net income change for the lessee in the third year of the agreement? O a. 58.209,88 TL decrease O b. 87.611,72 TL decrease Oc 51.790,12 increase O d. 91.523,30 TL increase

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the net income change for the lessee in the third year of the lease agreemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Information Systems The Processes and Controls

Authors: Leslie Turner, Andrea Weickgenannt

2nd edition

9781118473030, 1118162307, 1118473035, 978-1118162309

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App