Question

2. Suppose that the risk-free interest rate is 10%. A bond with 8% yield is traded at a price. The current bond price is

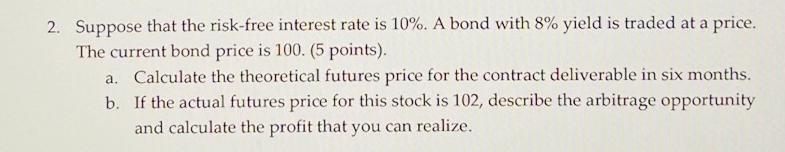

2. Suppose that the risk-free interest rate is 10%. A bond with 8% yield is traded at a price. The current bond price is 100. (5 points). a. Calculate the theoretical futures price for the contract deliverable in six months. b. If the actual futures price for this stock is 102, describe the arbitrage opportunity and calculate the profit that you can realize.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Absolutely Heres the breakdown of the theoretical futures price and the arbitrage opportunity a Theo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Bond Markets Analysis and Strategies

Authors: Frank J.Fabozzi

9th edition

133796779, 978-0133796773

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App