Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Suppose the expected return on a well diversified portfolio, P, of risky stocks is 15% and the return on the risk-free T-bill is 3%.

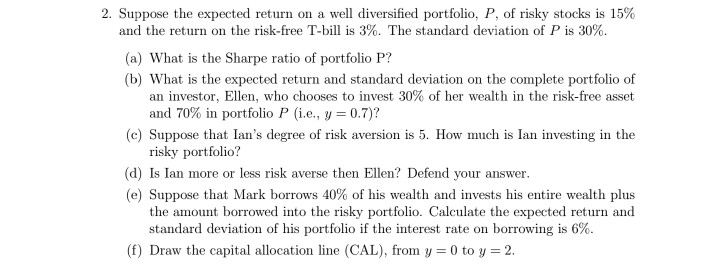

2. Suppose the expected return on a well diversified portfolio, P, of risky stocks is 15% and the return on the risk-free T-bill is 3%. The standard deviation of P is 30%. (a) What is the Sharpe ratio of portfolio P? (b) What is the expected return and standard deviation on the complete portfolio of an investor, Ellen, who chooses to invest 30% of her wealth in the risk-free asset and 70% in portfolio P (i.e., y-07)? (c) Suppose that Ian's degree of risk aversion is 5. How much is Ian investing in the risky portfolio? (d) Is Ian more or less risk averse then Ellen? Defend your answer. (e) Suppose that Mark borrows 40% of his wealth and invests his entire wealth plus the amount borrowed into the risky portfolio. Calculate the expected return and standard deviation of his portfolio if the interest rate on borrowing is 6%. (f) Draw the capital allocation line (CAL), from y = 0 to y = 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started