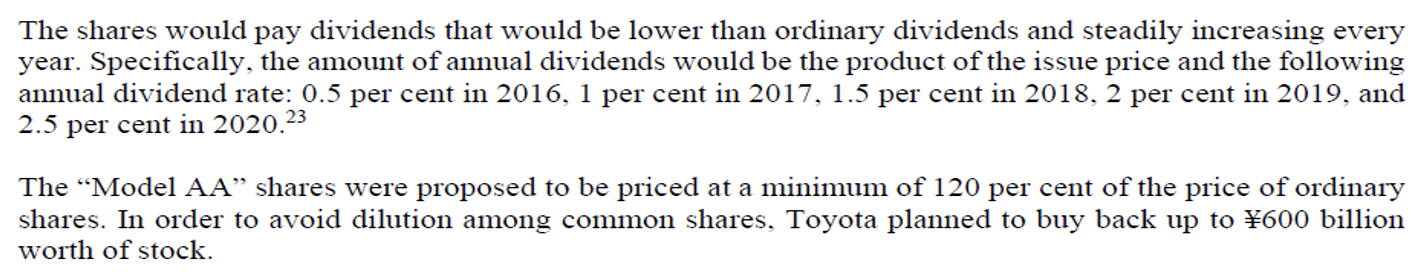

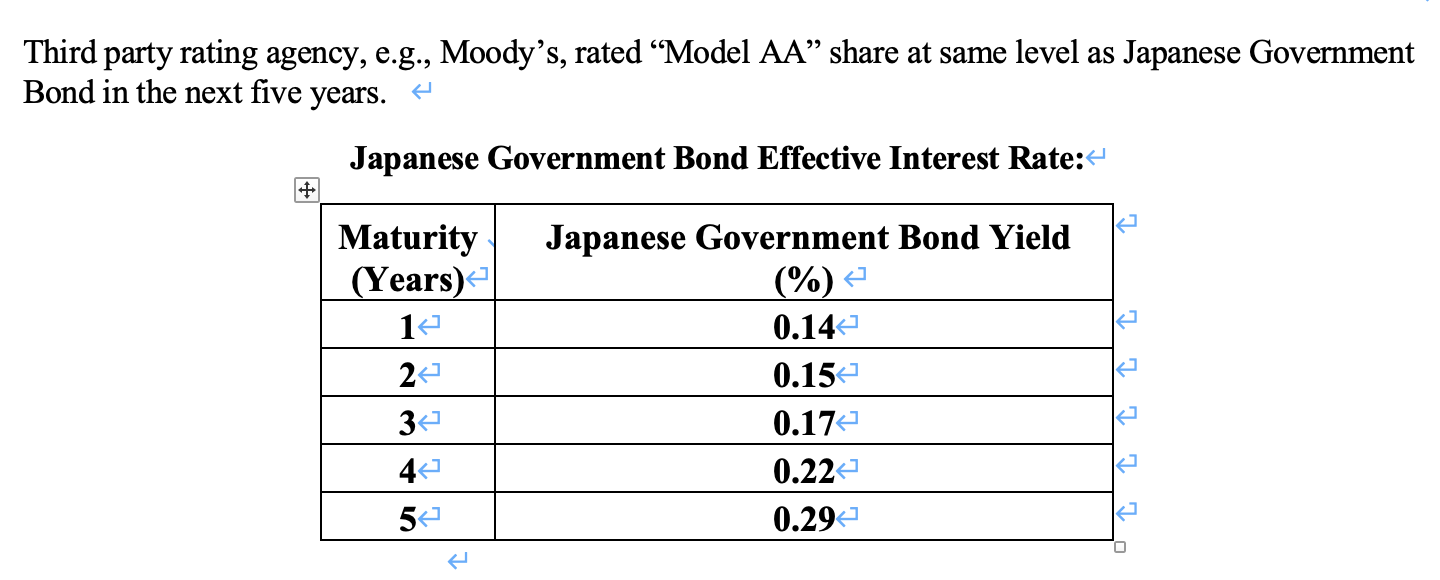

2. Suppose you are considering investing in Model AA shares. Before you purchase Model AA shares, you will conduct valuation to figure out how much you would expect to earn from the investment. You campare Model AA investment opportunity to alternative investment oporutnity. One potential investment opporuntiy is to invest in Audi common stock. Your friend, Seong Jin, is a security analyst and follws Audi stock. SJ informed you that if you invest in Audi stock today and hold it for 5 years, you would expect get 9% return in total. Would you invest in Model AA shares or in Audi shares? Please, show your work on figuring out the expected investment return for "Model AA. Hint 1 : Assume you must invest in either Toyota's Model AA or Audi's common stock. Hint 2 : Again, the holding period of investment is 5 YEARS. We don't know how Audi shares and Model AA shares would behave after 5 years. The shares would pay dividends that would be lower than ordinary dividends and steadily increasing every year. Specifically, the amount of annual dividends would be the product of the issue price and the following annual dividend rate: 0.5 per cent in 2016, 1 per cent in 2017, 1.5 per cent in 2018, 2 per cent in 2019, and 2.5 per cent in 2020.23 The Model AA shares were proposed to be priced at a minimum of 120 per cent of the price of ordinary shares. In order to avoid dilution among common shares, Toyota planned to buy back up to 600 billion worth of stock. Third party rating agency, e.g., Moody's, rated Model AA share at same level as Japanese Government Bond in the next five years. Japanese Government Bond Effective Interest Rate:- + Maturity (Years) Japanese Government Bond Yield (%) 0.14 10 2 0.15 34 0.174 0.22 42 52 0.294 O 2. Suppose you are considering investing in Model AA shares. Before you purchase Model AA shares, you will conduct valuation to figure out how much you would expect to earn from the investment. You campare Model AA investment opportunity to alternative investment oporutnity. One potential investment opporuntiy is to invest in Audi common stock. Your friend, Seong Jin, is a security analyst and follws Audi stock. SJ informed you that if you invest in Audi stock today and hold it for 5 years, you would expect get 9% return in total. Would you invest in Model AA shares or in Audi shares? Please, show your work on figuring out the expected investment return for "Model AA. Hint 1 : Assume you must invest in either Toyota's Model AA or Audi's common stock. Hint 2 : Again, the holding period of investment is 5 YEARS. We don't know how Audi shares and Model AA shares would behave after 5 years. The shares would pay dividends that would be lower than ordinary dividends and steadily increasing every year. Specifically, the amount of annual dividends would be the product of the issue price and the following annual dividend rate: 0.5 per cent in 2016, 1 per cent in 2017, 1.5 per cent in 2018, 2 per cent in 2019, and 2.5 per cent in 2020.23 The Model AA shares were proposed to be priced at a minimum of 120 per cent of the price of ordinary shares. In order to avoid dilution among common shares, Toyota planned to buy back up to 600 billion worth of stock. Third party rating agency, e.g., Moody's, rated Model AA share at same level as Japanese Government Bond in the next five years. Japanese Government Bond Effective Interest Rate:- + Maturity (Years) Japanese Government Bond Yield (%) 0.14 10 2 0.15 34 0.174 0.22 42 52 0.294 O