Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Suppose you collected monthly data on the returns of a given stock. You converted the returns into log returns by setting the return

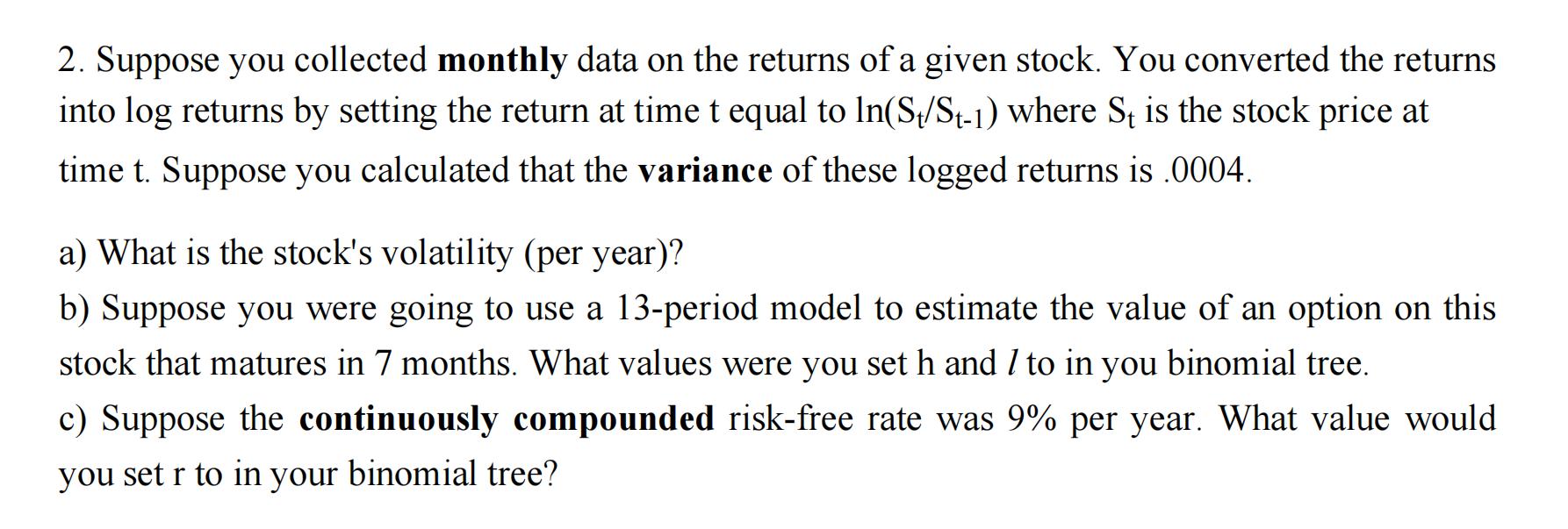

2. Suppose you collected monthly data on the returns of a given stock. You converted the returns into log returns by setting the return at time t equal to ln(St/St-1) where St is the stock price at time t. Suppose you calculated that the variance of these logged returns is .0004. a) What is the stock's volatility (per year)? b) Suppose you were going to use a 13-period model to estimate the value of an option on this stock that matures in 7 months. What values were you set h and I to in you binomial tree. c) Suppose the continuously compounded risk-free rate was 9% per year. What value would you set r to in your binomial tree?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The stocks volatility is 20 per year 0000405 sqrt12 02 b h 01429 and I 08571 17 01429 and 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started