Answered step by step

Verified Expert Solution

Question

1 Approved Answer

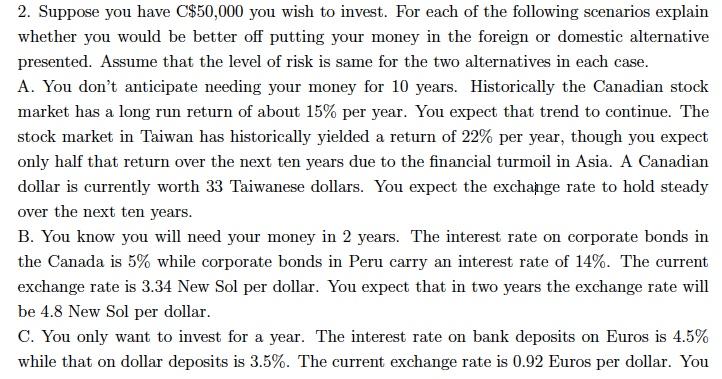

2. Suppose you have C$50,000 you wish to invest. For each of the following scenarios explain whether you would be better off putting your

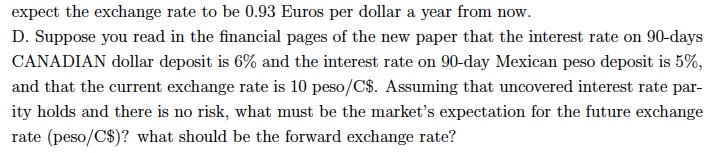

2. Suppose you have C$50,000 you wish to invest. For each of the following scenarios explain whether you would be better off putting your money in the foreign or domestic alternative presented. Assume that the level of risk is same for the two alternatives in each case. A. You don't anticipate needing your money for 10 years. Historically the Canadian stock market has a long run return of about 15% per year. You expect that trend to continue. The stock market in Taiwan has historically yielded a return of 22% per year, though you expect only half that return over the next ten years due to the financial turmoil in Asia. A Canadian dollar is currently worth 33 Taiwanese dollars. You expect the exchange rate to hold steady over the next ten years. B. You know you will need your money in 2 years. The interest rate on corporate bonds in the Canada is 5% while corporate bonds in Peru carry an interest rate of 14%. The current exchange rate is 3.34 New Sol per dollar. You expect that in two years the exchange rate will be 4.8 New Sol per dollar. C. You only want to invest for a year. The interest rate on bank deposits on Euros is 4.5% while that on dollar deposits is 3.5%. The current exchange rate is 0.92 Euros per dollar. You expect the exchange rate to be 0.93 Euros per dollar a year from now. D. Suppose you read in the financial pages of the new paper that the interest rate on 90-days CANADIAN dollar deposit is 6% and the interest rate on 90-day Mexican peso deposit is 5%, and that the current exchange rate is 10 peso/C$. Assuming that uncovered interest rate par- ity holds and there is no risk, what must be the market's expectation for the future exchange rate (peso/C$)? what should be the forward exchange rate?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A You dont anticipate needing your money for 10 years Historically the Canadian stock market has a long run return of about 15 per year You expect tha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started