Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Suppose your company provides a $50,000 three-year loan to the partner at a variable rate. The initial variable is 12%. The initial funds

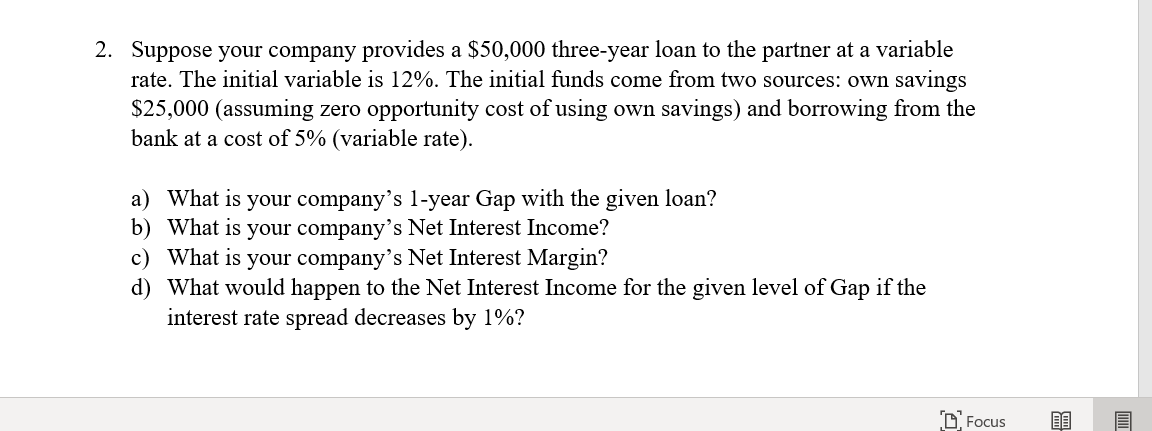

2. Suppose your company provides a $50,000 three-year loan to the partner at a variable rate. The initial variable is 12%. The initial funds come from two sources: own savings $25,000 (assuming zero opportunity cost of using own savings) and borrowing from the bank at a cost of 5% (variable rate). a) What is your company's 1-year Gap with the given loan? b) What is your company's Net Interest Income? c) What is your company's Net Interest Margin? d) What would happen to the Net Interest Income for the given level of Gap if the interest rate spread decreases by 1%? Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the 1year Gap Net Interest Income and Net Interest Margin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started