Answered step by step

Verified Expert Solution

Question

1 Approved Answer

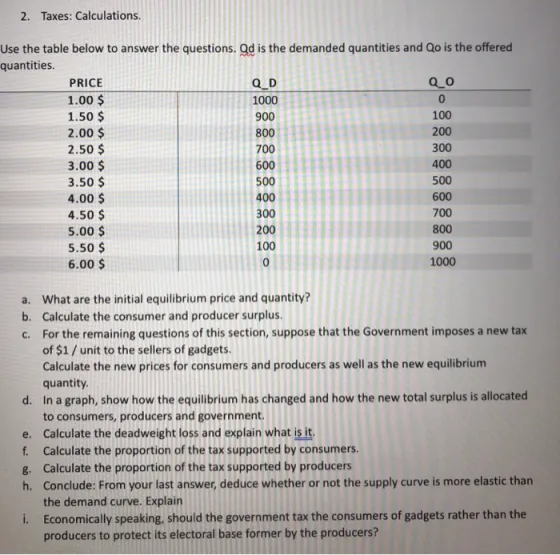

2. Taxes: Calculations. Use the table below to answer the questions. Qd is the demanded quantities and Qo is the offered quantities. PRICE 1.00

2. Taxes: Calculations. Use the table below to answer the questions. Qd is the demanded quantities and Qo is the offered quantities. PRICE 1.00 $ 1.50 $ 2.00 $ 2.50 $ 3.00 $ 3.50 $ 4.00 $ 4.50 $ 5.00 $ 5.50 $ 6.00 $ Q_D 1000 900 800 700 600 500 400 300 200 100 Q_0 0 100 200 300 400 500 600 700 800 900 1000 a. What are the initial equilibrium price and quantity? b. Calculate the consumer and producer surplus. c. For the remaining questions of this section, suppose that the Government imposes a new tax of $1 / unit to the sellers of gadgets. Calculate the new prices for consumers and producers as well as the new equilibrium quantity. d. In a graph, show how the equilibrium has changed and how the new total surplus is allocated to consumers, producers and government. e. Calculate the deadweight loss and explain what is it. f. Calculate the proportion of the tax supported by consumers. g. Calculate the proportion of the tax supported by producers h. Conclude: From your last answer, deduce whether or not the supply curve is more elastic than the demand curve. Explain i. Economically speaking, should the government tax the consumers of gadgets rather than the producers to protect its electoral base former by the producers?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The initial equilibrium price and quantity can be determined by looking at the table and finding the price at which the demanded quantity QD equals the offered quantity QO In this case the equilibri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started